- United Kingdom

- /

- Basic Materials

- /

- AIM:STCM

3 UK Penny Stocks With Market Caps Under £70M

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting the interconnectedness of global economies. Despite these broader market fluctuations, investors may find opportunities in lesser-known areas such as penny stocks. While the term "penny stock" might seem outdated, these smaller or newer companies can still offer intriguing prospects for those seeking hidden value and potential growth beyond traditional blue-chip investments.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £481.5M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.79 | £431.2M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.934 | £148.85M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.195 | £827.11M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.24 | £159.81M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.43 | £84.49M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.195 | £317.76M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| QinetiQ Group (LSE:QQ.) | £3.61 | £2.01B | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.435 | £182.75M | ★★★★★☆ |

Click here to see the full list of 446 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Brave Bison Group (AIM:BBSN)

Simply Wall St Financial Health Rating: ★★★★★☆

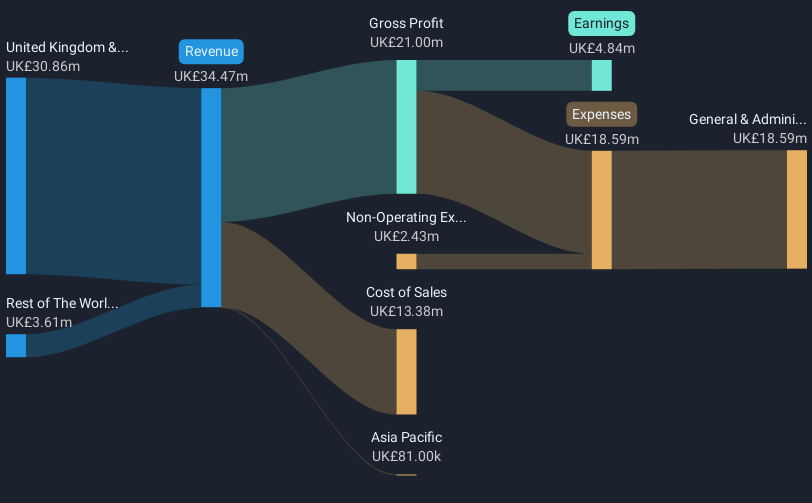

Overview: Brave Bison Group plc offers digital advertising and technology services across the United Kingdom, Europe, the Asia-Pacific, and internationally with a market cap of £31.65 million.

Operations: The company's revenue is primarily derived from monetising online video content, amounting to £34.38 million.

Market Cap: £31.65M

Brave Bison Group, with a market cap of £31.65 million, has demonstrated significant earnings growth of 481.8% over the past year, far outpacing the industry average. The company's financial health appears robust, with more cash than total debt and operating cash flow well covering its debt obligations. Trading at 22.7% below estimated fair value suggests potential undervaluation in the market. However, earnings are forecast to decline by an average of 46.1% annually over the next three years, which could impact future performance perceptions despite current high-quality earnings and strong net profit margins improvement from last year’s figures.

- Navigate through the intricacies of Brave Bison Group with our comprehensive balance sheet health report here.

- Gain insights into Brave Bison Group's outlook and expected performance with our report on the company's earnings estimates.

Personal Group Holdings (AIM:PGH)

Simply Wall St Financial Health Rating: ★★★★★★

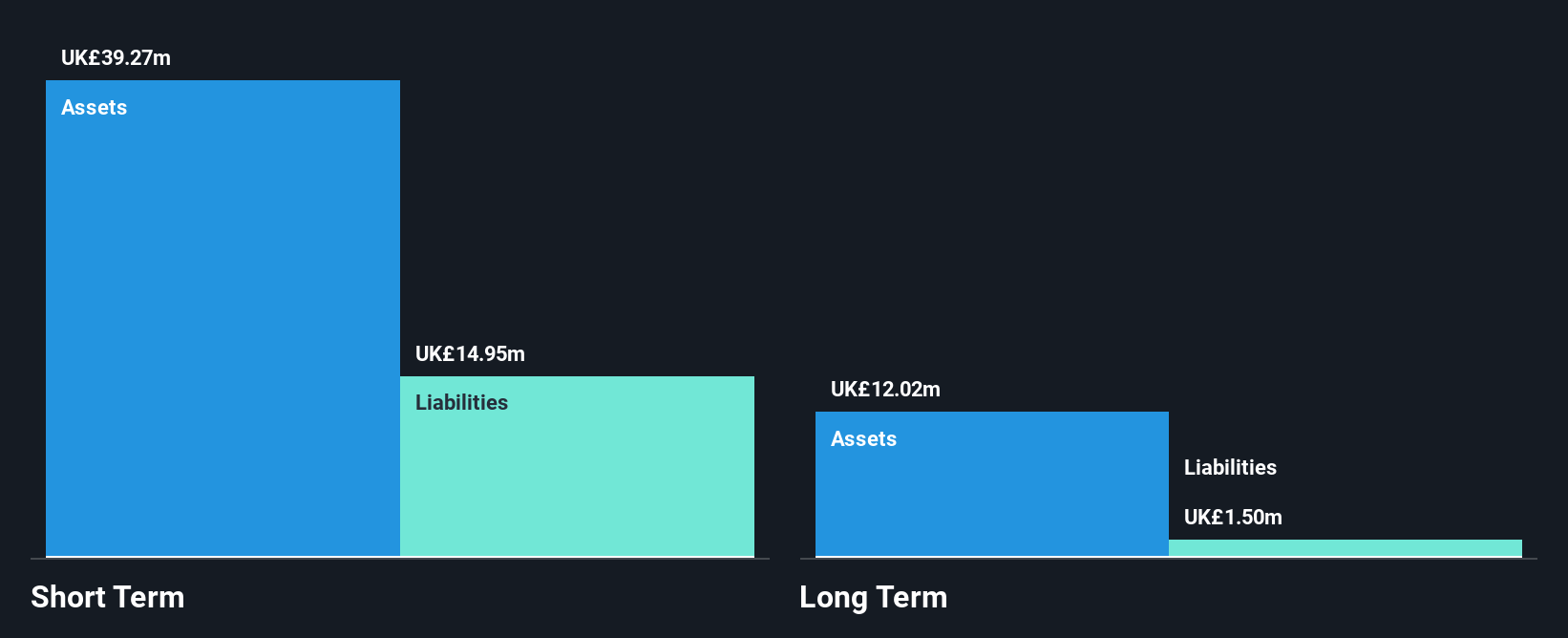

Overview: Personal Group Holdings Plc operates in the United Kingdom, offering benefits and platform products, pay and reward consultancy services, and salary sacrifice technology products, with a market cap of £64.48 million.

Operations: The company's revenue is primarily derived from its Affordable Insurance segment (£30.27 million), Benefits Platform (£10.09 million), and Pay & Reward consultancy services (£2.37 million).

Market Cap: £64.48M

Personal Group Holdings Plc, with a market cap of £64.48 million, recently became profitable, although its earnings have declined by 39.9% annually over the past five years. The company operates debt-free and maintains short-term assets (£34.4M) that exceed both short-term (£12.7M) and long-term liabilities (£1.5M). While the price-to-earnings ratio (14.2x) is below the UK market average, indicating potential value, its return on equity is considered low at 14.2%. The dividend yield of 6.28% may not be sustainable due to insufficient free cash flow coverage despite experienced management and board tenure.

- Take a closer look at Personal Group Holdings' potential here in our financial health report.

- Learn about Personal Group Holdings' future growth trajectory here.

Steppe Cement (AIM:STCM)

Simply Wall St Financial Health Rating: ★★★★☆☆

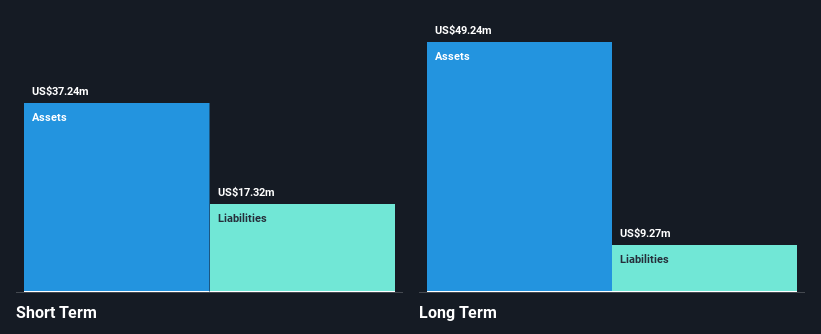

Overview: Steppe Cement Ltd. is an investment holding company involved in the production and sale of cement and clinkers in Kazakhstan, with a market capitalization of £33.95 million.

Operations: The company generates revenue of $79.26 million from its operations in the production and sale of cement.

Market Cap: £33.95M

Steppe Cement Ltd., with a market cap of £33.95 million, faces challenges despite its stable short-term asset position ($37.2M) exceeding liabilities and a satisfactory net debt to equity ratio (5.6%). The company has experienced significant earnings decline (-87.5%) over the past year, impacting profit margins which fell from 9.6% to 1.2%. A large one-off gain of $381.4K affected recent financial results, complicating the assessment of core performance. While not diluted recently and having reduced its debt-to-equity ratio over five years, Steppe Cement's low return on equity (1.6%) and insufficient cash flow coverage for debt remain concerns amidst capital restructuring efforts including a planned share capital reduction.

- Jump into the full analysis health report here for a deeper understanding of Steppe Cement.

- Review our historical performance report to gain insights into Steppe Cement's track record.

Where To Now?

- Click here to access our complete index of 446 UK Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:STCM

Steppe Cement

An investment holding company, engages in the production and sale of cement and clinkers in Kazakhstan.

Excellent balance sheet and good value.

Market Insights

Community Narratives