- United Kingdom

- /

- Insurance

- /

- LSE:JUST

GB Group And 2 Other Undervalued Small Caps In The United Kingdom With Insider Buying

Reviewed by Simply Wall St

The United Kingdom's stock market has been under pressure recently, with the FTSE 100 and FTSE 250 indices both closing lower amid weak trade data from China. This downturn has highlighted the importance of identifying resilient small-cap stocks that can weather broader economic challenges. In this context, we will explore GB Group and two other undervalued small caps in the UK that have shown promising insider buying activity.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 24.0x | 5.4x | 14.72% | ★★★★★☆ |

| Domino's Pizza Group | 15.1x | 1.7x | 29.10% | ★★★★★☆ |

| C&C Group | NA | 0.4x | 47.74% | ★★★★★☆ |

| GB Group | NA | 3.0x | 33.30% | ★★★★★☆ |

| CVS Group | 21.9x | 1.2x | 42.14% | ★★★★☆☆ |

| Hochschild Mining | NA | 1.6x | 43.57% | ★★★★☆☆ |

| Norcros | 7.9x | 0.5x | -0.47% | ★★★☆☆☆ |

| H&T Group | 8.0x | 0.8x | -2.52% | ★★★☆☆☆ |

| Foxtons Group | 27.2x | 1.3x | 46.89% | ★★★☆☆☆ |

| Harworth Group | 14.5x | 7.6x | -531.39% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

GB Group (AIM:GBG)

Simply Wall St Value Rating: ★★★★★☆

Overview: GB Group specializes in identity verification, fraud prevention, and location intelligence services with a market cap of approximately £1.09 billion.

Operations: The company generates revenue primarily from Identity (£156.06m), Location (£81.07m), and Fraud (£40.20m) segments. Over the analyzed periods, its gross profit margin has shown an upward trend, reaching 0.77612% in September 2017 before experiencing fluctuations and settling at 0.70142% by March 2024.

PE: -17.3x

GB Group, a small-cap stock in the UK, reported sales of £277.33 million for the year ending March 31, 2024, with a net loss of £48.58 million—an improvement from the previous year's £119.79 million loss. They declared a final dividend of 4.20 pence per share at their AGM on July 23, 2024. Insider confidence is evident as several insiders made share purchases over the last six months. The company expects mid-single-digit revenue growth and high single-digit profit growth for FY25 due to operational efficiency gains achieved in FY24.

- Unlock comprehensive insights into our analysis of GB Group stock in this valuation report.

Examine GB Group's past performance report to understand how it has performed in the past.

