The OnTheMarket (LON:OTMP) Share Price Is Up 76% And Shareholders Are Holding On

The simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you could make more than that. For example, the OnTheMarket plc (LON:OTMP) share price is up 76% in the last year, clearly besting the market decline of around 10% (not including dividends). That's a solid performance by our standards! Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

View our latest analysis for OnTheMarket

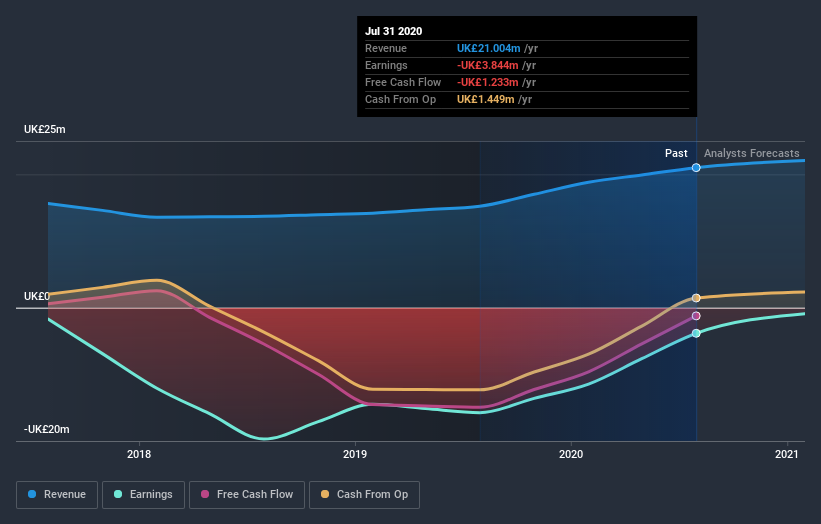

OnTheMarket isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year OnTheMarket saw its revenue grow by 38%. That's a fairly respectable growth rate. Buyers pushed the share price 76% in response, which isn't unreasonable. If revenue stays on trend, there may be plenty more share price gains to come. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at OnTheMarket's financial health with this free report on its balance sheet.

A Different Perspective

OnTheMarket boasts a total shareholder return of 76% for the last year. And the share price momentum remains respectable, with a gain of 42% in the last three months. This suggests the company is continuing to win over new investors. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for OnTheMarket (1 shouldn't be ignored) that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

When trading OnTheMarket or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:OTMP

OnTheMarket

OnTheMarket plc provides online property portal services to businesses in the estate and lettings agency industry in the United Kingdom.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives