- United Kingdom

- /

- Banks

- /

- LSE:TBCG

UK Exchange Highlights: Three Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As the United Kingdom's financial markets navigate through a period marked by political changes and economic policies under new leadership, investors are closely monitoring indices like the FTSE 100 for signs of stability and growth potential. In such a climate, growth companies with high insider ownership can be particularly appealing, as significant internal investment often signals strong confidence in the company’s future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 32.7% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 124.5% |

| Gulf Keystone Petroleum (LSE:GKP) | 10.8% | 47.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

| Helios Underwriting (AIM:HUW) | 23.1% | 14.7% |

| Foresight Group Holdings (LSE:FSG) | 31.9% | 26.1% |

| Velocity Composites (AIM:VEL) | 27.8% | 143.4% |

| Mothercare (AIM:MTC) | 15.1% | 41.2% |

| Afentra (AIM:AET) | 37.2% | 64.4% |

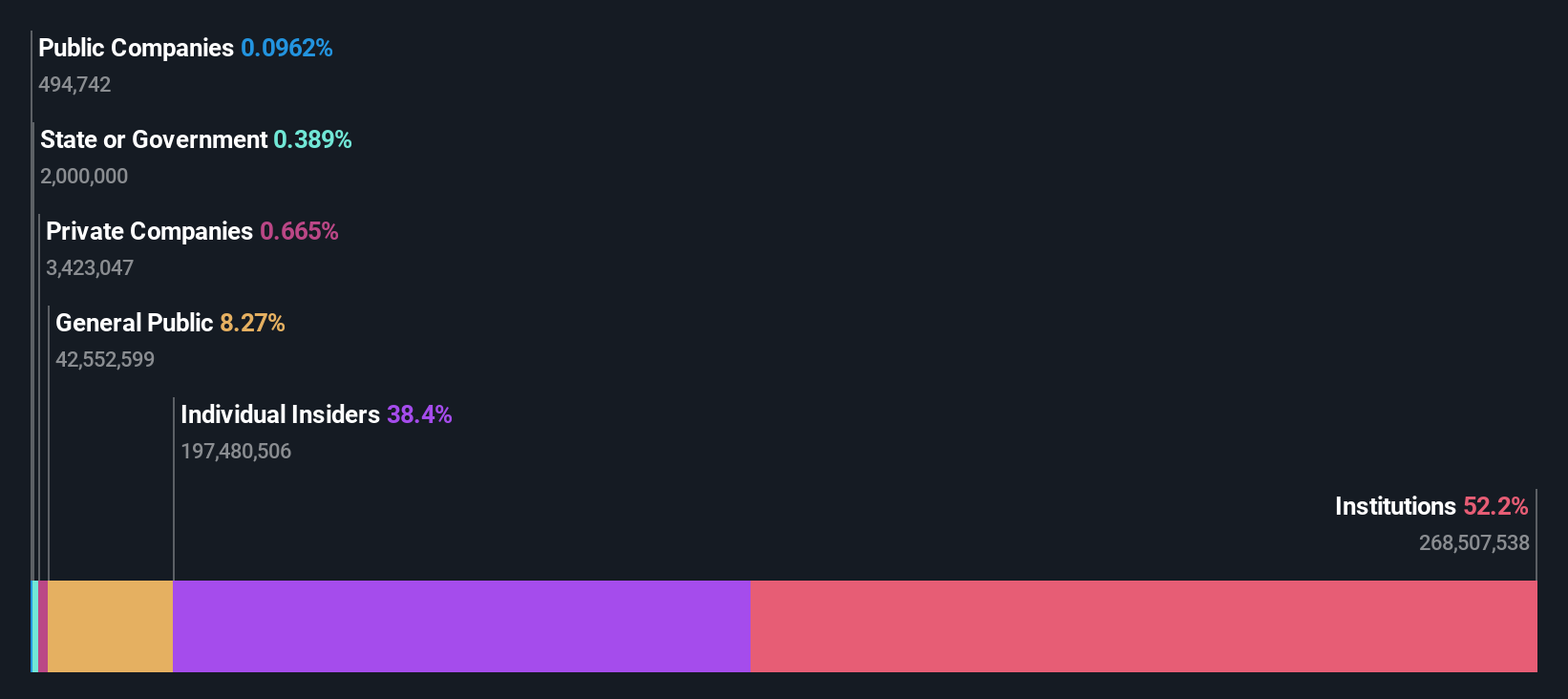

| Hochschild Mining (LSE:HOC) | 38.4% | 42.6% |

Let's dive into some prime choices out of from the screener.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of approximately £0.97 billion.

Operations: The company generates revenue primarily from its San Jose, Inmaculada, and Pallancata mines, which contributed $242.46 million, $396.64 million, and $54.05 million respectively.

Insider Ownership: 38.4%

Hochschild Mining is poised for significant growth with an expected revenue increase of 11.3% per year, outpacing the UK market's 3.5%. The company is forecast to become profitable within the next three years, with earnings projected to grow by 42.62% annually. Insider activity has been positive, with more shares bought than sold in recent months, underscoring strong internal confidence. Trading at 37.7% below its estimated fair value suggests potential undervaluation. Recent production results show a stable output in silver and an increase in gold production, supporting robust operational performance.

- Click here and access our complete growth analysis report to understand the dynamics of Hochschild Mining.

- In light of our recent valuation report, it seems possible that Hochschild Mining is trading behind its estimated value.

Playtech (LSE:PTEC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Playtech plc is a global technology company specializing in gambling software, services, content, and platform technologies with a market capitalization of approximately £1.54 billion.

Operations: Playtech's revenue is primarily generated through its Gaming B2B and Gaming B2C segments, which earned €684.10 million and €946.60 million respectively, along with smaller contributions from B2C operations like HAPPYBET and Sun Bingo totaling €91.60 million.

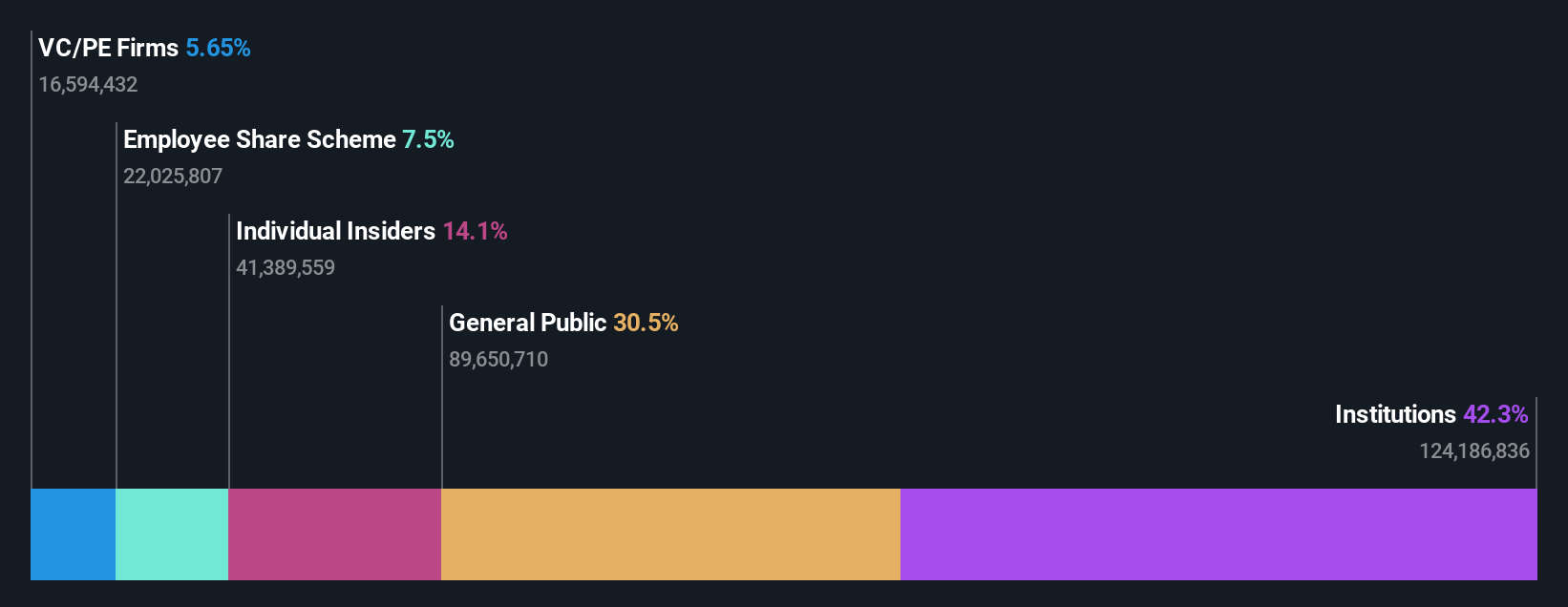

Insider Ownership: 13.5%

Playtech, a UK-based growth company with high insider ownership, is trading at 53.8% below its estimated fair value, indicating potential undervaluation. Earnings are expected to increase by 20.62% annually over the next three years, outperforming the UK market forecast of 12.6%. However, its Return on Equity is projected to be low at 8.9%. Recently, Playtech announced a significant partnership with MGM Resorts to provide immersive live casino content from Las Vegas venues, potentially boosting future revenue streams despite current financial impacts from one-off items.

- Unlock comprehensive insights into our analysis of Playtech stock in this growth report.

- Our expertly prepared valuation report Playtech implies its share price may be lower than expected.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates primarily in Georgia, Azerbaijan, and Uzbekistan, offering a range of financial services including banking, leasing, insurance, brokerage, and card processing with a market capitalization of approximately £1.49 billion.

Operations: The company generates its revenue through diverse financial services such as banking, leasing, insurance, brokerage, and card processing in Georgia, Azerbaijan, and Uzbekistan.

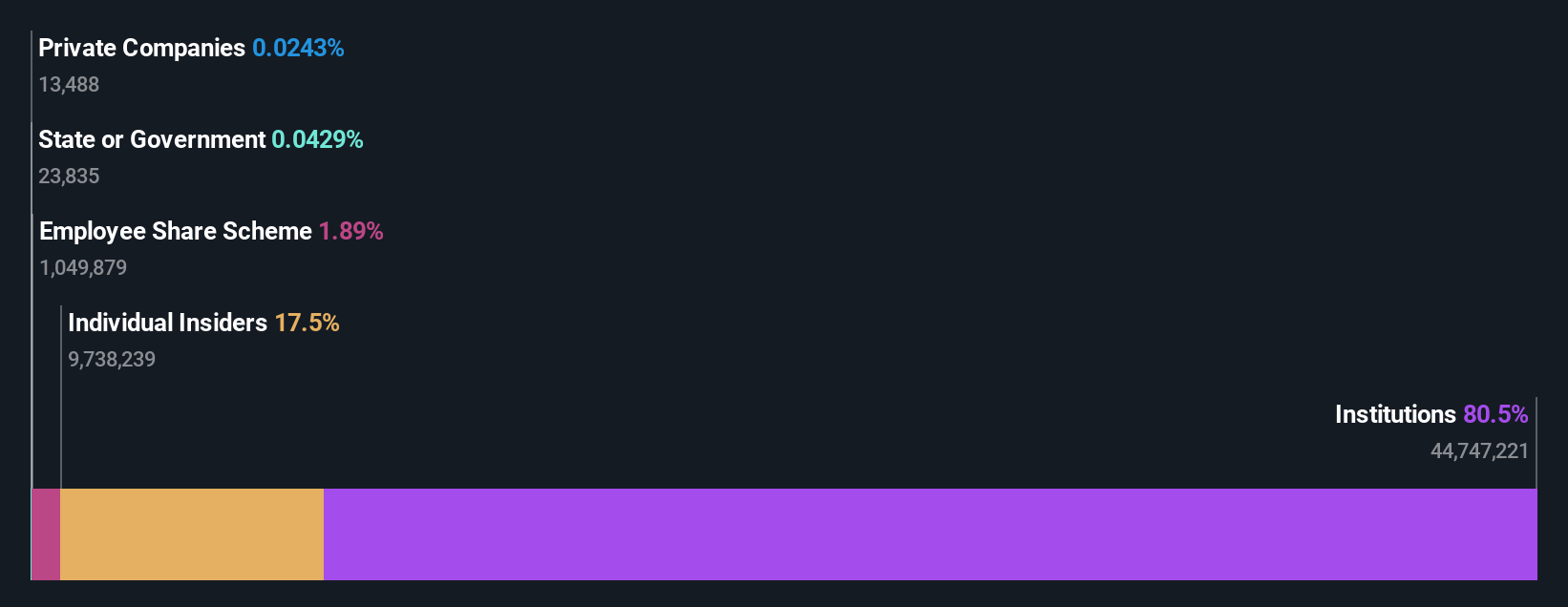

Insider Ownership: 18%

TBC Bank Group, a growth-oriented UK firm with substantial insider ownership, has demonstrated robust financial performance with earnings increasing by 23.6% annually over the past five years. Recent forecasts predict earnings and revenue growth outpacing the UK market at 15.2% and 18.3% per year respectively. However, concerns persist due to its high bad loans ratio of 2.1% and low allowance for bad loans at 74%. Additionally, TBCG recently initiated a share repurchase program valued at GEL 75 million aimed at reducing share capital, reflecting confidence in its financial health despite some underlying risks.

- Delve into the full analysis future growth report here for a deeper understanding of TBC Bank Group.

- Insights from our recent valuation report point to the potential undervaluation of TBC Bank Group shares in the market.

Make It Happen

- Gain an insight into the universe of 67 Fast Growing UK Companies With High Insider Ownership by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TBC Bank Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TBCG

TBC Bank Group

Through its subsidiaries, provides banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion