Those Who Purchased OnTheMarket (LON:OTMP) Shares A Year Ago Have A 43% Loss To Show For It

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Investors in OnTheMarket plc (LON:OTMP) have tasted that bitter downside in the last year, as the share price dropped 43%. That's well bellow the market return of 9.2%. OnTheMarket may have better days ahead, of course; we've only looked at a one year period. Furthermore, it's down 33% in about a quarter. That's not much fun for holders.

View our latest analysis for OnTheMarket

OnTheMarket isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, OnTheMarket increased its revenue by 11%. That's not a very high growth rate considering it doesn't make profits. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 43% in a year. It's important not to lose sight of the fact that profitless companies must grow. So remember, if you buy a profitless company then you risk being a profitless investor.

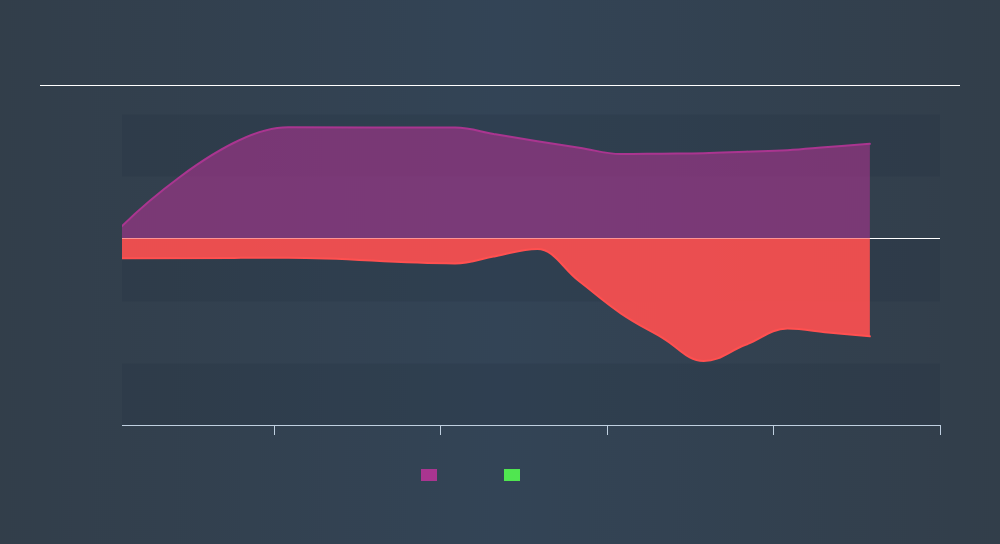

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Given that the market gained 9.2% in the last year, OnTheMarket shareholders might be miffed that they lost 43%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 33%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

But note: OnTheMarket may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:OTMP

OnTheMarket

OnTheMarket plc provides online property portal services to businesses in the estate and lettings agency industry in the United Kingdom.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026