- United Kingdom

- /

- Chemicals

- /

- LSE:ZTF

We Think Some Shareholders May Hesitate To Increase Zotefoams plc's (LON:ZTF) CEO Compensation

In the past three years, the share price of Zotefoams plc (LON:ZTF) has struggled to grow and now shareholders are sitting on a loss. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 26 May 2021. They could also influence management through voting on resolutions such as executive remuneration. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

See our latest analysis for Zotefoams

How Does Total Compensation For David Stirling Compare With Other Companies In The Industry?

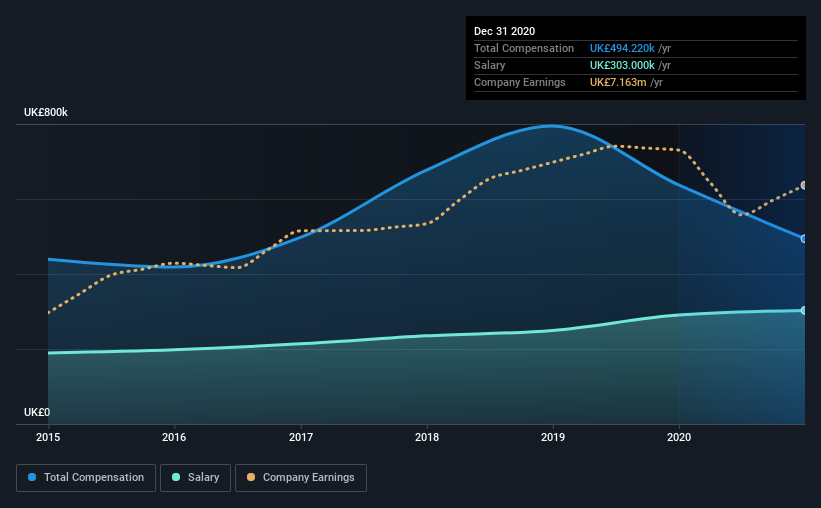

Our data indicates that Zotefoams plc has a market capitalization of UK£197m, and total annual CEO compensation was reported as UK£494k for the year to December 2020. Notably, that's a decrease of 22% over the year before. In particular, the salary of UK£303.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between UK£71m and UK£283m had a median total CEO compensation of UK£465k. From this we gather that David Stirling is paid around the median for CEOs in the industry. Moreover, David Stirling also holds UK£1.8m worth of Zotefoams stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£303k | UK£291k | 61% |

| Other | UK£191k | UK£347k | 39% |

| Total Compensation | UK£494k | UK£637k | 100% |

On an industry level, roughly 67% of total compensation represents salary and 33% is other remuneration. Our data reveals that Zotefoams allocates salary more or less in line with the wider market. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Zotefoams plc's Growth

Zotefoams plc has seen its earnings per share (EPS) increase by 2.8% a year over the past three years. In the last year, its revenue is up 2.3%.

We would argue that the improvement in revenue is good, but isn't particularly impressive, but it is good to see modest EPS growth. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Zotefoams plc Been A Good Investment?

Since shareholders would have lost about 26% over three years, some Zotefoams plc investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would be keen to know what's holding the stock back when earnings have grown. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for Zotefoams that you should be aware of before investing.

Switching gears from Zotefoams, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Zotefoams, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zotefoams might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:ZTF

Zotefoams

Manufactures, distributes, and sells polyolefin block foams in the United Kingdom, rest of Europe, North America, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives