- United Kingdom

- /

- Capital Markets

- /

- AIM:TRUE

3 UK Penny Stocks With Market Caps Below £200M

Reviewed by Simply Wall St

The United Kingdom's stock market has been experiencing fluctuations, with the FTSE 100 index recently closing lower due to weaker trade data from China, highlighting global economic interdependencies. In such a climate, investors often look toward smaller or newer companies for potential opportunities. Penny stocks, though an older term, continue to represent a valuable segment of the market where strong financial fundamentals can offer both stability and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Foresight Group Holdings (LSE:FSG) | £4.00 | £455.98M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.00 | £323.15M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.185 | £316.77M | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | £0.956 | £152.36M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.865 | £468.97M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.22 | £836.53M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.32 | £165.52M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.28 | £81.63M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £0.87 | £73.85M | ★★★★★★ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

Click here to see the full list of 445 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Braveheart Investment Group (AIM:BRH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Braveheart Investment Group plc is a private equity and venture capital firm that focuses on various investment stages including seed/startup, early venture, and buyouts in growth capital companies, with a market cap of £3.35 million.

Operations: The company's revenue segment is primarily from the United Kingdom, with reported revenues of -£4.78 million.

Market Cap: £3.35M

Braveheart Investment Group plc, with a market cap of £3.35 million, is currently pre-revenue and unprofitable, reporting revenues of -£4.78 million. Despite being debt-free and having short-term assets exceeding liabilities (£1.2M vs £43.6K), the company faces challenges due to high volatility and significant losses over the past five years (42.4% per year). The board is experienced with an average tenure of 5.7 years, but management tenure data is insufficient to assess experience levels fully. Recent changes include the appointment of MAH as auditors for the financial year ending March 2025, pending shareholder approval at the AGM.

- Click here and access our complete financial health analysis report to understand the dynamics of Braveheart Investment Group.

- Explore historical data to track Braveheart Investment Group's performance over time in our past results report.

Topps Tiles (LSE:TPT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Topps Tiles Plc operates in the United Kingdom, focusing on the retail and wholesale distribution of ceramic and porcelain tiles, natural stone, and related products for both residential and commercial markets, with a market cap of £68.77 million.

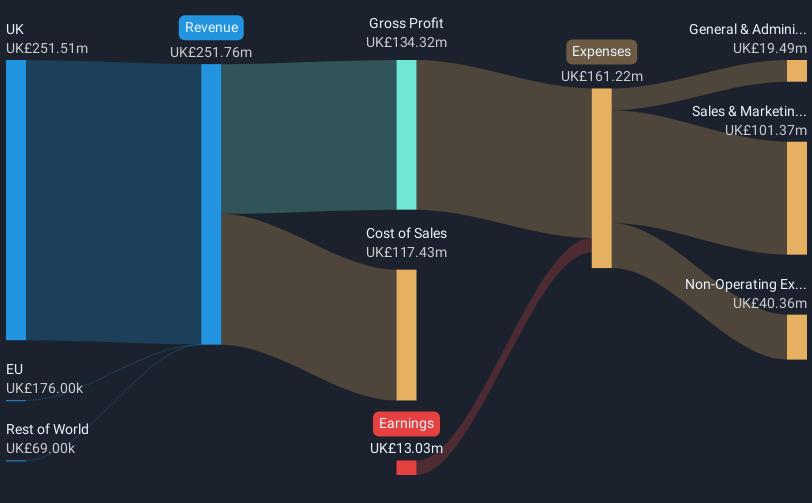

Operations: The company generates revenue from its Retail - Building Products segment, amounting to £251.76 million.

