- United Kingdom

- /

- Media

- /

- AIM:NFG

3 UK Dividend Stocks With Up To 6% Yield

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and falling commodity prices impacting major companies. In such uncertain times, dividend stocks can offer a measure of stability and income potential, making them an attractive option for investors seeking reliable returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 7.38% | ★★★★★★ |

| Treatt (LSE:TET) | 3.34% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 5.12% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 6.32% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.82% | ★★★★★☆ |

| Man Group (LSE:EMG) | 7.21% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.54% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.70% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.79% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.57% | ★★★★★☆ |

Click here to see the full list of 57 stocks from our Top UK Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

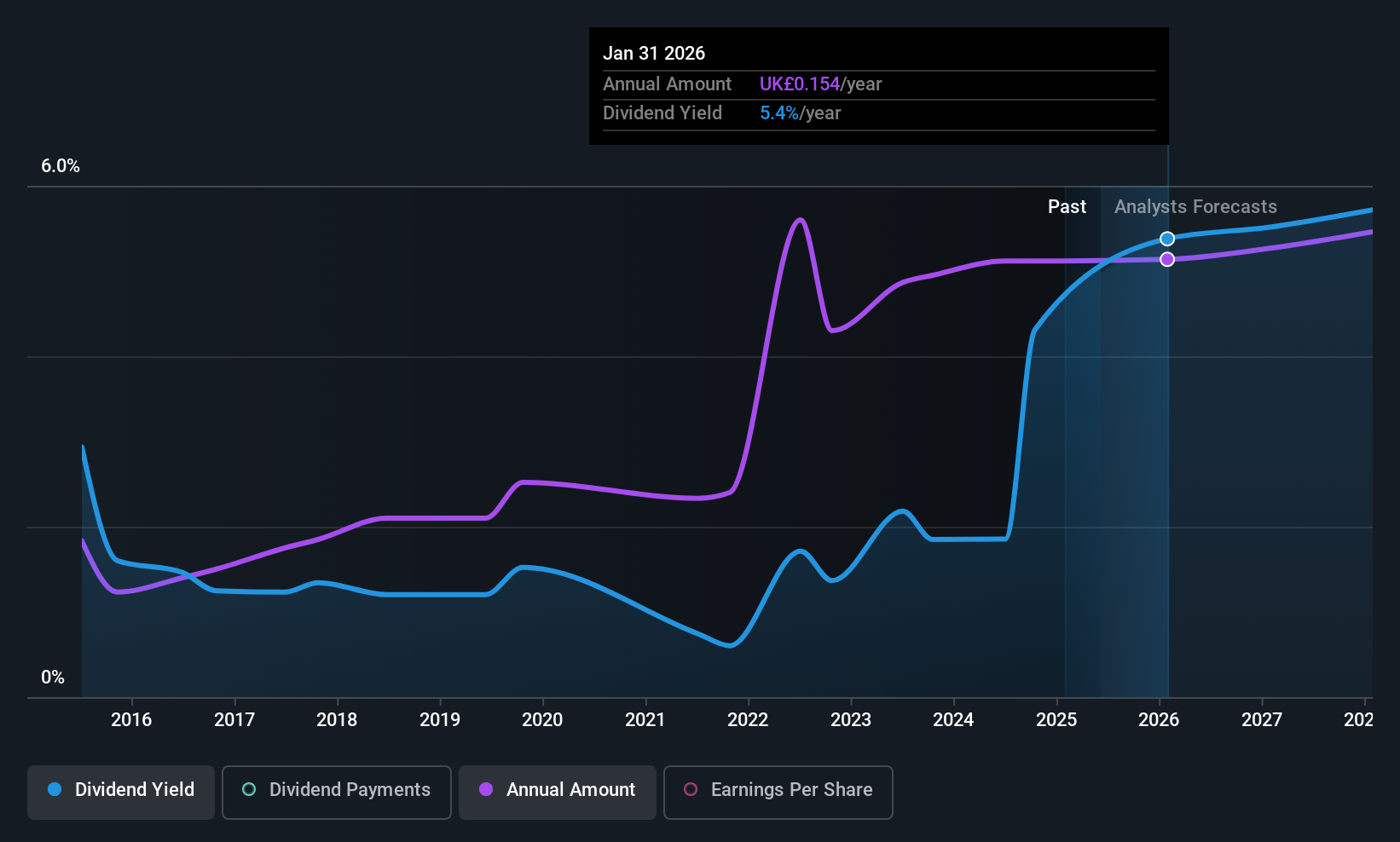

Next 15 Group (AIM:NFG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Next 15 Group plc, with a market cap of £256.35 million, provides customer insight, delivery, engagement, and business transformation services across the United Kingdom, Africa, the United States, Europe, Middle East and Africa.

Operations: Next 15 Group plc generates revenue through four primary segments: Customer Engage (£340.56 million), Customer Insight (£73.87 million), Customer Delivery (£171.19 million), and Business Transformation (£144.19 million).

Dividend Yield: 6%

Next 15 Group offers a mixed dividend profile with its payments well-covered by earnings and cash flows, boasting a low payout ratio of 39% and cash payout ratio of 22.7%. However, the dividend history is unreliable and volatile over the past decade. Despite recent leadership changes, including a new CFO, the company trades at good value compared to peers. Recent financials show stable revenue but declining net income year-on-year.

- Dive into the specifics of Next 15 Group here with our thorough dividend report.

- Our valuation report unveils the possibility Next 15 Group's shares may be trading at a discount.

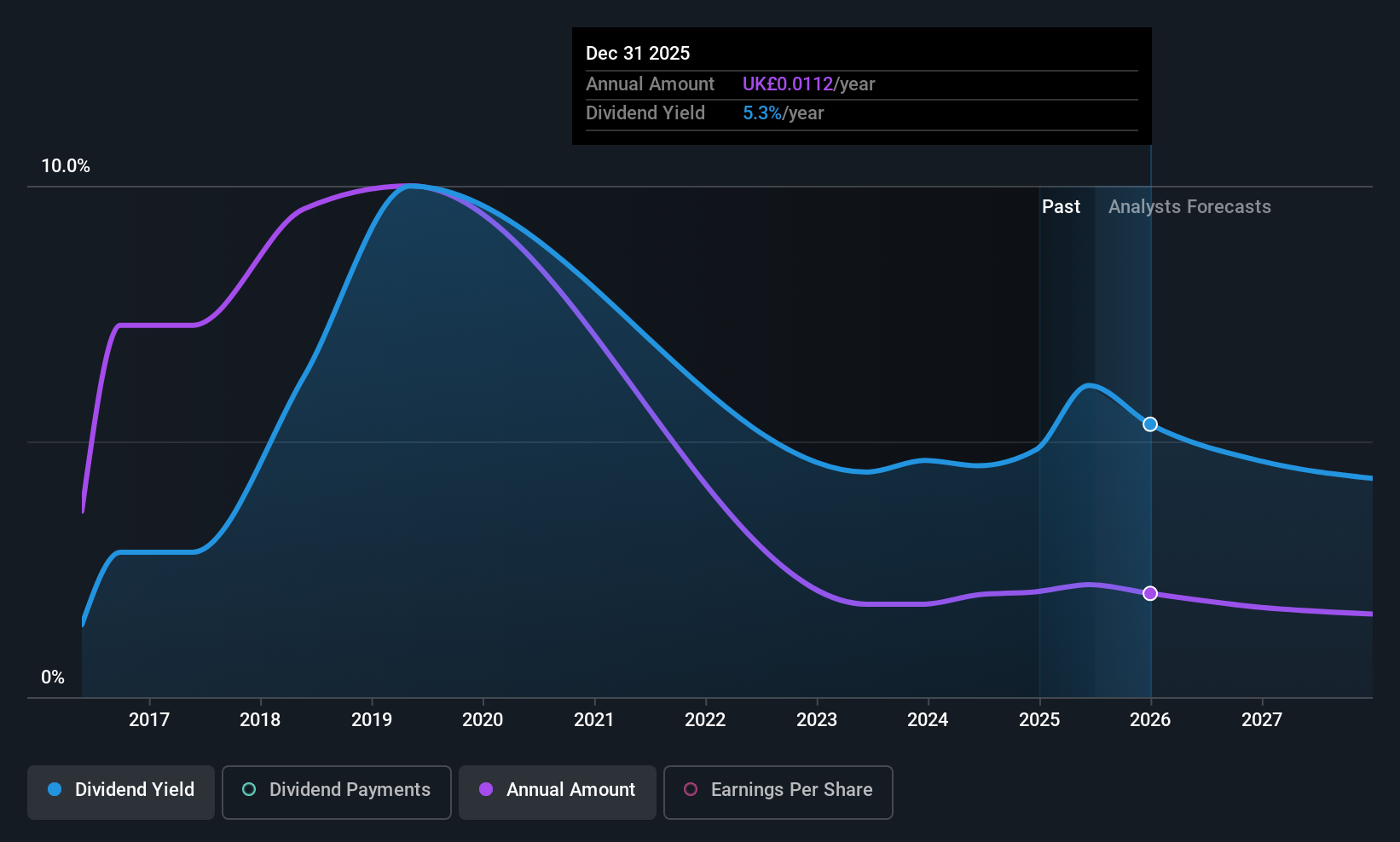

Pharos Energy (LSE:PHAR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pharos Energy plc is an independent energy company focused on exploring, developing, and producing oil and gas properties in Vietnam and Egypt, with a market cap of £86.07 million.

Operations: Pharos Energy generates revenue from its operations in Egypt and Southeast Asia, with contributions of $20.70 million and $115.40 million respectively.

Dividend Yield: 5.6%

Pharos Energy's dividend payments, covered by a low payout ratio of 26.8% and cash payout ratio of 21.7%, are financially sustainable despite historical volatility and declines over the past decade. The recent approval for a two-year extension in Vietnam may support future operations, but earnings are forecasted to decline significantly. Leadership changes, including João Saraiva e Silva as Non-Executive Chair, could influence strategic directions amidst these challenges.

- Click to explore a detailed breakdown of our findings in Pharos Energy's dividend report.

- In light of our recent valuation report, it seems possible that Pharos Energy is trading behind its estimated value.

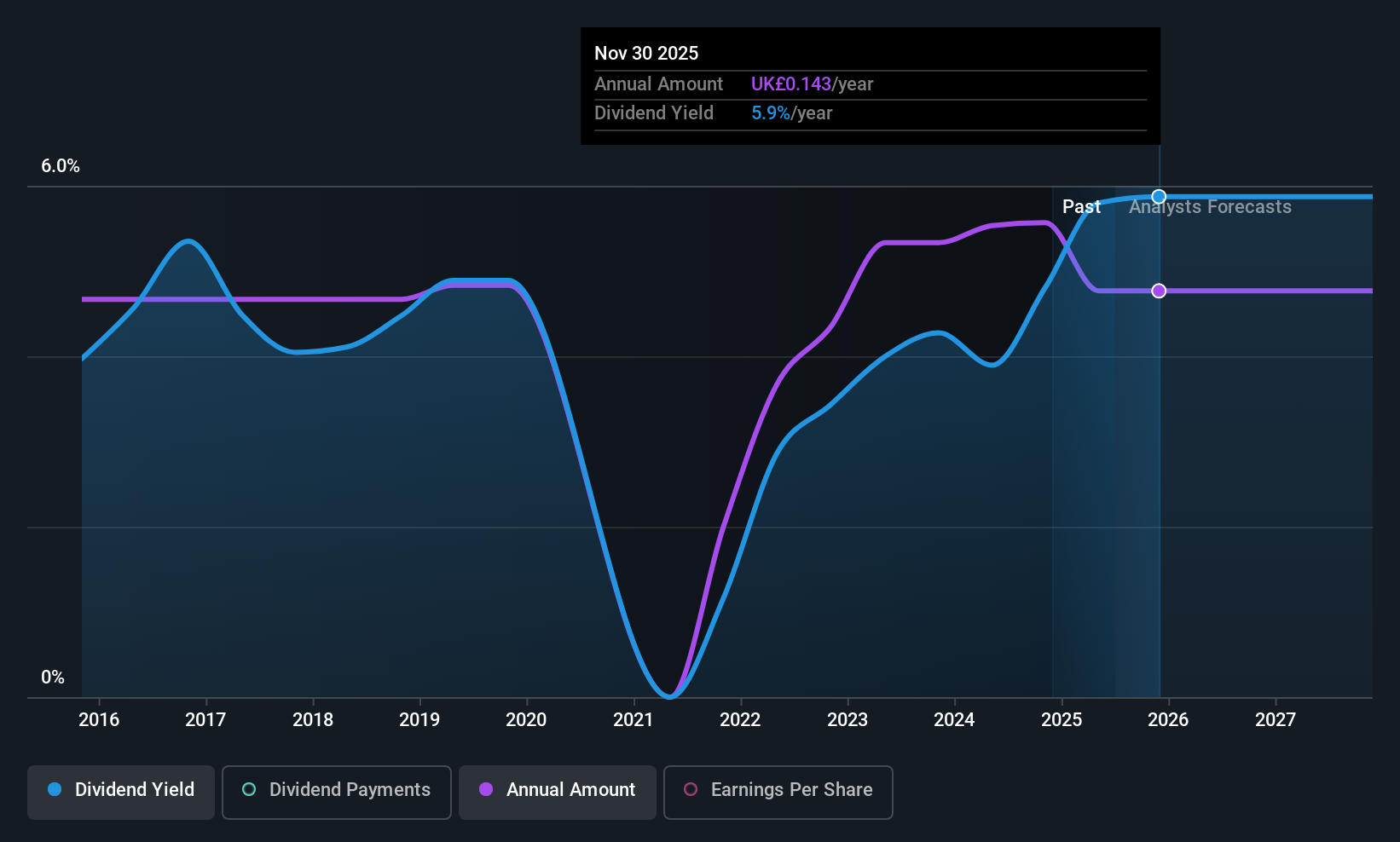

SThree (LSE:STEM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SThree plc is a specialist recruitment firm operating in the STEM fields across multiple countries including the UK, US, and several European and Asian markets, with a market cap of £306.87 million.

Operations: SThree plc's revenue is primarily derived from its operations in the USA (£299.23 million), DACH region (£456.05 million), Rest of Europe (£353.15 million), Middle East & Asia (£40.91 million), and Netherlands (including Spain) (£343.57 million).

Dividend Yield: 5.9%

SThree's dividend is well-covered by earnings with a payout ratio of 38.2% and a cash payout ratio of 68%, indicating financial sustainability despite past volatility. The recent approval of a final dividend at 9.2 pence per share reflects ongoing shareholder returns, although the track record remains unstable. Executive changes, including Imogen Joss as Senior Independent Director, may impact future strategic decisions while the completed £20 million share buyback suggests confidence in company value.

- Delve into the full analysis dividend report here for a deeper understanding of SThree.

- The valuation report we've compiled suggests that SThree's current price could be quite moderate.

Where To Now?

- Get an in-depth perspective on all 57 Top UK Dividend Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Next 15 Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NFG

Next 15 Group

Next 15 Group plc, together with its subsidiaries, customer insight, customer delivery, customer engagement, and business transformation services in the United Kingdom, Africa, the United States, Europe, Middle East, and Africa.

Undervalued established dividend payer.

Market Insights

Community Narratives