Next 15 Group plc (LON:NFG) stock is about to trade ex-dividend in 3 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Thus, you can purchase Next 15 Group's shares before the 17th of October in order to receive the dividend, which the company will pay on the 22nd of November.

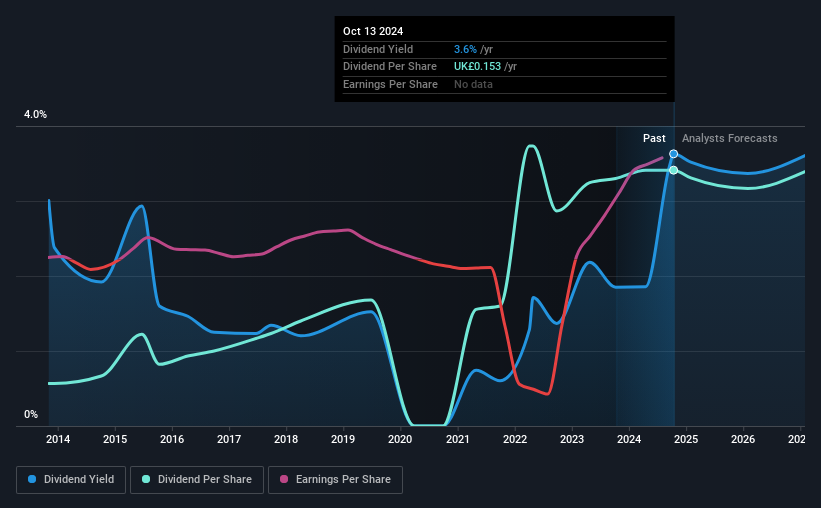

The company's next dividend payment will be UK£0.0475 per share, and in the last 12 months, the company paid a total of UK£0.15 per share. Calculating the last year's worth of payments shows that Next 15 Group has a trailing yield of 3.6% on the current share price of UK£4.23. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for Next 15 Group

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Next 15 Group paid out a comfortable 25% of its profit last year. A useful secondary check can be to evaluate whether Next 15 Group generated enough free cash flow to afford its dividend. Luckily it paid out just 23% of its free cash flow last year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. It's encouraging to see Next 15 Group has grown its earnings rapidly, up 28% a year for the past five years. Earnings per share have been growing very quickly, and the company is paying out a relatively low percentage of its profit and cash flow. Companies with growing earnings and low payout ratios are often the best long-term dividend stocks, as the company can both grow its earnings and increase the percentage of earnings that it pays out, essentially multiplying the dividend.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the last 10 years, Next 15 Group has lifted its dividend by approximately 20% a year on average. It's exciting to see that both earnings and dividends per share have grown rapidly over the past few years.

The Bottom Line

From a dividend perspective, should investors buy or avoid Next 15 Group? Next 15 Group has grown its earnings per share while simultaneously reinvesting in the business. Unfortunately it's cut the dividend at least once in the past 10 years, but the conservative payout ratio makes the current dividend look sustainable. It's a promising combination that should mark this company worthy of closer attention.

In light of that, while Next 15 Group has an appealing dividend, it's worth knowing the risks involved with this stock. To that end, you should learn about the 5 warning signs we've spotted with Next 15 Group (including 2 which are a bit unpleasant).

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Next 15 Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:NFG

Next 15 Group

Next 15 Group plc, together with its subsidiaries, customer insight, customer delivery, customer engagement, and business transformation services in the United Kingdom, Africa, the United States, Europe, Middle East, and Africa.

Undervalued with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion