- United Kingdom

- /

- Professional Services

- /

- AIM:LTG

Undervalued Small Caps With Insider Action In UK For December 2024

Reviewed by Simply Wall St

The United Kingdom's market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic interdependencies. As the broader market sentiment remains cautious amidst these international pressures, investors may find opportunities in small-cap stocks that demonstrate resilience through strong fundamentals and potential insider confidence.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Headlam Group | NA | 0.2x | 36.37% | ★★★★★☆ |

| iomart Group | 27.8x | 0.7x | 25.78% | ★★★★☆☆ |

| Sabre Insurance Group | 11.2x | 1.5x | 12.99% | ★★★★☆☆ |

| Harworth Group | 11.0x | 5.8x | -506.64% | ★★★★☆☆ |

| Optima Health | NA | 1.2x | 38.64% | ★★★★☆☆ |

| Telecom Plus | 19.2x | 0.8x | 25.74% | ★★★☆☆☆ |

| Treatt | 20.1x | 1.9x | 47.18% | ★★★☆☆☆ |

| Gooch & Housego | 37.5x | 0.9x | 37.37% | ★★★☆☆☆ |

| Reach | 6.9x | 0.5x | -138.26% | ★★★☆☆☆ |

| THG | NA | 0.3x | -983.52% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

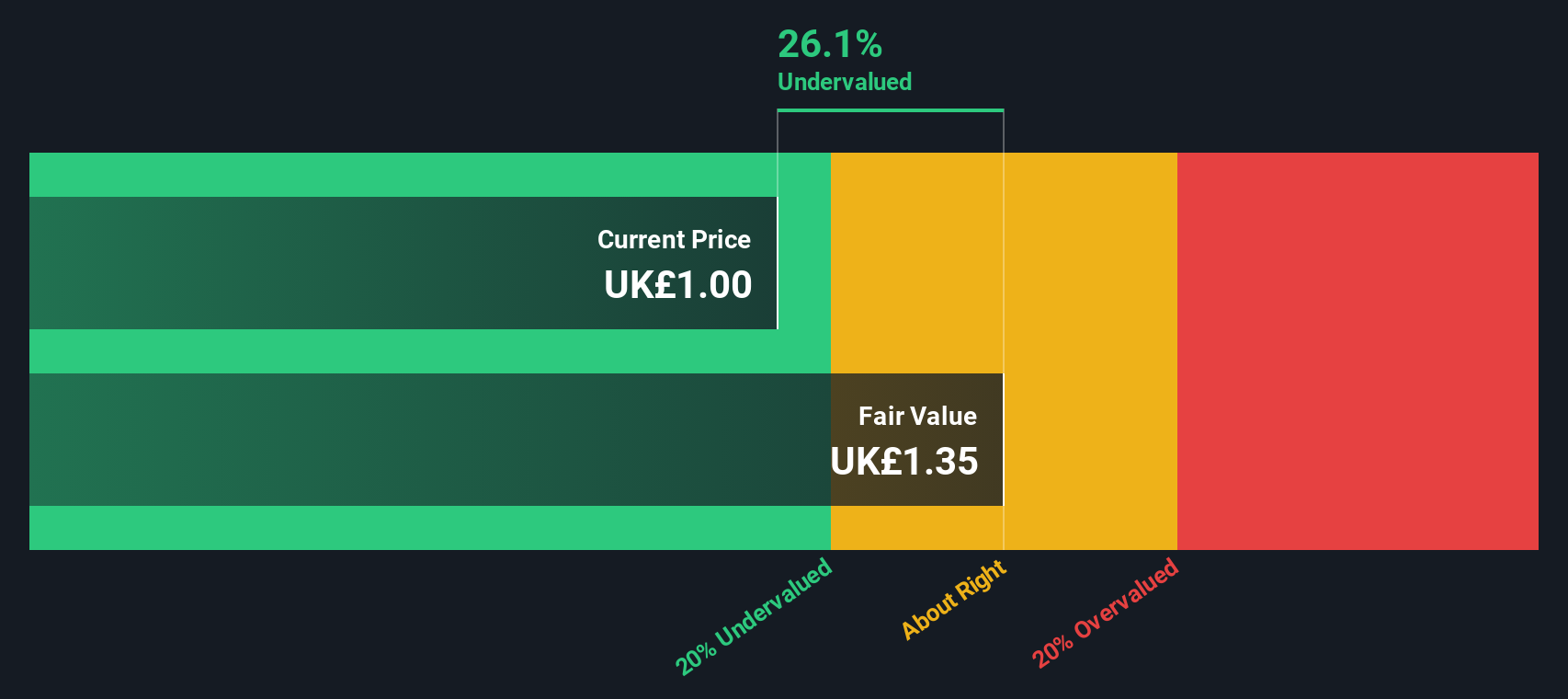

Learning Technologies Group (AIM:LTG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Learning Technologies Group is a company that specializes in providing digital learning and talent management solutions, with operations divided into Content & Services and Software & Platforms segments, and has a market cap of approximately £1.15 billion.

Operations: The company generates revenue primarily from Content & Services (£390.17 million) and Software & Platforms (£137.88 million). The gross profit margin has shown fluctuations, reaching 14.67% in the latest period.

PE: 16.5x

Learning Technologies Group, a UK-based company, is currently in the spotlight due to a £790 million acquisition offer from General Atlantic. This proposal includes an option for shareholders to reinvest in an unlisted equity alternative. Despite recent earnings showing sales of £250 million and net income rising to £26.61 million for the half-year ending June 2024, its volatile share price and reliance on external borrowing highlight potential risks. Insider confidence remains steady with no significant insider buying activity reported recently.

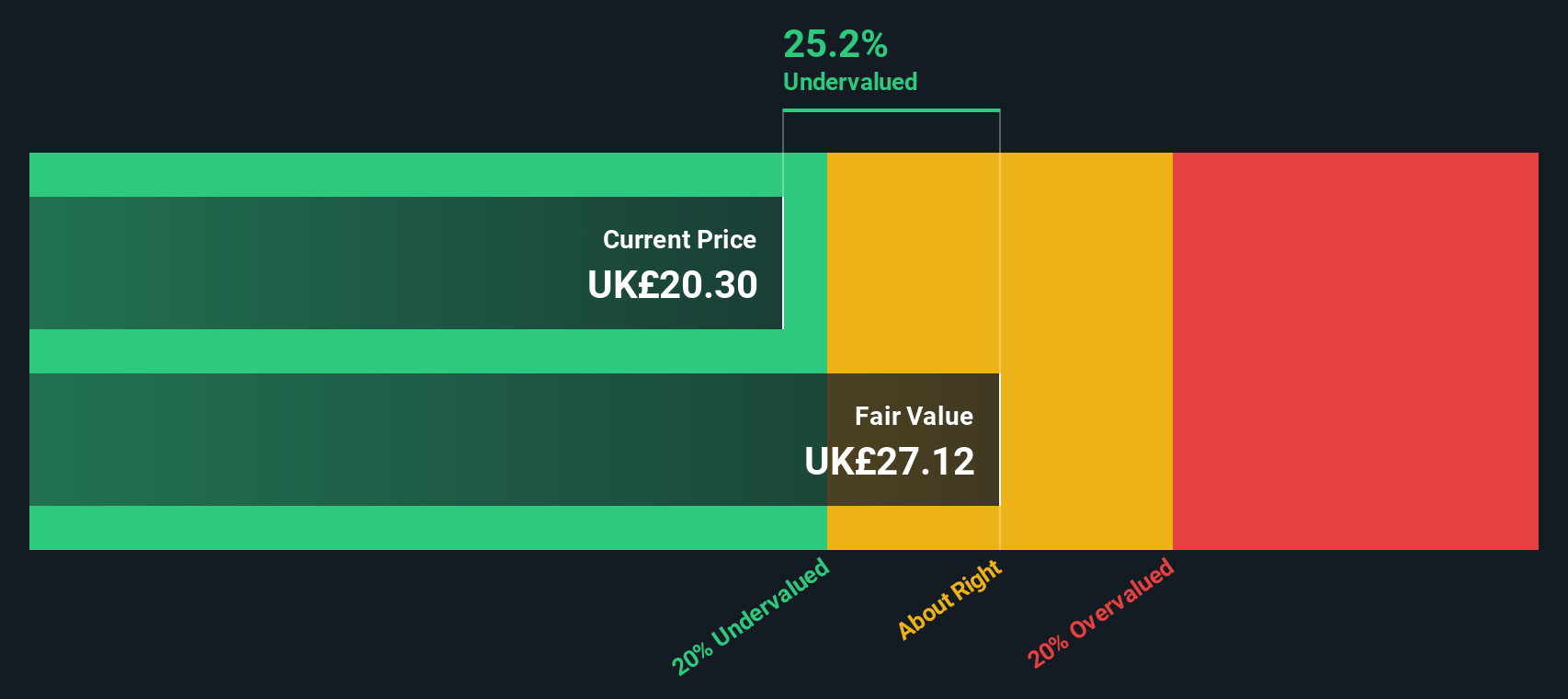

Telecom Plus (LSE:TEP)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Telecom Plus is a UK-based multi-utility provider offering bundled services such as gas, electricity, broadband, and mobile to residential and small business customers with a market cap of £1.57 billion.

Operations: The company generates revenue primarily from its non-regulated utility segment, with recent figures showing a gross profit margin of 19.32%. Operating expenses have been significant, including general and administrative costs and sales and marketing expenses. The net income margin was recorded at 4.06% in the latest period, indicating profitability after accounting for all costs.

PE: 19.2x

Telecom Plus, a UK-based company, recently reported H1 2025 earnings with sales of £697.75 million and net income rising to £27.63 million from the previous year. Basic earnings per share increased to £0.351, signaling improved profitability despite lower sales compared to last year. Insider confidence is notable as insiders have been purchasing shares throughout 2024, indicating potential value recognition within the company. Although reliant on external borrowing for funding, Telecom Plus maintains a strong financial position with projected annual earnings growth of 11.97%.

- Delve into the full analysis valuation report here for a deeper understanding of Telecom Plus.

Assess Telecom Plus' past performance with our detailed historical performance reports.

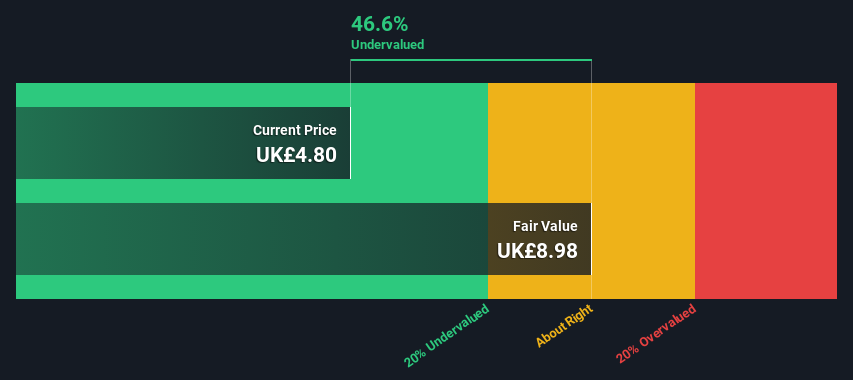

Treatt (LSE:TET)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Treatt is a global manufacturer and supplier of innovative ingredient solutions, specializing in flavors and fragrances for the beverage, personal care, and household sectors, with a market capitalization of approximately £0.47 billion.

Operations: Revenue has shown a general upward trend, reaching £153.07 million by the end of 2024. The cost of goods sold (COGS) has also increased, impacting the gross profit margin which was at 29.06% in September 2024. Operating expenses have been rising steadily, with general and administrative expenses forming a significant part of these costs. Net income margin improved to 9.41% by September 2024, indicating better profitability despite higher non-operating expenses over time.

PE: 20.1x

Treatt, a UK-based company, has seen its sales grow to £153.07 million for the year ending September 2024, up from £147.4 million the previous year. Net income rose to £14.4 million compared to £10.94 million previously, reflecting solid financial performance despite relying on higher-risk external borrowing for funding. The proposed final dividend of 5.81 pence per share underscores confidence in future growth prospects, supported by strategic leadership changes aimed at enhancing regional operations in Europe and boosting overall earnings growth forecasted at 8.85% annually.

- Dive into the specifics of Treatt here with our thorough valuation report.

Explore historical data to track Treatt's performance over time in our Past section.

Make It Happen

- Investigate our full lineup of 29 Undervalued UK Small Caps With Insider Buying right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:LTG

Learning Technologies Group

Provides talent and learning solutions, content, services, and digital platforms to corporate and government clients.

Undervalued with solid track record.