Market Cap: £68.77M

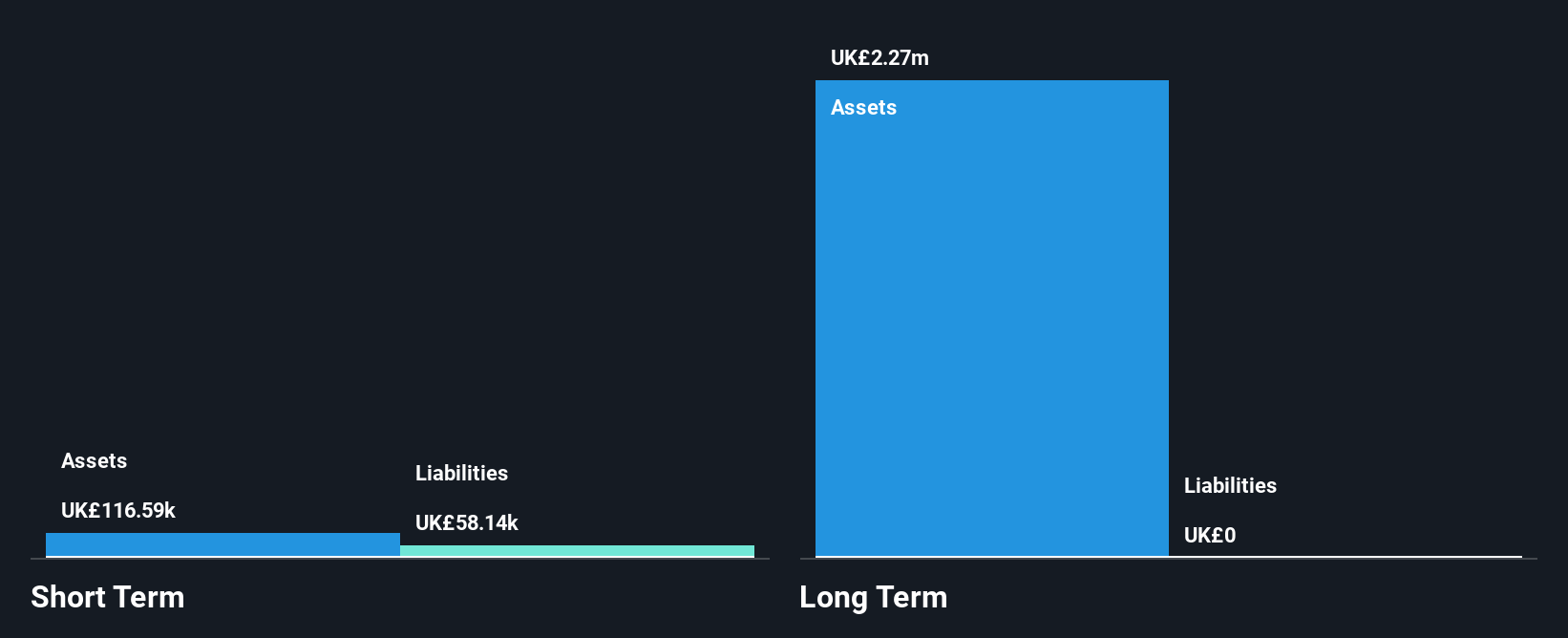

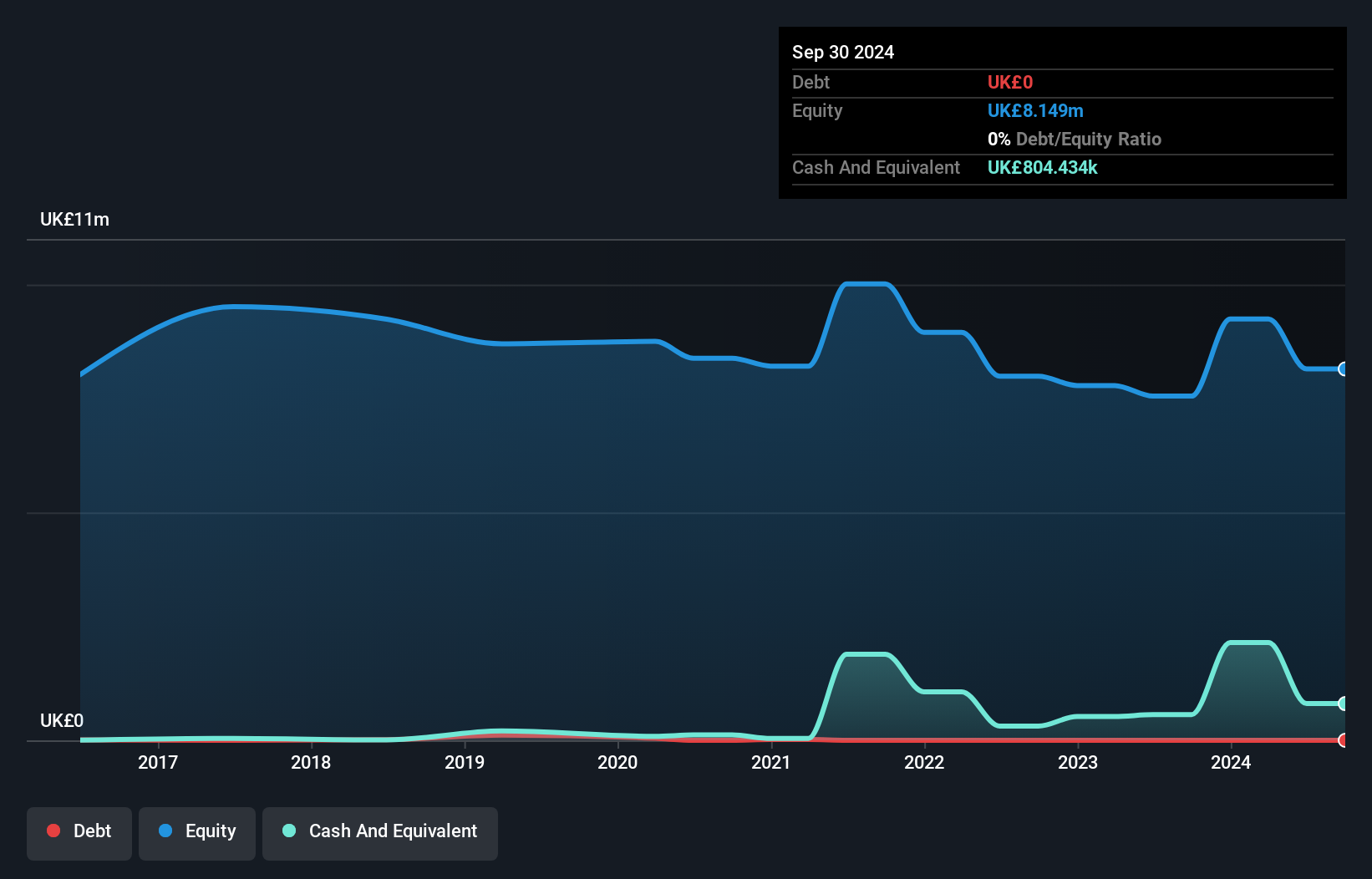

Topps Tiles Plc, with a market cap of £68.77 million, faces challenges as it remains unprofitable with increased losses over the past five years. Despite its financial struggles, the company has demonstrated robust sales growth in recent periods, reporting a 4.6% year-on-year increase for the 13 weeks ending December 2024 and strong online sales performance. While its debt is well covered by operating cash flow and interest payments are well managed, Topps Tiles' short-term assets do not cover long-term liabilities. The CEO's planned retirement highlights potential leadership changes that could impact future strategic direction.

- Navigate through the intricacies of Topps Tiles with our comprehensive balance sheet health report here.

- Examine Topps Tiles' earnings growth report to understand how analysts expect it to perform.

SulNOx Group (OFEX:SNOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SulNOx Group PLC manufactures and develops fuel conditioners and emulsifiers aimed at decarbonizing liquid hydrocarbon fuels globally, with a market cap of £120.67 million.

Operations: The company generates its revenue primarily from the Specialty Chemicals segment, totaling £0.85 million.

Market Cap: £120.67M

SulNOx Group, with a market cap of £120.67 million, is pre-revenue despite generating £0.85 million from its Specialty Chemicals segment. The company has no debt and recently raised capital through private placements and follow-on equity offerings to bolster its cash runway, which was initially forecasted for just three months based on free cash flow estimates. However, it remains unprofitable with increasing losses over the past five years and a negative return on equity of -26.52%. The management team is relatively new, while the board is experienced. Despite high volatility in share price, short-term assets exceed liabilities comfortably.

- Unlock comprehensive insights into our analysis of SulNOx Group stock in this financial health report.

- Gain insights into SulNOx Group's past trends and performance with our report on the company's historical track record.

Make It Happen

- Reveal the 445 hidden gems among our UK Penny Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truetide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TRUE

Truetide

A private equity and venture capital firm specializing in loan, mezzanine, seed/startup, early venture, late stage, emerging growth, turnaround, distress situations, buyout and growth capital companies.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives