- United Kingdom

- /

- Metals and Mining

- /

- LSE:HOC

Investors Continue Waiting On Sidelines For Hochschild Mining plc (LON:HOC)

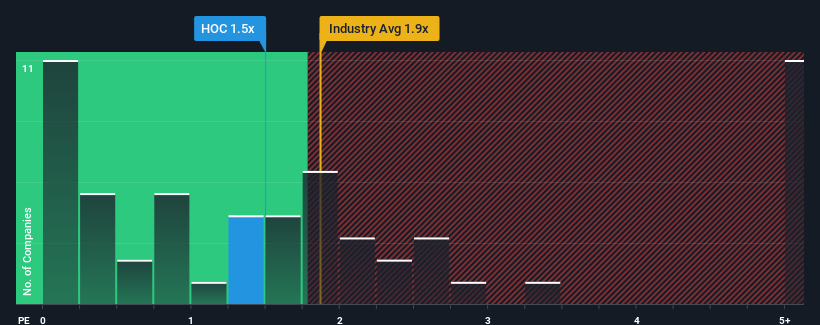

It's not a stretch to say that Hochschild Mining plc's (LON:HOC) price-to-sales (or "P/S") ratio of 1.5x right now seems quite "middle-of-the-road" for companies in the Metals and Mining industry in the United Kingdom, where the median P/S ratio is around 1.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Hochschild Mining

What Does Hochschild Mining's Recent Performance Look Like?

Hochschild Mining certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Hochschild Mining will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Hochschild Mining's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 9.9% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 1.7% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 12% each year during the coming three years according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 4.1% per annum, which is noticeably less attractive.

In light of this, it's curious that Hochschild Mining's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Hochschild Mining's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Hochschild Mining currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Hochschild Mining that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hochschild Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:HOC

Hochschild Mining

A precious metals company, engages in the exploration, mining, processing, and sale of gold and silver deposits in Peru, Argentina, the United Kingdom, Canada, Brazil, and Chile.

Outstanding track record and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success