Here's Why We Think Digitalbox (LON:DBOX) Is Well Worth Watching

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Digitalbox (LON:DBOX). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Digitalbox

How Fast Is Digitalbox Growing Its Earnings Per Share?

In the last three years Digitalbox's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Impressively, Digitalbox's EPS catapulted from UK£0.0034 to UK£0.0068, over the last year. Year on year growth of 100% is certainly a sight to behold.

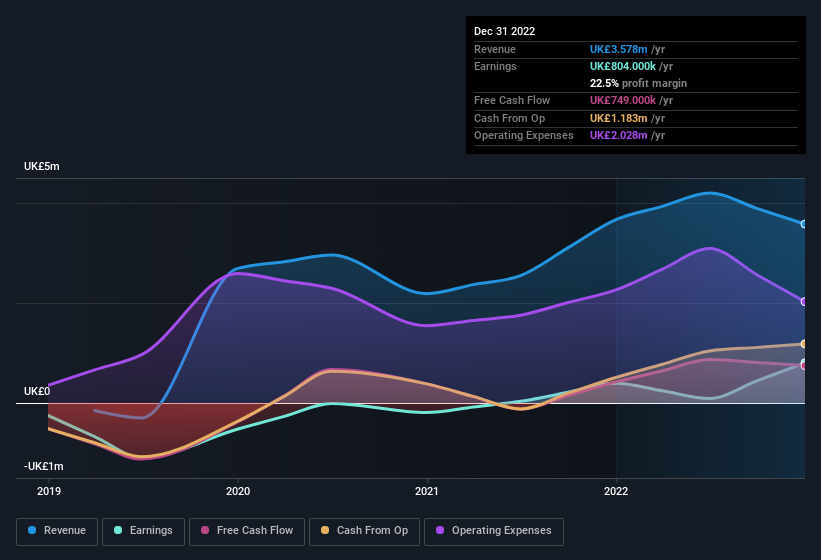

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Unfortunately, Digitalbox's revenue dropped 2.4% last year, but the silver lining is that EBIT margins improved from 17% to 23%. That falls short of ideal.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Digitalbox isn't a huge company, given its market capitalisation of UK£8.2m. That makes it extra important to check on its balance sheet strength.

Are Digitalbox Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But more importantly, CFO & Director David Joseph spent UK£44k acquiring shares, doing so at an average price of UK£0.08. Purchases like this clue us in to the to the faith management has in the business' future.

Recent insider purchases of Digitalbox stock is not the only way management has kept the interests of the general public shareholders in mind. To be specific, the CEO is paid modestly when compared to company peers of the same size. For companies with market capitalisations under UK£157m, like Digitalbox, the median CEO pay is around UK£274k.

Digitalbox offered total compensation worth UK£138k to its CEO in the year to December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Digitalbox To Your Watchlist?

Digitalbox's earnings per share growth have been climbing higher at an appreciable rate. Not to mention the company's insiders have been adding to their portfolios and the CEO's remuneration policy looks to have had shareholders in mind seeing as it's quite modest for the company size. The strong EPS growth suggests Digitalbox may be at an inflection point. If these have piqued your interest, then this stock surely warrants a spot on your watchlist. However, before you get too excited we've discovered 3 warning signs for Digitalbox that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Digitalbox isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:DBOX

Digitalbox

A holding company, engages in the publication of consumer media through digital mobile channel.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives