We Ran A Stock Scan For Earnings Growth And Brave Bison Group (LON:BBSN) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Brave Bison Group (LON:BBSN). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Brave Bison Group with the means to add long-term value to shareholders.

See our latest analysis for Brave Bison Group

How Fast Is Brave Bison Group Growing Its Earnings Per Share?

In the last three years Brave Bison Group's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Brave Bison Group's EPS shot up from UK£0.0019 to UK£0.0026; a result that's bound to keep shareholders happy. That's a impressive gain of 37%.

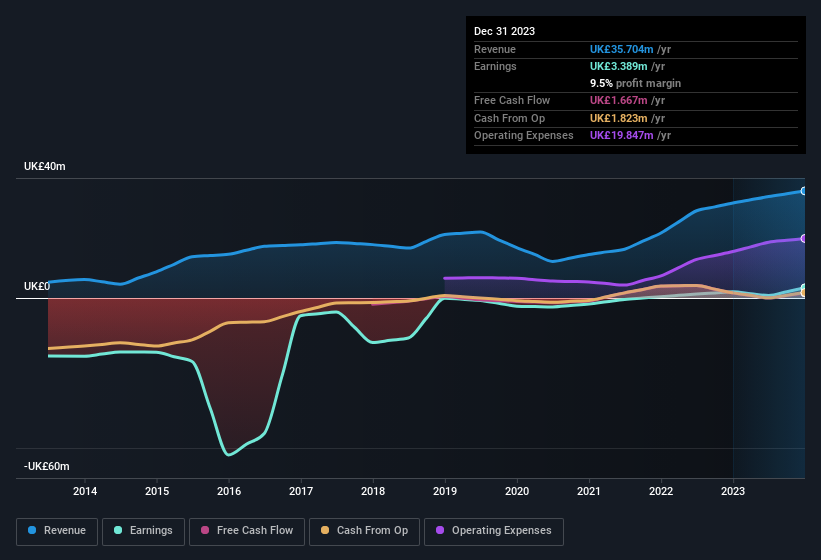

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Brave Bison Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 13% to UK£36m. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Brave Bison Group isn't a huge company, given its market capitalisation of UK£33m. That makes it extra important to check on its balance sheet strength.

Are Brave Bison Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for Brave Bison Group shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Philippa Norridge, the CFO, Company Secretary & Director of the company, paid UK£5.0k for shares at around UK£0.016 each. It seems that at least one insider is prepared to show the market there is potential within Brave Bison Group.

On top of the insider buying, it's good to see that Brave Bison Group insiders have a valuable investment in the business. Indeed, they hold UK£10m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 32% of the company, demonstrating a degree of high-level alignment with shareholders.

Is Brave Bison Group Worth Keeping An Eye On?

You can't deny that Brave Bison Group has grown its earnings per share at a very impressive rate. That's attractive. Better still, insiders own a large chunk of the company and one has even been buying more shares. Astute investors will want to keep this stock on watch. However, before you get too excited we've discovered 3 warning signs for Brave Bison Group (1 doesn't sit too well with us!) that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Brave Bison Group isn't the only one. You can see a a curated list of British companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Brave Bison Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:BBSN

Brave Bison Group

Provides digital advertising and technology services in the United Kingdom, Europe, and internationally.

High growth potential and fair value.

Market Insights

Community Narratives