- United Kingdom

- /

- Entertainment

- /

- AIM:EMAN

Further weakness as Everyman Media Group (LON:EMAN) drops 10% this week, taking three-year losses to 47%

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Everyman Media Group plc (LON:EMAN) shareholders have had that experience, with the share price dropping 47% in three years, versus a market return of about 18%. Shareholders have had an even rougher run lately, with the share price down 23% in the last 90 days.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for Everyman Media Group

Everyman Media Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years, Everyman Media Group's revenue dropped 2.3% per year. That's not what investors generally want to see. The annual decline of 14% per year in that period has clearly disappointed holders. That makes sense given the lack of either profits or revenue growth. However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

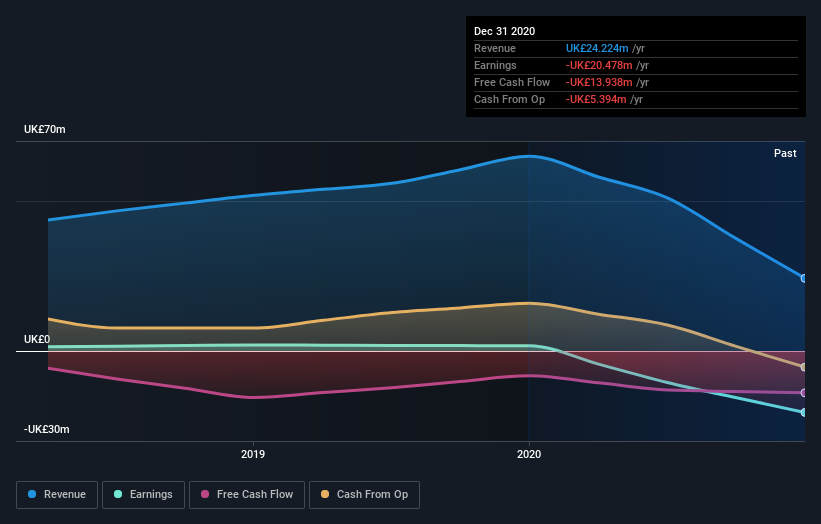

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Everyman Media Group's earnings, revenue and cash flow.

A Different Perspective

It's good to see that Everyman Media Group has rewarded shareholders with a total shareholder return of 37% in the last twelve months. That's better than the annualised return of 0.5% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Everyman Media Group better, we need to consider many other factors. Even so, be aware that Everyman Media Group is showing 2 warning signs in our investment analysis , and 1 of those is potentially serious...

Everyman Media Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you’re looking to trade Everyman Media Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Everyman Media Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:EMAN

Undervalued with imperfect balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026