- United Kingdom

- /

- Banks

- /

- LSE:TBCG

May 2024 Insight Into UK Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

Over the past year, the United Kingdom stock market has experienced a steady rise of 7.7%, with recent activity remaining flat over the last week. In this context, companies with high insider ownership can be particularly compelling, as they often reflect a management team deeply invested in the company's success, aligning well with forecasts of robust annual earnings growth.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Getech Group (AIM:GTC) | 17.2% | 86.1% |

| Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 50.8% |

| Petrofac (LSE:PFC) | 16.6% | 115.4% |

| Spectra Systems (AIM:SPSY) | 23.3% | 26.3% |

| Energean (LSE:ENOG) | 10.7% | 22.4% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

| Plant Health Care (AIM:PHC) | 26.4% | 94.4% |

| Velocity Composites (AIM:VEL) | 28.5% | 140.5% |

| TEAM (AIM:TEAM) | 25.8% | 58.6% |

| Afentra (AIM:AET) | 38.3% | 198.2% |

Let's explore several standout options from the results in the screener.

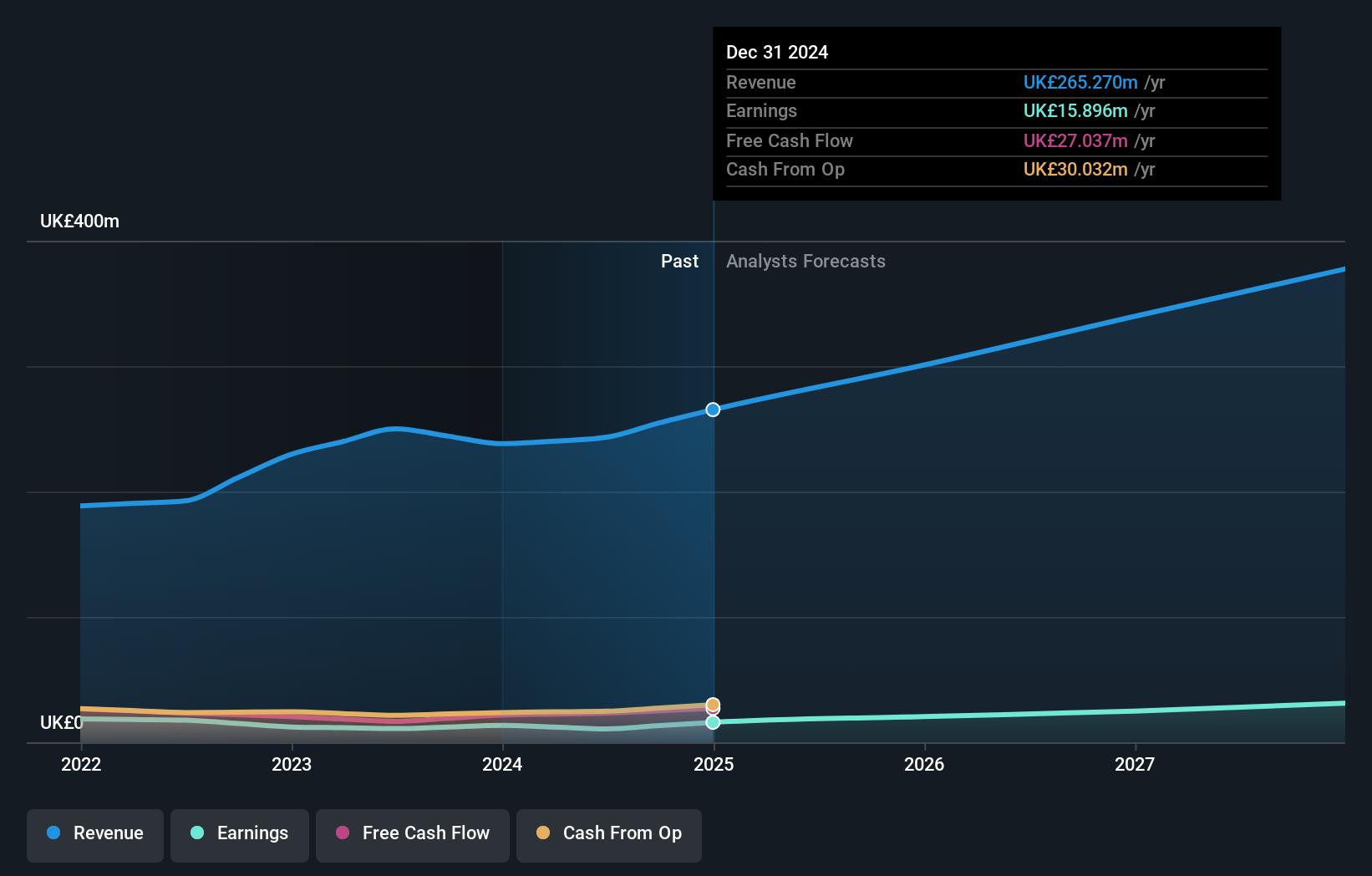

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mortgage Advice Bureau (Holdings) plc operates in the United Kingdom, offering mortgage advice services through its subsidiaries, with a market capitalization of approximately £516.65 million.

Operations: The company generates £236.92 million from its provision of financial services.

Insider Ownership: 20.2%

Earnings Growth Forecast: 19.6% p.a.

Mortgage Advice Bureau, a UK-based company, has shown consistent growth with a 10.1% increase in earnings last year and an anticipated annual earnings growth of 19.6%. Despite challenges like dividends not being well-covered by earnings, the firm benefits from substantial insider confidence, evidenced by recent insider purchases. The appointment of Emilie McCarthy as CFO could strengthen financial leadership, aligning with the company's growth trajectory in a market where it outpaces average UK revenue growth forecasts.

- Click to explore a detailed breakdown of our findings in Mortgage Advice Bureau (Holdings)'s earnings growth report.

- Upon reviewing our latest valuation report, Mortgage Advice Bureau (Holdings)'s share price might be too optimistic.

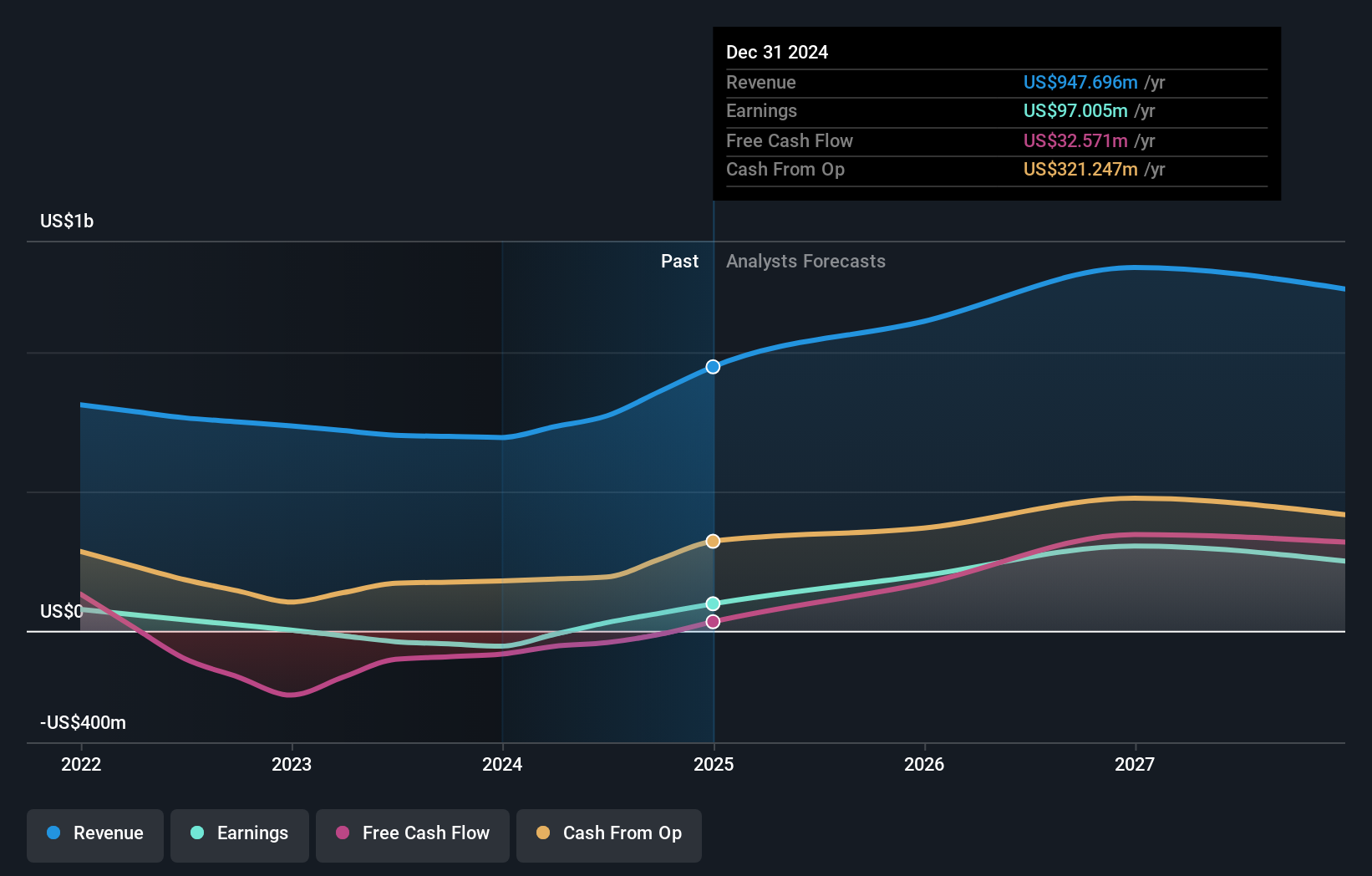

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company that specializes in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of approximately £0.85 billion.

Operations: The company generates revenue primarily from its San Jose, Inmaculada, and Pallancata mines, which collectively brought in $693.15 million.

Insider Ownership: 38.4%

Earnings Growth Forecast: 57.2% p.a.

Hochschild Mining is expected to become profitable within three years, with revenue growth forecasted at 8.3% annually, outpacing the UK market average. Recent insider activities show more buying than selling, indicating strong confidence from those closest to the company. Despite a challenging past with a net loss reported in the previous year and low forecasted return on equity, Hochschild's increased production guidance and strategic M&A pursuits signal potential for future growth and operational expansion.

- Delve into the full analysis future growth report here for a deeper understanding of Hochschild Mining.

- In light of our recent valuation report, it seems possible that Hochschild Mining is trading beyond its estimated value.

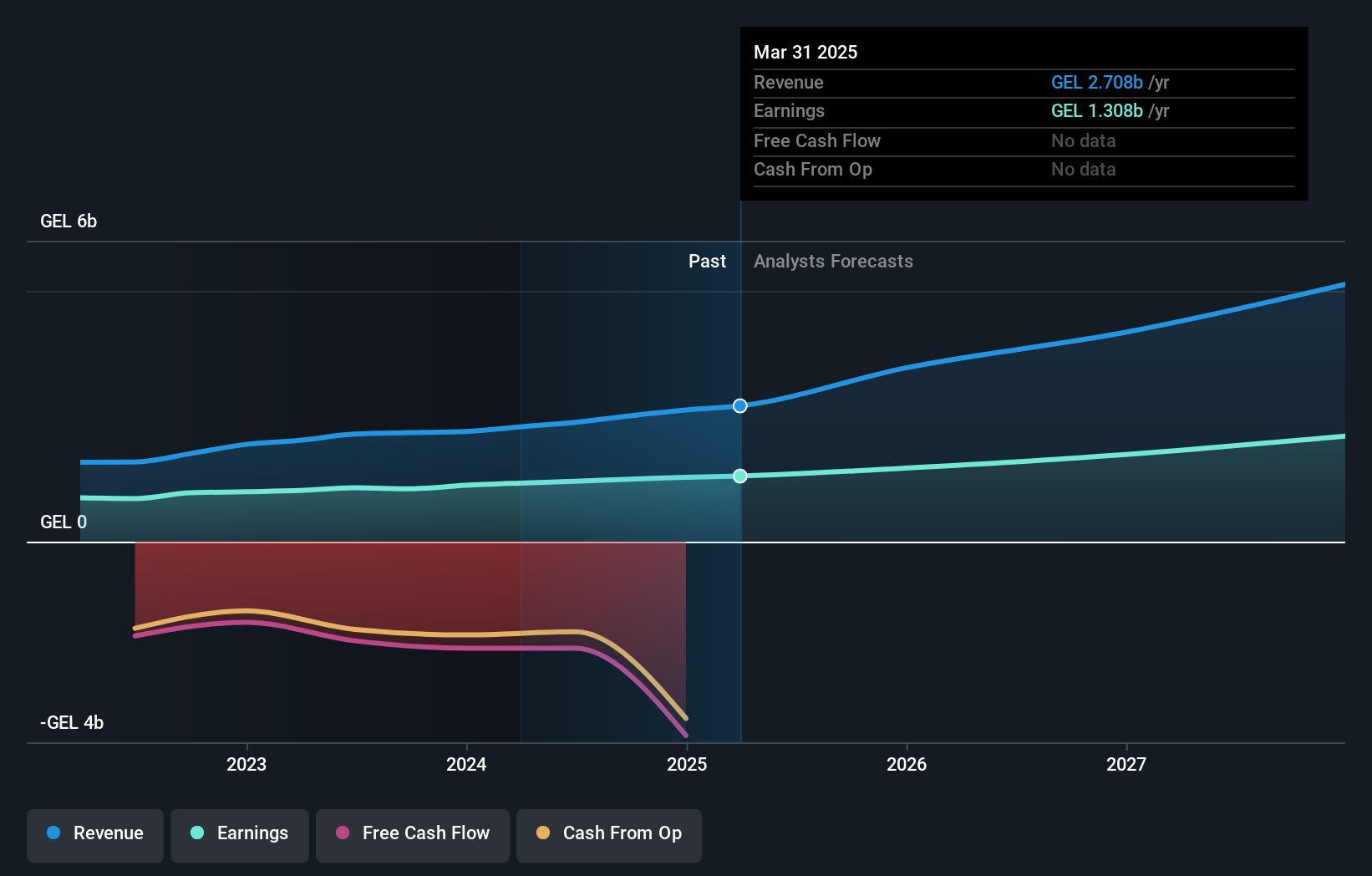

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates primarily in Georgia, Azerbaijan, and Uzbekistan, offering a range of financial services including banking, leasing, insurance, brokerage, and card processing with a market capitalization of approximately £1.48 billion.

Operations: The company generates revenue through diverse financial services such as banking, leasing, insurance, brokerage, and card processing across Georgia, Azerbaijan, and Uzbekistan.

Insider Ownership: 17.9%

Earnings Growth Forecast: 15.2% p.a.

TBC Bank Group has demonstrated solid performance with a recent increase in both net interest income and net income, reflecting robust earnings growth. Despite trading at good value relative to peers, it faces challenges like a high bad loans ratio (2.1%) and an unstable dividend track record. However, its revenue is expected to grow substantially above the market average, supported by strong insider confidence and strategic financial activities including a successful $300 million fixed-income offering.

- Unlock comprehensive insights into our analysis of TBC Bank Group stock in this growth report.

- The analysis detailed in our TBC Bank Group valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Embark on your investment journey to our 66 Fast Growing UK Companies With High Insider Ownership selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if TBC Bank Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TBCG

TBC Bank Group

Through its subsidiaries, provides banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan.

Undervalued with excellent balance sheet and pays a dividend.