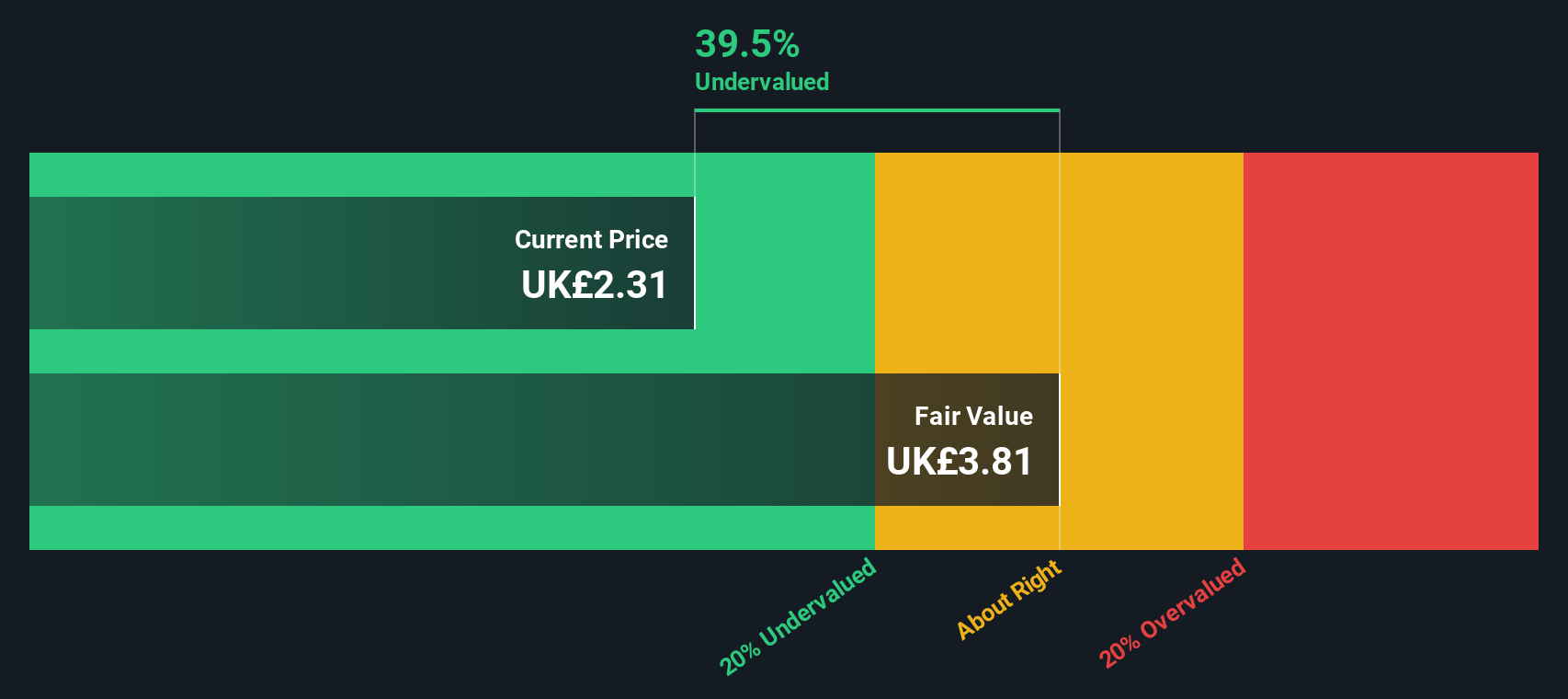

Hochschild Mining (LSE:HOC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hochschild Mining is a precious metals company engaged in the exploration, mining, processing, and sale of gold and silver with operations primarily in Peru and Argentina; it has a market cap of approximately £0.95 billion.

Operations: Hochschild Mining generates revenue primarily from its Inmaculada and San Jose segments, with combined contributions of approximately $639.11 million. The company's cost of goods sold (COGS) stands at $510.14 million, resulting in a gross profit margin of 26.46%.

PE: -20.7x

Hochschild Mining, a company in the precious metals sector, has shown promising signs of being undervalued. Despite a slight dip in quarterly silver production to 2,589 koz from 2,955 koz last year, gold output increased to 66.37 koz from 54.12 koz. Notably, Eduardo Navarro's insider confidence is evident with their purchase of 148,000 shares valued at £235K between January and June this year. The company forecasts earnings growth of 53% annually and maintains its production guidance for the rest of the year at up to 360K gold equivalent ounces.

- Delve into the full analysis valuation report here for a deeper understanding of Hochschild Mining.

Assess Hochschild Mining's past performance with our detailed historical performance reports.

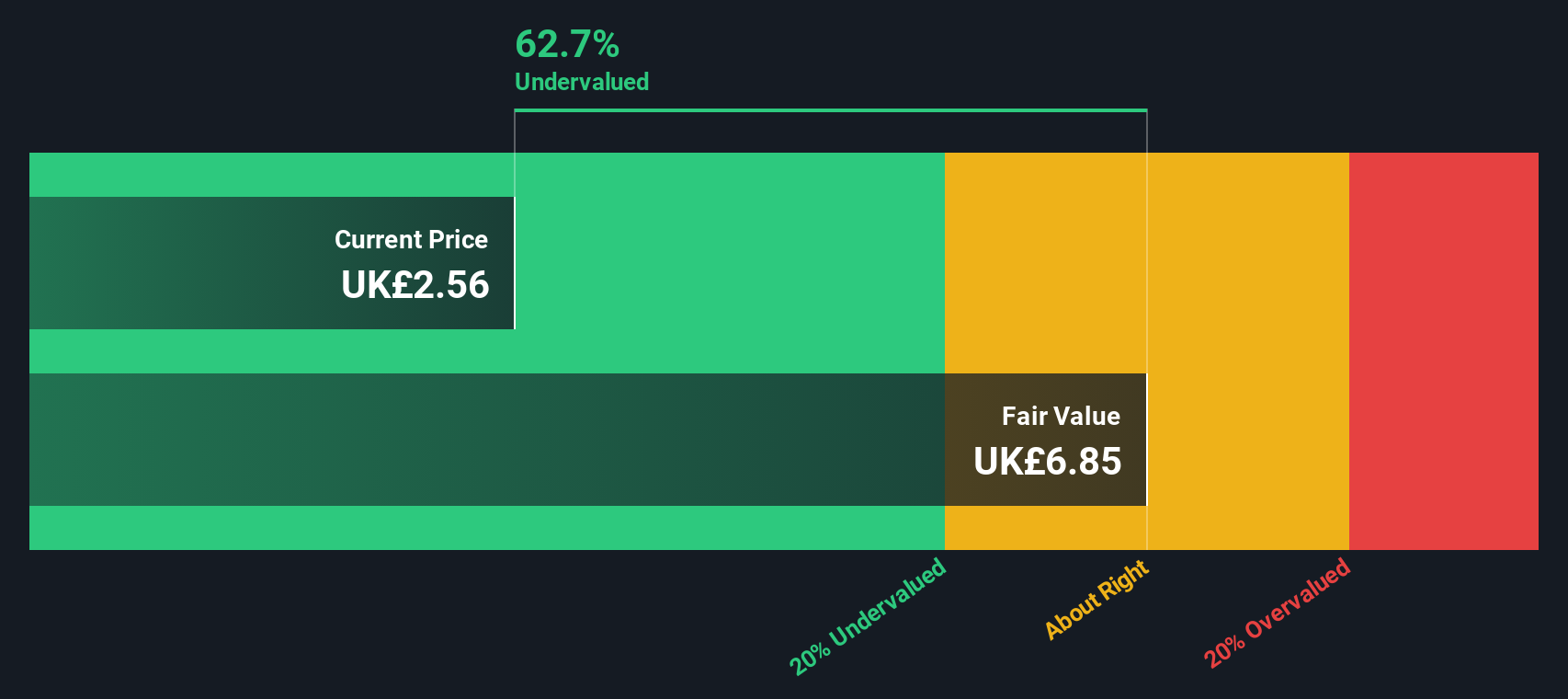

Just Group (LSE:JUST)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Just Group is a UK-based financial services company specializing in retirement income products and services, with a market cap of approximately £1.25 billion.

Operations: Just Group generates revenue primarily from its core business operations, with notable fluctuations in gross profit margin, reaching as high as 54.28% in recent periods. Operating expenses and non-operating expenses are significant cost components impacting net income, which has varied widely over the observed periods.

PE: 10.4x

Just Group, a small-cap stock in the UK, has caught attention due to insider confidence with significant share purchases over the past six months. Recently, their H1 2024 earnings call on July 10 highlighted a forecasted annual earnings growth of 9.18%. However, it's worth noting that all liabilities stem from higher-risk external borrowing rather than customer deposits. This blend of growth potential and financial risk makes Just Group an intriguing option for those exploring undervalued UK stocks.

Seize The Opportunity

- Get an in-depth perspective on all 25 Undervalued UK Small Caps With Insider Buying by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:JUST

Just Group

Provides various retirement income products and services to individual, homeowners, and corporate clients in the United Kingdom.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.