- United Kingdom

- /

- Entertainment

- /

- AIM:FDEV

We Think Shareholders Will Probably Be Generous With Frontier Developments plc's (LON:FDEV) CEO Compensation

It would be hard to discount the role that CEO David Braben has played in delivering the impressive results at Frontier Developments plc (LON:FDEV) recently. Shareholders will have this at the front of their minds in the upcoming AGM on 27 October 2021. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

See our latest analysis for Frontier Developments

How Does Total Compensation For David Braben Compare With Other Companies In The Industry?

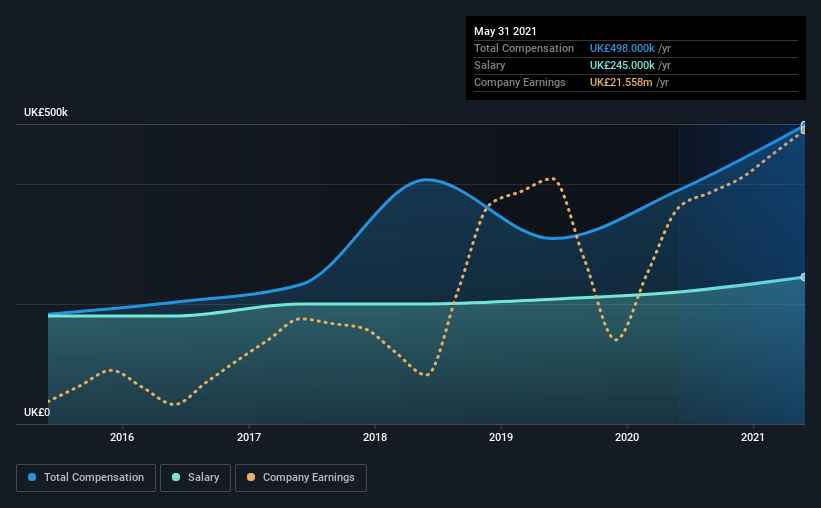

At the time of writing, our data shows that Frontier Developments plc has a market capitalization of UK£1.0b, and reported total annual CEO compensation of UK£498k for the year to May 2021. We note that's an increase of 28% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at UK£245k.

On comparing similar companies from the same industry with market caps ranging from UK£723m to UK£2.3b, we found that the median CEO total compensation was UK£534k. So it looks like Frontier Developments compensates David Braben in line with the median for the industry. What's more, David Braben holds UK£344m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | UK£245k | UK£220k | 49% |

| Other | UK£253k | UK£170k | 51% |

| Total Compensation | UK£498k | UK£390k | 100% |

On an industry level, roughly 70% of total compensation represents salary and 30% is other remuneration. Frontier Developments sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Frontier Developments plc's Growth Numbers

Over the past three years, Frontier Developments plc has seen its earnings per share (EPS) grow by 79% per year. In the last year, its revenue is up 19%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Frontier Developments plc Been A Good Investment?

Most shareholders would probably be pleased with Frontier Developments plc for providing a total return of 152% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 2 warning signs for Frontier Developments (of which 1 can't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Important note: Frontier Developments is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:FDEV

Frontier Developments

Develops and publishes video games for the interactive entertainment sector.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)