- United Kingdom

- /

- Media

- /

- AIM:NFG

Top 3 UK Dividend Stocks For Reliable Income

Reviewed by Simply Wall St

As the FTSE 100 index experiences fluctuations due to global economic challenges, particularly from China's sluggish recovery, investors in the UK are seeking stability amidst market volatility. In such an environment, dividend stocks can offer a reliable income stream by providing consistent payouts, making them an attractive option for those looking to balance risk with steady returns.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Pets at Home Group (LSE:PETS) | 6.08% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.57% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 8.36% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.33% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.08% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.67% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.68% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.04% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.30% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.81% | ★★★★★☆ |

Click here to see the full list of 62 stocks from our Top UK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Next 15 Group (AIM:NFG)

Simply Wall St Dividend Rating: ★★★★☆☆

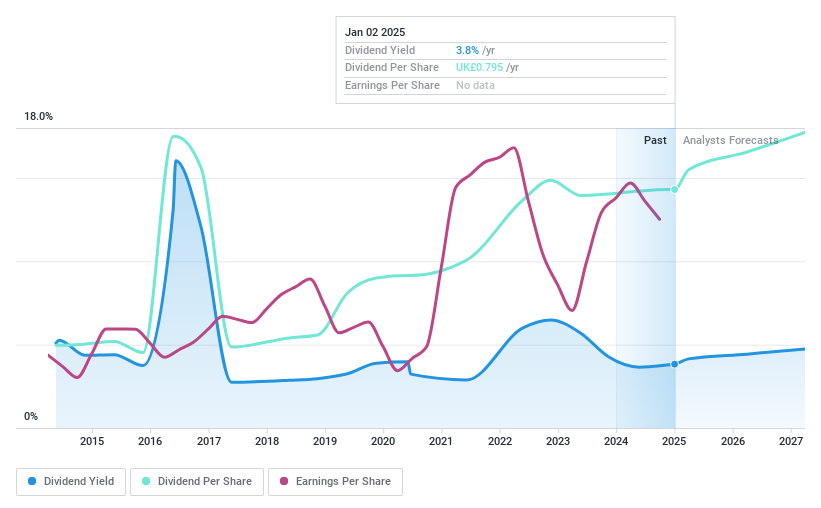

Overview: Next 15 Group plc, along with its subsidiaries, offers communications services across the United Kingdom, Europe, Africa, the United States, and the Asia Pacific with a market cap of £343.12 million.

Operations: Next 15 Group plc generates its revenue through providing a range of communications services across multiple regions, including the United Kingdom, Europe, Africa, the United States, and the Asia Pacific.

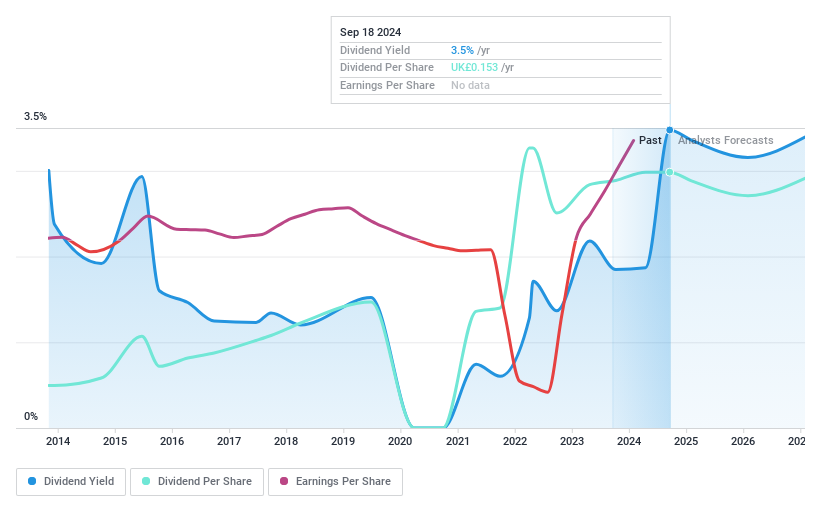

Dividend Yield: 4.1%

Next 15 Group's dividend payments are well covered by both earnings and cash flows, with payout ratios of 25.2% and 23.3%, respectively. However, the company has an unstable dividend track record over the past decade, marked by volatility in payments despite some growth. While trading at a significant discount to fair value estimates and showing good relative value compared to peers, high debt levels and forecasted earnings decline pose concerns for future dividend sustainability.

- Click to explore a detailed breakdown of our findings in Next 15 Group's dividend report.

- Our expertly prepared valuation report Next 15 Group implies its share price may be lower than expected.

Vertu Motors (AIM:VTU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vertu Motors plc is an automotive retailer operating in the United Kingdom with a market capitalization of £181.39 million.

Operations: Vertu Motors plc generates revenue primarily from its Retail - Gasoline & Auto Dealers segment, amounting to £4.79 billion.

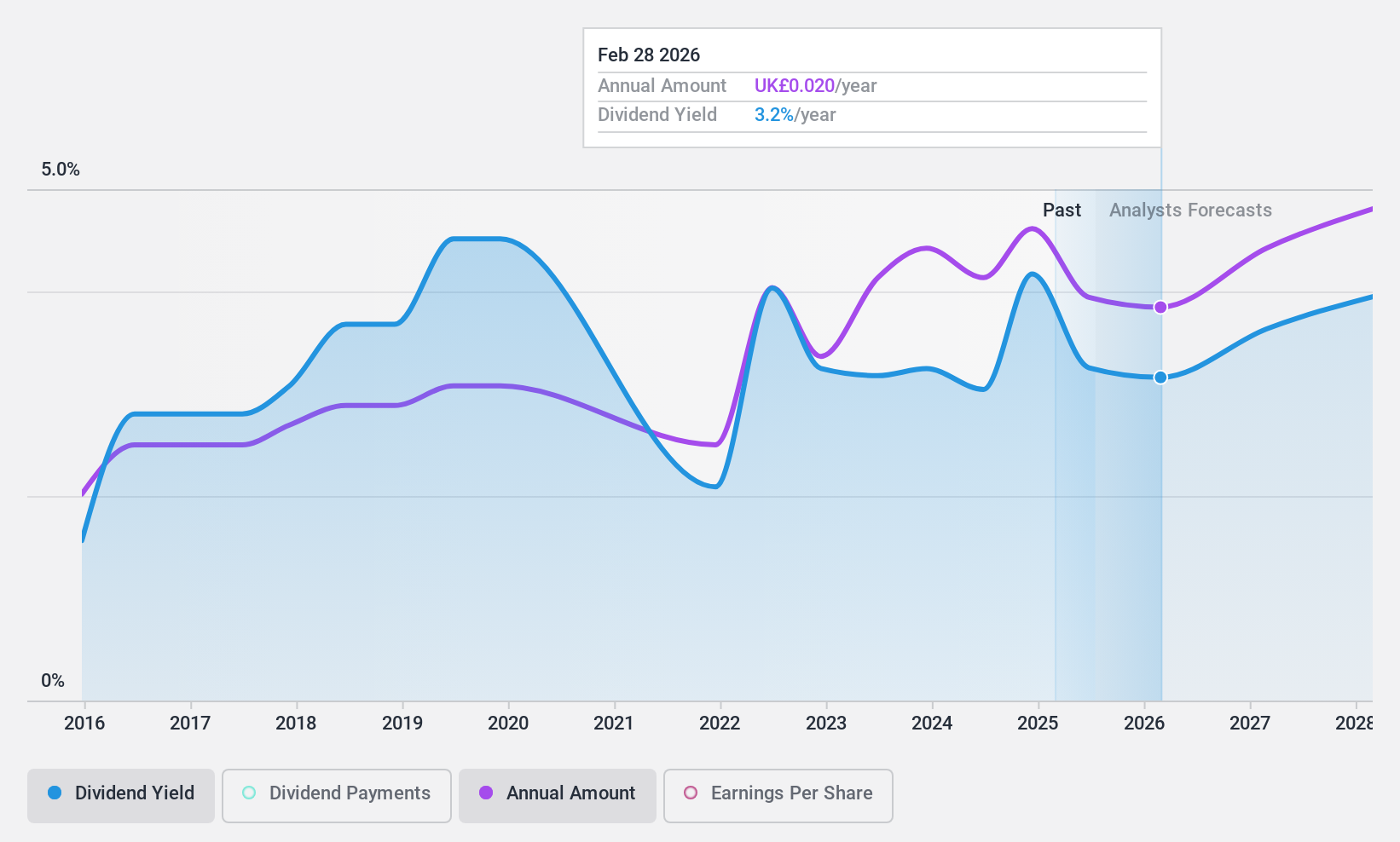

Dividend Yield: 4.4%

Vertu Motors' dividends are well-supported by earnings and cash flows, with payout ratios of 41.8% and 17.4%, respectively, despite an unstable dividend history marked by volatility over the past decade. The stock trades at a discount to its estimated fair value but has seen significant insider selling recently. Profit margins have declined slightly from last year, yet revenue is expected to grow annually by 5.66%. Amanda Jane Cox's recent board appointment may bring strategic insights from her extensive retail experience.

- Click here to discover the nuances of Vertu Motors with our detailed analytical dividend report.

- The analysis detailed in our Vertu Motors valuation report hints at an deflated share price compared to its estimated value.

Intermediate Capital Group (LSE:ICG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Intermediate Capital Group plc is a private equity firm specializing in direct and fund of fund investments, with a market cap of £6.63 billion.

Operations: Intermediate Capital Group plc generates revenue through its Investment Company segment, contributing £214.10 million, and its Fund Management Company segment, adding £708.50 million.

Dividend Yield: 3.5%

Intermediate Capital Group's dividends are supported by a payout ratio of 57.1% from earnings and 50.5% from cash flows, despite a history of volatility over the past decade. While the dividend yield is lower than top-tier UK payers, recent increases signal potential growth, with an interim dividend declared at £0.263 per share. The company trades below its estimated fair value and has expanded its real estate platform into North America with strategic hires to drive growth in this region.

- Take a closer look at Intermediate Capital Group's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Intermediate Capital Group is priced higher than what may be justified by its financials.

Next Steps

- Gain an insight into the universe of 62 Top UK Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Next 15 Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NFG

Next 15 Group

Provides communications services in the United Kingdom, Europe, Africa, the United States, and the Asia Pacific.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives