- United Kingdom

- /

- Media

- /

- AIM:NEXN

Nexxen International Ltd. (LON:NEXN) Stocks Shoot Up 27% But Its P/S Still Looks Reasonable

The Nexxen International Ltd. (LON:NEXN) share price has done very well over the last month, posting an excellent gain of 27%. The last month tops off a massive increase of 166% in the last year.

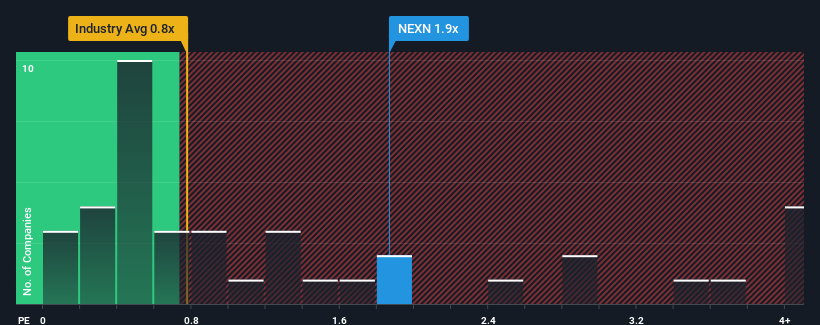

Since its price has surged higher, you could be forgiven for thinking Nexxen International is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.9x, considering almost half the companies in the United Kingdom's Media industry have P/S ratios below 0.8x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Nexxen International

What Does Nexxen International's Recent Performance Look Like?

Recent times haven't been great for Nexxen International as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Nexxen International's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Nexxen International?

In order to justify its P/S ratio, Nexxen International would need to produce impressive growth in excess of the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Fortunately, a few good years before that means that it was still able to grow revenue by 8.8% in total over the last three years. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue growth will be highly resilient over the next year growing by 11%. That would be an excellent outcome when the industry is expected to decline by 3.5%.

In light of this, it's understandable that Nexxen International's P/S sits above the majority of other companies. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

The Bottom Line On Nexxen International's P/S

The large bounce in Nexxen International's shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We can see that Nexxen International maintains its high P/S on the strength of its forecast growth potentially beating a struggling industry, as expected. At this stage investors feel the potential for a deterioration in revenue is remote enough to justify paying a premium in the form of a high P/S. Questions could still raised over whether this level of outperformance can continue in the context of a a tumultuous industry climate. Otherwise, it's hard to see the share price falling strongly in the near future under the current growth expectations.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Nexxen International with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nexxen International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:NEXN

Nexxen International

Provides end-to-end software platform that enables advertisers to reach publishers Israel.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives