3 Penny Stocks On The UK Exchange With Market Caps Larger Than £4M

Reviewed by Simply Wall St

The UK stock market has been experiencing a downturn, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, highlighting ongoing global economic challenges. Despite these broader market pressures, there remains potential within smaller companies often referred to as penny stocks. Although the term may seem outdated, it still applies to companies that can offer value and growth opportunities when backed by solid financials. In this context, we explore three promising penny stocks on the UK exchange that stand out for their financial strength and potential for future success.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.49M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £481.5M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £330.8M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.97 | £451.13M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.28 | £859.14M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.23 | £159.09M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.67 | £89.06M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.315 | £329.7M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| QinetiQ Group (LSE:QQ.) | £3.696 | £2.06B | ★★★★★☆ |

Click here to see the full list of 443 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Gfinity (AIM:GFIN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gfinity plc, along with its subsidiaries, offers digital media services across the United Kingdom, North America, and globally, with a market cap of £4.23 million.

Operations: The company generates revenue from its Computer Graphics segment, amounting to £1.90 million.

Market Cap: £4.23M

Gfinity plc, with a market cap of £4.23 million, operates in the digital media sector and reported revenues of £1.90 million for the year ending June 2024. Despite being unprofitable, it has reduced its losses significantly over five years at a rate of 26.3% annually and remains debt-free with experienced management and board teams. Recently, Gfinity completed a follow-on equity offering raising £0.26 million to bolster its cash position amid high share price volatility and increased weekly volatility from 28% to 43%. Short-term assets exceed liabilities, yet the company lacks meaningful revenue streams currently.

- Jump into the full analysis health report here for a deeper understanding of Gfinity.

- Explore historical data to track Gfinity's performance over time in our past results report.

Midwich Group (AIM:MIDW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Midwich Group plc, along with its subsidiaries, distributes audio visual solutions to trade customers across various regions including the United Kingdom, Ireland, Europe, the Middle East, Africa, the Asia Pacific, and North America; it has a market cap of £263.96 million.

Operations: The company's revenue is derived from its wholesale segment focused on computer peripherals, generating £1.32 billion.

Market Cap: £263.96M

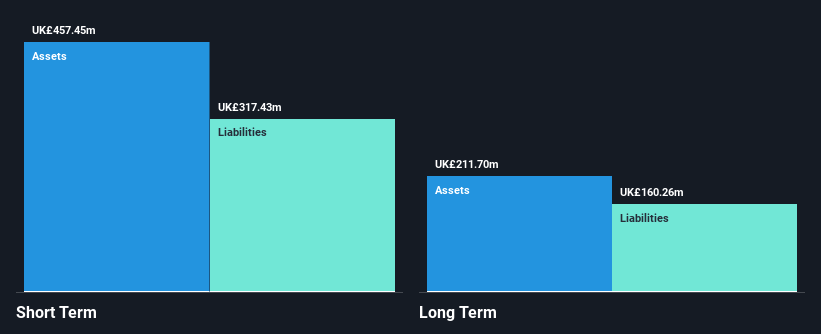

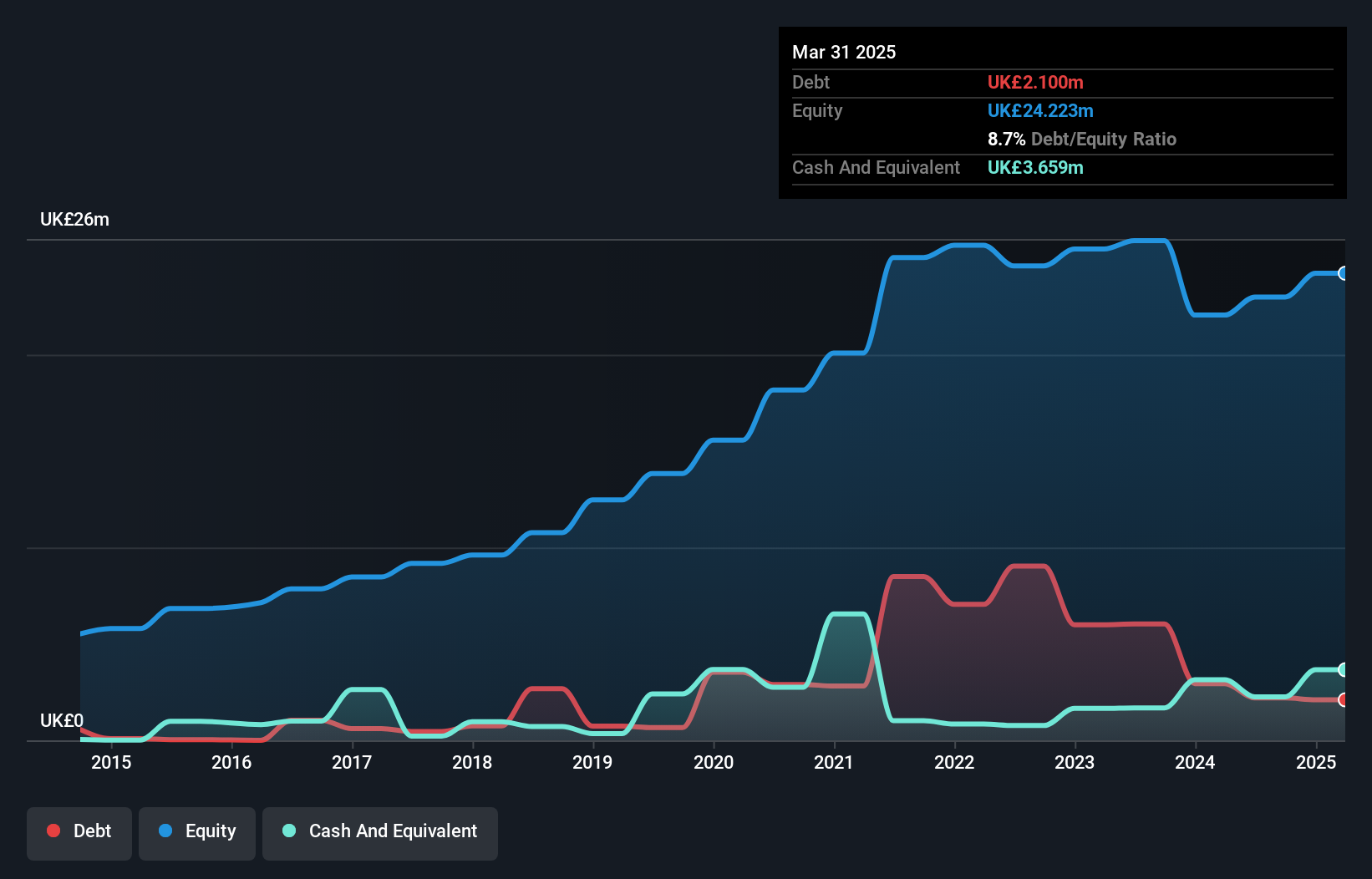

Midwich Group, with a market cap of £263.96 million, operates in the audio visual distribution sector and generates significant revenue of £1.32 billion. Despite its high net debt to equity ratio of 69.1%, the company's interest payments are well covered by EBIT at 3.9 times coverage, and its operating cash flow covers 37.7% of its debt, indicating manageable financial health. The management team is experienced with an average tenure of 6.1 years, though earnings growth has slowed recently compared to past performance and future forecasts suggest a slight decline in earnings over the next three years.

- Take a closer look at Midwich Group's potential here in our financial health report.

- Gain insights into Midwich Group's future direction by reviewing our growth report.

Creightons (LSE:CRL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Creightons Plc, along with its subsidiaries, develops, manufactures, and markets toiletries and fragrances both in the United Kingdom and internationally, with a market cap of £21.21 million.

Operations: The company generates its revenue from the Personal Products segment, which amounts to £52.72 million.

Market Cap: £21.21M

Creightons Plc, with a market cap of £21.21 million, has shown volatility typical of penny stocks, yet its financials reveal some stability. The company reported half-year sales of £27.08 million and net income improvement to £1.22 million from the previous year. Despite being currently unprofitable with a negative return on equity, Creightons' short-term assets comfortably cover both short and long-term liabilities, indicating sound liquidity management. Recent board changes include the addition of Paul Watts as an Independent Non-Executive Director, expected to bolster governance through his extensive financial services experience.

- Get an in-depth perspective on Creightons' performance by reading our balance sheet health report here.

- Examine Creightons' past performance report to understand how it has performed in prior years.

Where To Now?

- Click this link to deep-dive into the 443 companies within our UK Penny Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MIDW

Midwich Group

Distributes audio visual (AV) solutions to trade customers in the United Kingdom, Ireland, rest of Europe, the Middle East, Africa, the Asia Pacific, and North America.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives