- United Kingdom

- /

- Retail Distributors

- /

- AIM:LIKE

Promising UK Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently faced challenges, closing lower due to weak trade data from China, which has affected global market sentiments. In such fluctuating conditions, investors often seek opportunities in smaller or newer companies that can offer both value and potential growth. While the term "penny stocks" might seem outdated, these securities remain relevant as they often represent companies with strong financials and promising prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.50 | £12.57M | ✅ 3 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.71 | £537.89M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.175 | £175.71M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.885 | £13.36M | ✅ 2 ⚠️ 3 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.075 | £14.79M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.30 | £29.18M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.565 | $328.45M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.73 | £269.94M | ✅ 5 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £2.54 | £91.34M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £178.75M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 297 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Gaming Realms (AIM:GMR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gaming Realms plc develops, publishes, and licenses mobile gaming content across various regions including the UK, US, Isle of Man, Malta, Gibraltar, and internationally with a market cap of £119.54 million.

Operations: The company generates revenue primarily through Licensing (£27.02 million) and Social Publishing excluding Licensing (£3.86 million).

Market Cap: £119.54M

Gaming Realms plc, with a market cap of £119.54 million, continues to grow its revenue streams primarily through licensing (£27.02 million) and social publishing (£3.86 million). The company is debt-free and maintains strong short-term asset coverage over liabilities, indicating financial stability. Recent collaborations with Light & Wonder Inc. enhance its portfolio with new Slingo titles, potentially expanding its reach in North America. Despite a decrease in net income to £2.66 million for H1 2025 compared to the previous year, earnings forecasts suggest growth at 11.31% annually, supported by high-quality earnings and robust return on equity (21.5%).

- Click here to discover the nuances of Gaming Realms with our detailed analytical financial health report.

- Gain insights into Gaming Realms' future direction by reviewing our growth report.

Likewise Group (AIM:LIKE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Likewise Group Plc, along with its subsidiaries, operates in the wholesale and distribution of floorcoverings, rugs, and matting products for both domestic and commercial markets across the United Kingdom and Europe, with a market cap of £66.43 million.

Operations: The company generates revenue from its textile manufacturing segment, which amounts to £156.99 million.

Market Cap: £66.43M

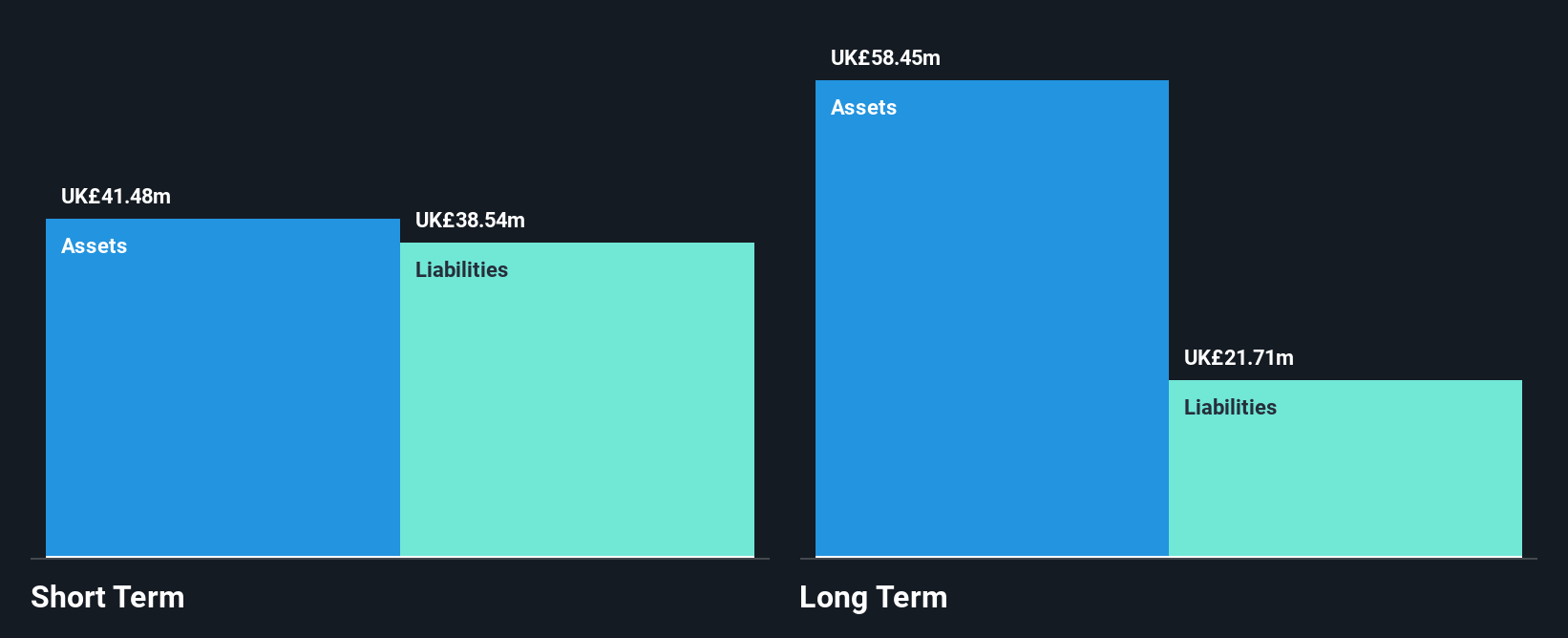

Likewise Group Plc, with a market cap of £66.43 million, has shown promising revenue growth, reporting sales of £77.95 million for H1 2025. Despite low return on equity at 3.3%, the company has improved its net profit margin to 0.8% and achieved earnings growth of 32.7% over the past year, surpassing industry averages. The board's experience is reflected in a stable financial position with short-term assets exceeding liabilities and debt well-covered by operating cash flow (88.7%). Recent dividend increases and facility expansions indicate strategic efforts to enhance shareholder value and operational capacity.

- Take a closer look at Likewise Group's potential here in our financial health report.

- Examine Likewise Group's earnings growth report to understand how analysts expect it to perform.

OPG Power Ventures (AIM:OPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OPG Power Ventures Plc, along with its subsidiaries, is involved in the development, ownership, operation, and maintenance of private sector power projects in India with a market cap of £23.24 million.

Operations: The company generates revenue from its thermal power segment, amounting to £156.74 million.

Market Cap: £23.24M

OPG Power Ventures, with a market cap of £23.24 million, is navigating challenges as it plans to delist from AIM by December 2025. Despite generating revenue of £156.74 million from its thermal power segment, the company faces declining earnings and profit margins, with net income dropping to £1.45 million for the year ended March 2025. While debt levels have improved significantly over five years and are well-covered by cash flow, interest coverage remains weak at 2.2x EBIT. The management team and board are experienced; however, share price volatility remains high amidst strategic transitions like appointing new directors and potential delisting impacts.

- Unlock comprehensive insights into our analysis of OPG Power Ventures stock in this financial health report.

- Understand OPG Power Ventures' track record by examining our performance history report.

Seize The Opportunity

- Unlock our comprehensive list of 297 UK Penny Stocks by clicking here.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:LIKE

Likewise Group

Likewise Group Plc, together with its subsidiaries, wholesales and distributes floorcoverings, rugs, and matting products for domestic and commercial flooring markets in the United Kingdom and Rest of Europe.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives