- United Kingdom

- /

- Software

- /

- LSE:PINE

High Growth Tech Stocks in the UK with Promising Potential

Reviewed by Simply Wall St

The United Kingdom's stock market has been experiencing fluctuations, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting global economic challenges that are impacting investor sentiment. In this environment, identifying high growth tech stocks requires a focus on companies that demonstrate resilience and adaptability amid broader market pressures.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| Filtronic | 21.68% | 55.69% | ★★★★★★ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Facilities by ADF | 48.47% | 189.97% | ★★★★★☆ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| YouGov | 8.52% | 55.02% | ★★★★★☆ |

| Windar Photonics | 36.65% | 46.33% | ★★★★★☆ |

| Oxford Biomedica | 21.20% | 92.53% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 50 stocks from our UK High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

LBG Media (AIM:LBG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LBG Media plc is an online media publisher with operations in the United Kingdom, Ireland, Australia, the United States, and internationally, and has a market capitalization of £278.08 million.

Operations: LBG Media generates revenue primarily from its online media publishing activities, amounting to £82.54 million. The company operates across multiple regions, including the UK, Ireland, Australia, and the US.

LBG Media, a contender in the UK's tech landscape, showcases robust growth with earnings surging by 33% last year, outpacing its industry's -24.9% downturn. Despite challenges like a one-off loss of £3.5M impacting financials, LBG's strategic focus on innovative content has paid dividends. With revenue and earnings projected to grow at 9.2% and 24.5% annually—surpassing UK market averages of 3.5% and 14.4%, respectively—the company is poised for continued expansion in the dynamic tech sector, driven by its adept adaptation to market demands and consistent investment in cutting-edge technology.

- Click to explore a detailed breakdown of our findings in LBG Media's health report.

Examine LBG Media's past performance report to understand how it has performed in the past.

M&C Saatchi (AIM:SAA)

Simply Wall St Growth Rating: ★★★★☆☆

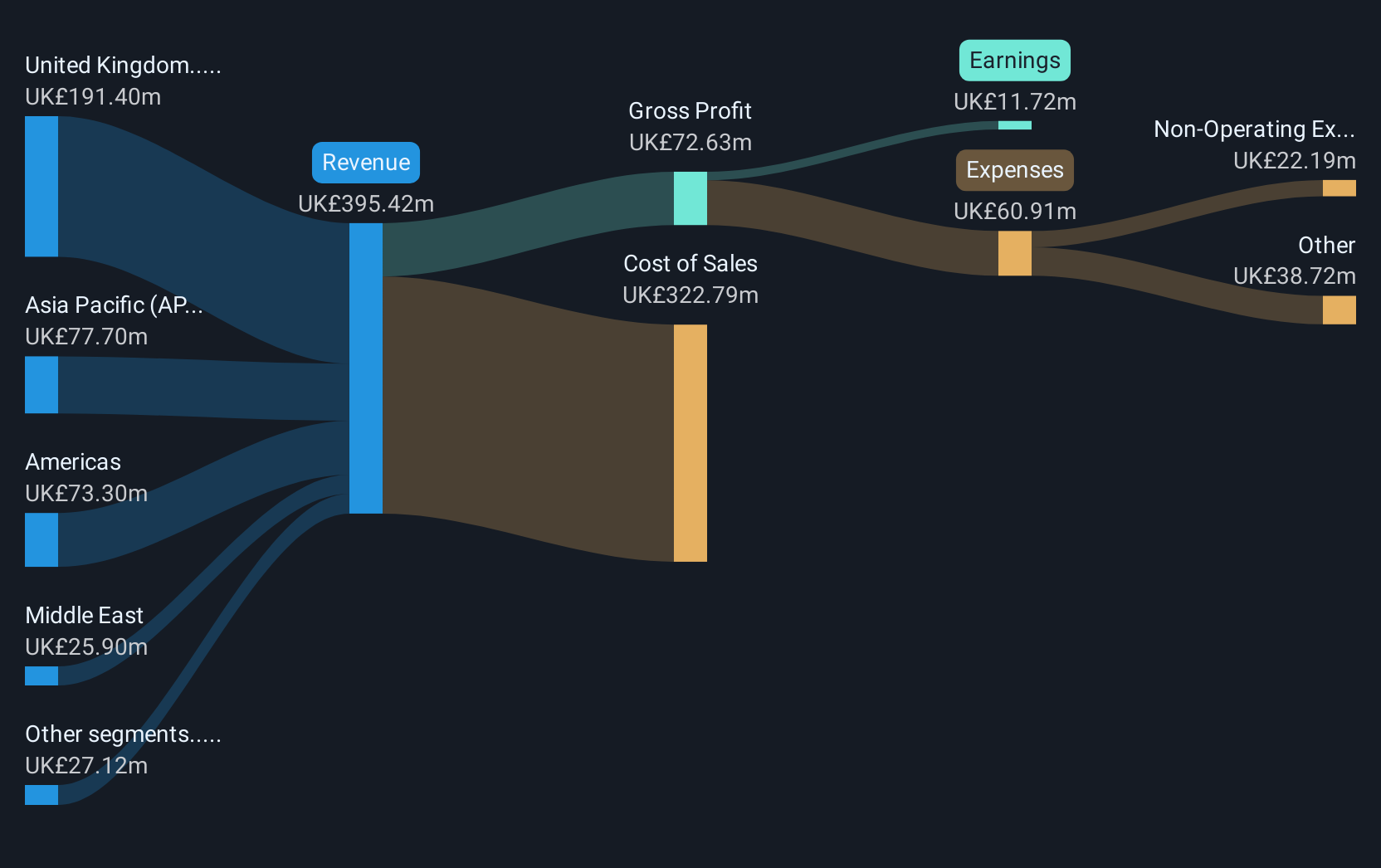

Overview: M&C Saatchi plc offers advertising and marketing communications services across various regions including the UK, Europe, the Middle East, Africa, Asia Pacific, and the Americas, with a market cap of £215.17 million.

Operations: The company generates revenue primarily through its advertising and marketing communications services across multiple regions. Its business model focuses on delivering creative solutions to clients, with a significant portion of costs attributed to personnel expenses. Notably, the net profit margin has shown variability in recent periods.

M&C Saatchi's recent executive reshuffle, with Nadja Bellan-White at the helm, underscores its strategic push into North America, aiming to synergize its diverse agencies under a unified profit and loss framework. Despite facing a challenging environment with projected annual revenue declines of 15.2%, the company's robust forecasted return on equity at 32.1% in three years reflects strong underlying profitability potential. This resilience is further evidenced by overcoming a significant one-off loss of £17.3M last year, positioning it for an anticipated earnings growth of 27.4% annually, outstripping the UK market average significantly.

- Take a closer look at M&C Saatchi's potential here in our health report.

Evaluate M&C Saatchi's historical performance by accessing our past performance report.

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Growth Rating: ★★★★★☆

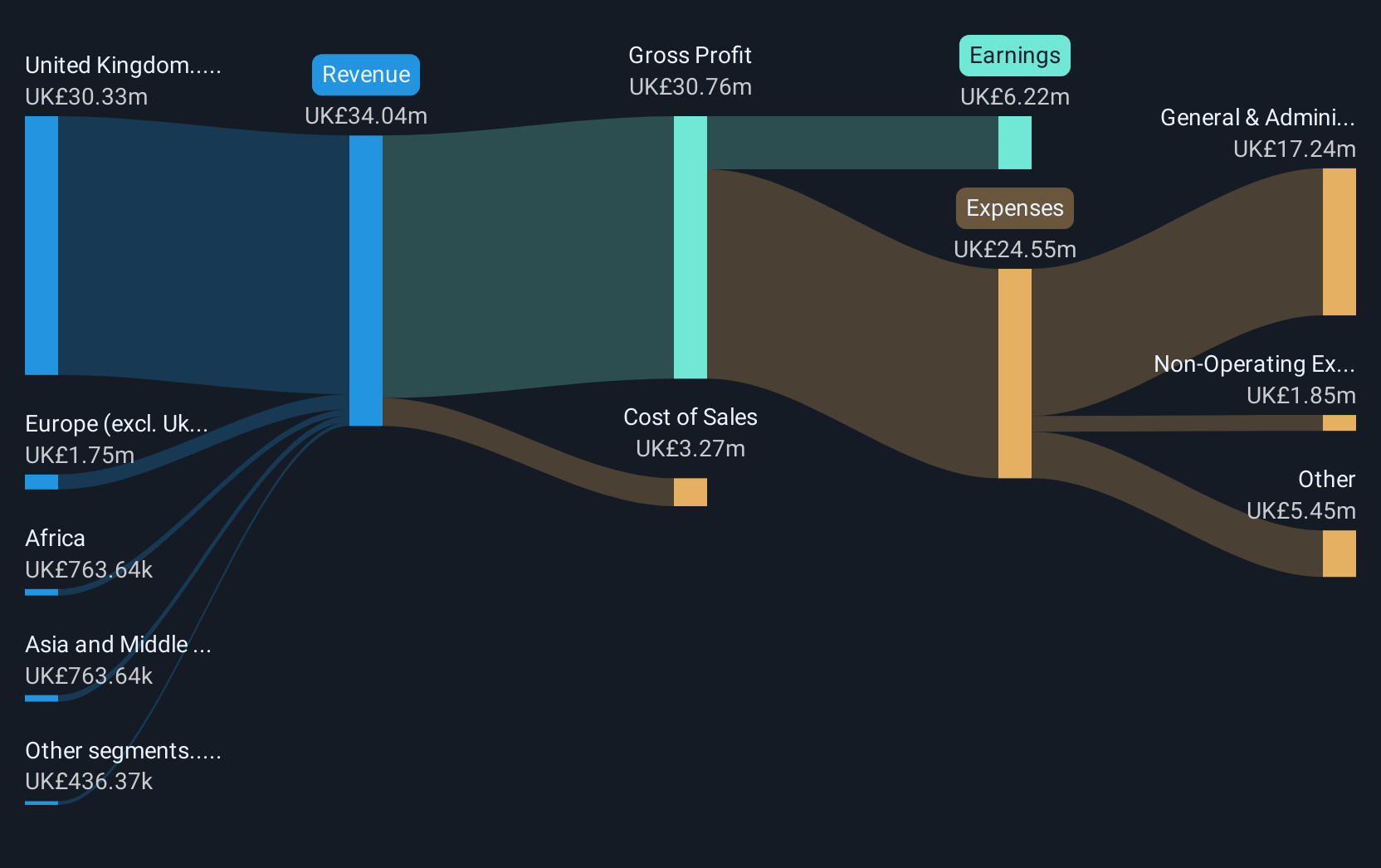

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider serving the automotive industry both in the United Kingdom and internationally, with a market cap of £297.69 million.

Operations: The company generates revenue primarily through its software solutions, amounting to £22.62 million.

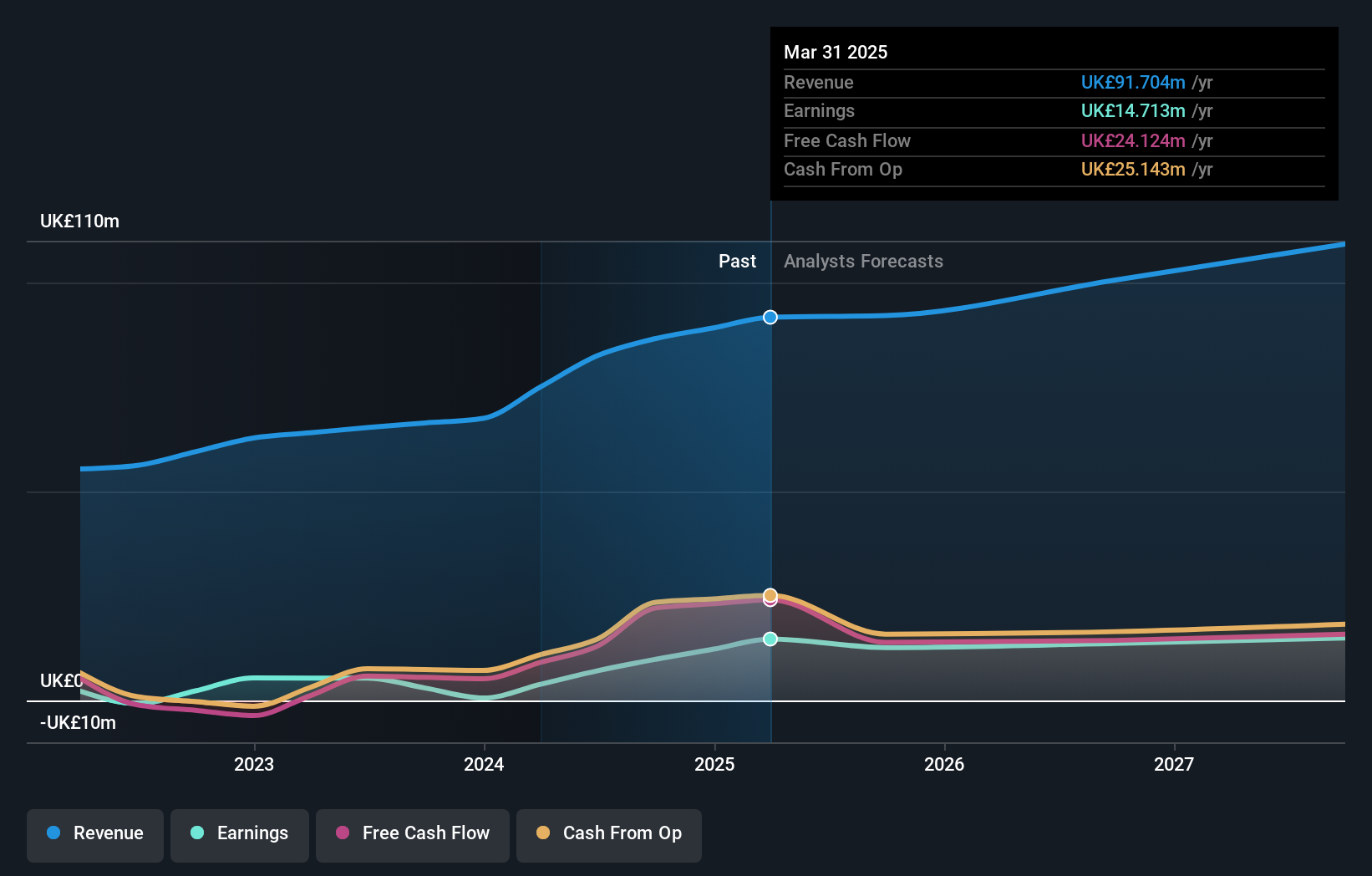

Pinewood Technologies Group, amidst a challenging tech landscape, has secured a pivotal five-year contract with Marshall Motor Group to enhance its dealership operations through the Pinewood systems. This strategic move not only diversifies its client base but also underscores its adaptability and commitment to growth within the automotive retail sector. Despite a significant 81.6% dip in earnings last year, Pinewood's projected revenue and earnings growth of 20.1% and 25.1% per annum respectively outpace the broader UK market significantly, hinting at robust potential recovery and scalability in its niche market segment. This blend of strategic client acquisitions coupled with promising financial forecasts positions Pinewood uniquely within the high-growth tech sphere in the UK.

Next Steps

- Take a closer look at our UK High Growth Tech and AI Stocks list of 50 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PINE

Pinewood Technologies Group

Operates as a cloud-based dealer management software provider that offers software solutions to the automotive industry in the United Kingdom and internationally.

Flawless balance sheet with high growth potential.