- United Kingdom

- /

- Entertainment

- /

- AIM:FDEV

Hopeful week for insiders who might be regretting buying UK£546k of Frontier Developments plc (LON:FDEV) stock earlier this year

Insiders who bought UK£546k worth of Frontier Developments plc (LON:FDEV) stock in the last year have seen some of their losses recouped as the stock gained 8.2% last week. The purchase, however, has proven to be a pricey bet, with losses currently totalling UK£241k.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we do think it is perfectly logical to keep tabs on what insiders are doing.

Check out our latest analysis for Frontier Developments

Frontier Developments Insider Transactions Over The Last Year

In the last twelve months, the biggest single purchase by an insider was when Independent Non-Executive Director Charles William Cotton bought UK£446k worth of shares at a price of UK£26.14 per share. That means that an insider was happy to buy shares at above the current price of UK£14.56. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. We always take careful note of the price insiders pay when purchasing shares. Generally speaking, it catches our eye when an insider has purchased shares at above current prices, as it suggests they believed the shares were worth buying, even at a higher price. Charles William Cotton was the only individual insider to buy shares in the last twelve months.

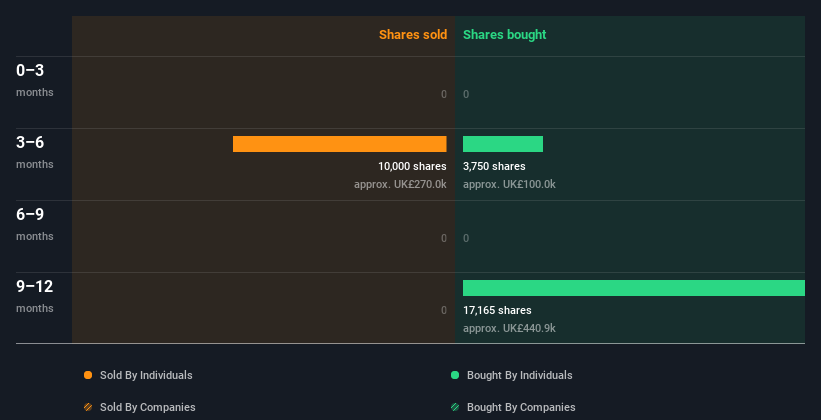

Charles William Cotton purchased 20.92k shares over the year. The average price per share was UK£26.09. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Frontier Developments is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Does Frontier Developments Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. A high insider ownership often makes company leadership more mindful of shareholder interests. Frontier Developments insiders own 35% of the company, currently worth about UK£197m based on the recent share price. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

What Might The Insider Transactions At Frontier Developments Tell Us?

The fact that there have been no Frontier Developments insider transactions recently certainly doesn't bother us. On a brighter note, the transactions over the last year are encouraging. It would be great to see more insider buying, but overall it seems like Frontier Developments insiders are reasonably well aligned (owning significant chunk of the company's shares) and optimistic for the future. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. For example - Frontier Developments has 2 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:FDEV

Frontier Developments

Develops and publishes video games for the interactive entertainment sector.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion