- United Kingdom

- /

- Hospitality

- /

- LSE:PPH

3 UK Growth Stocks With Up To 38% Insider Ownership

Reviewed by Simply Wall St

As the UK market grapples with global economic challenges, including weak trade data from China impacting the FTSE 100 and commodity prices, investors are keenly observing how these factors influence broader market trends. In such a turbulent environment, growth companies with high insider ownership can be of particular interest as they often signal strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Filtronic (AIM:FTC) | 24.9% | 35.5% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 108.1% |

| Foresight Group Holdings (LSE:FSG) | 34.4% | 25.8% |

| Judges Scientific (AIM:JDG) | 10.7% | 23.7% |

| LSL Property Services (LSE:LSL) | 10.4% | 26.9% |

| Facilities by ADF (AIM:ADF) | 13.1% | 190% |

| Getech Group (AIM:GTC) | 11.8% | 114.5% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 26.4% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 189.1% |

Let's uncover some gems from our specialized screener.

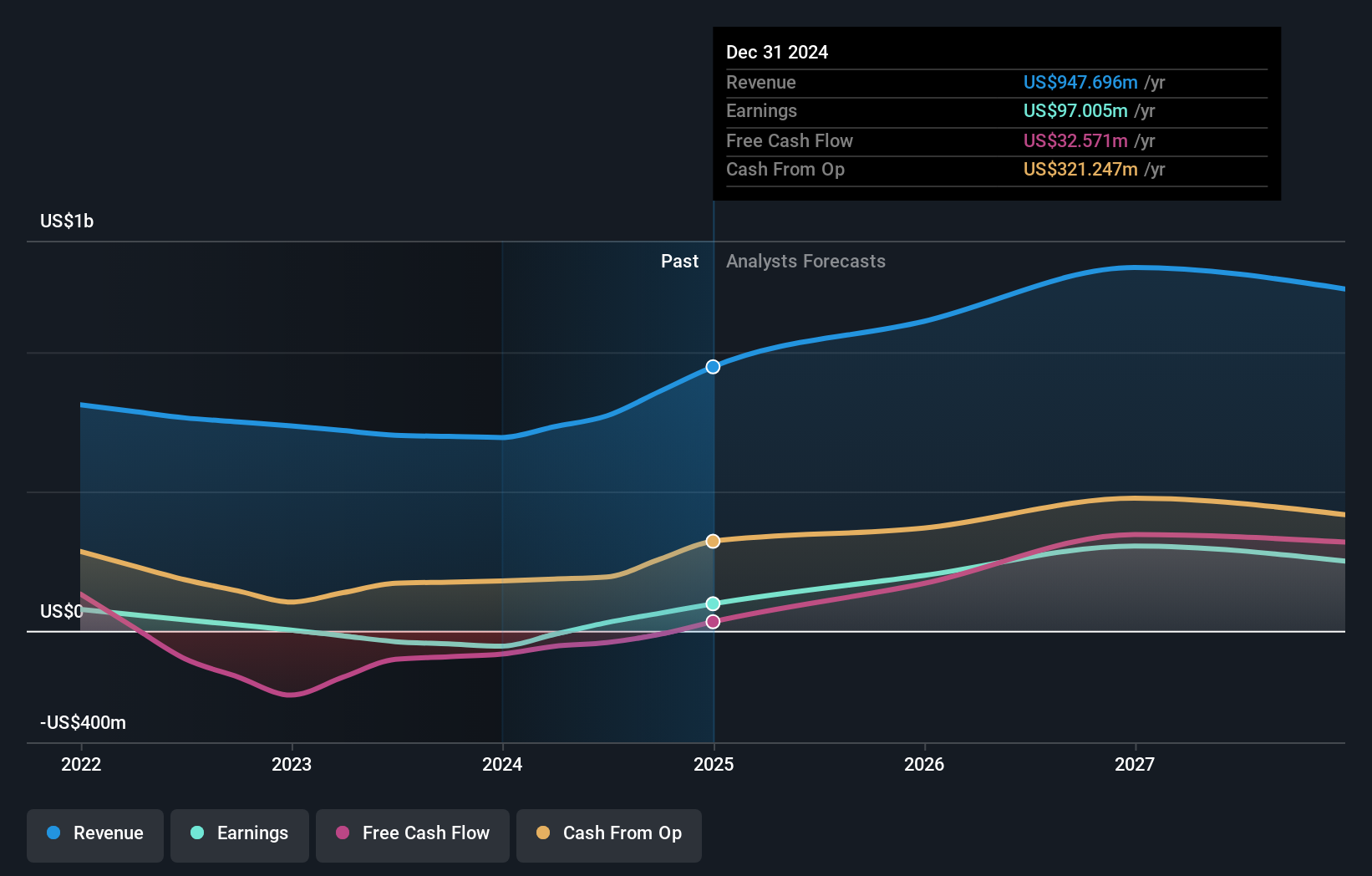

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver across several countries including Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £905.45 million.

Operations: The company's revenue segments include $266.70 million from San Jose and $451.91 million from Inmaculada.

Insider Ownership: 38.4%

Hochschild Mining's earnings are forecast to grow significantly, outpacing the UK market. Despite a volatile share price and high debt levels, it trades below its estimated fair value. Recent production results showed increased gold output while silver decreased slightly. The company has expanded by acquiring the Monte Do Carmo Project and plans further growth with new production guidance for 2025. Analysts agree on a potential stock price rise of 47.3%.

- Take a closer look at Hochschild Mining's potential here in our earnings growth report.

- Our valuation report here indicates Hochschild Mining may be undervalued.

LSL Property Services (LSE:LSL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LSL Property Services plc operates in the United Kingdom, offering business-to-business services to mortgage intermediaries and estate agency franchisees, as well as valuation services to lenders, with a market cap of £301.30 million.

Operations: The company's revenue is derived from three main segments: Financial Services (£47.22 million), Surveying and Valuation (£79.49 million), and Estate Agency excluding Financial Services (£30.61 million).

Insider Ownership: 10.4%

LSL Property Services is poised for significant earnings growth, outpacing the UK market with a forecast of 26.9% annually. Insider activity has seen more buying than selling recently, though not in substantial volumes. The stock trades at a notable discount to its estimated fair value, yet its dividend coverage remains weak. Changes in leadership include Adam Castleton stepping up as CEO, ensuring continuity and leveraging his extensive experience within the company.

- Click to explore a detailed breakdown of our findings in LSL Property Services' earnings growth report.

- Our expertly prepared valuation report LSL Property Services implies its share price may be lower than expected.

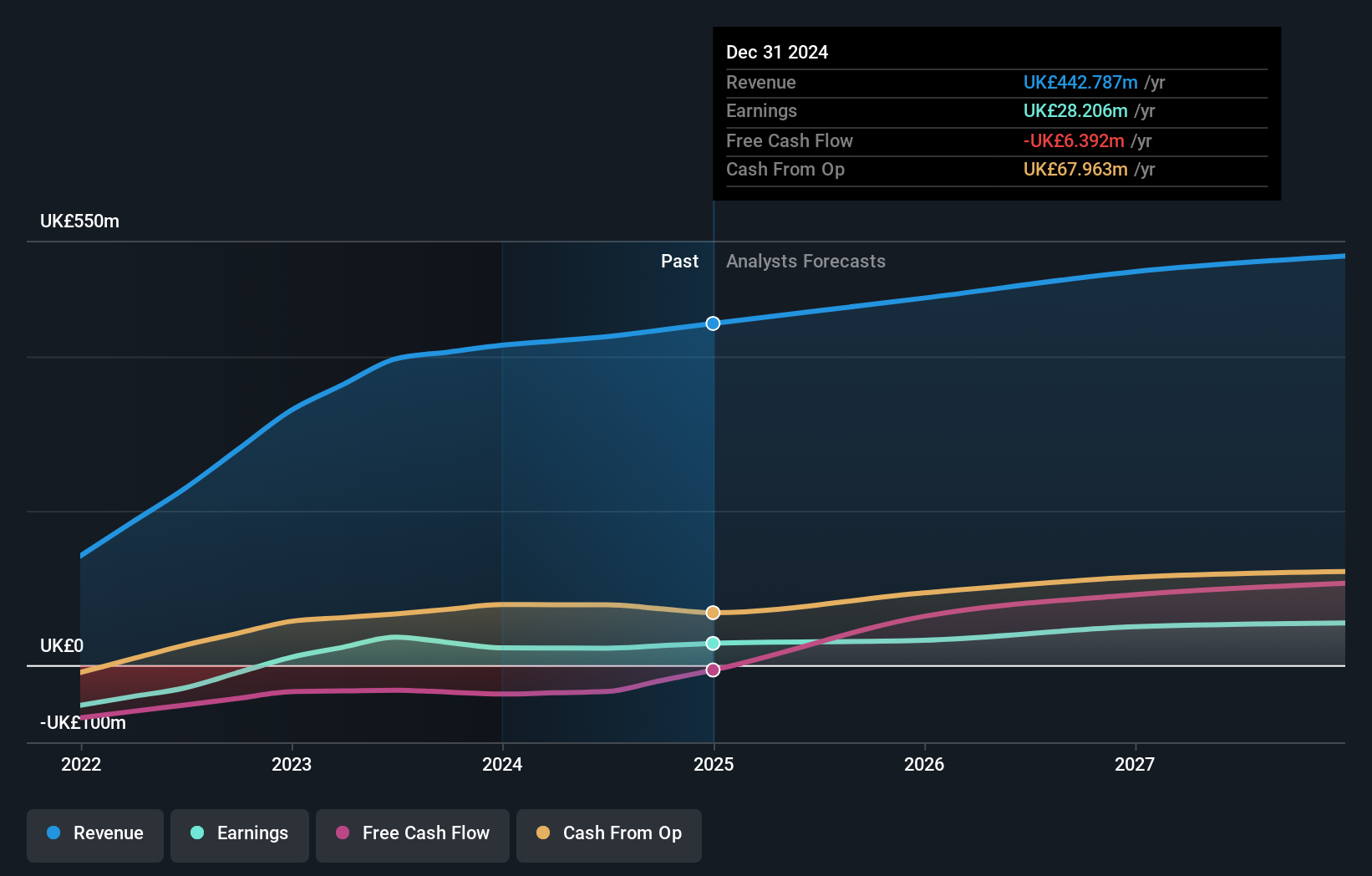

PPHE Hotel Group (LSE:PPH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PPHE Hotel Group Limited is involved in owning, co-owning, developing, leasing, operating, and franchising upscale and lifestyle hotels across several European countries including the Netherlands and the United Kingdom, with a market cap of £545.35 million.

Operations: The company's revenue segments comprise £236.99 million from Owned Hotel Operations in the United Kingdom, £81.63 million from Croatia, £65.92 million from the Netherlands, £24.10 million from Germany, Hungary, and Serbia combined, and £50.09 million from Management and Central Services.

Insider Ownership: 14.8%

PPHE Hotel Group is set for significant earnings growth at 27.05% annually, surpassing UK market expectations. Despite trading at a substantial discount to its estimated fair value, the company faces challenges with interest coverage and dividend sustainability. Recent board changes include Ken Bradley replacing Eli Papouchado as Chairman amid an HR-related claim against Papouchado, who continues to hold a large voting stake through family trusts. Revenue growth forecasts remain modest compared to earnings projections.

- Click here and access our complete growth analysis report to understand the dynamics of PPHE Hotel Group.

- The valuation report we've compiled suggests that PPHE Hotel Group's current price could be inflated.

Key Takeaways

- Get an in-depth perspective on all 57 Fast Growing UK Companies With High Insider Ownership by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PPH

PPHE Hotel Group

Owns, co-owns, develops, leases, operates, and franchises full-service upscale, upper upscale, and lifestyle hotels in the Netherlands, Germany, Hungary, Croatia, Serbia, Italy, Austria, and the United Kingdom.

Reasonable growth potential slight.

Similar Companies

Market Insights

Community Narratives