- United Kingdom

- /

- Metals and Mining

- /

- LSE:GLEN

Glencore (LSE:GLEN): Evaluating Valuation Prospects as Share Price Holds Steady

Reviewed by Kshitija Bhandaru

Glencore (LSE:GLEN) has seen its shares fluctuate over the past month, catching the attention of investors looking for value in the evolving materials sector. Due to recent moves in its stock price, the company stands out for close analysis.

See our latest analysis for Glencore.

Glencore’s share price has stayed relatively flat in recent months, despite swings in the broader materials sector and the company’s own volatile earnings results. While the stock’s short-term price momentum has faded, its 5-year total shareholder return of 1.6% hints at long-term potential for patient investors, even as the 1-year total shareholder return still sits in negative territory.

If sector shifts have you scanning for fresh opportunities, it could be the right time to discover fast growing stocks with high insider ownership.

The question facing investors is clear: Is Glencore’s muted share price a sign that the market is overlooking its recovery potential, or is future growth already firmly priced into today’s valuation?

Most Popular Narrative: 7.7% Undervalued

Glencore’s current share price of £3.48 sits below the most widely followed narrative’s fair value estimate of £3.77, hinting at modest market upside if the core thesis plays out.

A significant uplift in copper production volumes is expected in the second half of 2025 and beyond, as operational bottlenecks and mine sequencing normalize across key sites. There is a clear pathway to 1 million tonnes of annual copper by 2028, with new low-capex, high-return brownfield and greenfield projects in Argentina (MARA, El Pachón) progressing. This is expected to support sustained, long-term revenue and EBITDA growth in alignment with continued global electrification and EV adoption.

Curious what makes analysts believe Glencore could justify a premium price? This fair value call hinges on projected profit growth, bold margin targets, and a long-term financial strategy that is usually reserved for growth stocks, not commodity giants. Want to see the numbers that set this narrative apart? Take a closer look at the details driving this outlook.

Result: Fair Value of £3.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainty in Argentina and persistent volatility in commodity prices could present challenges for Glencore’s growth outlook and may limit potential future upside.

Find out about the key risks to this Glencore narrative.

Another View: Discounted Cash Flow Challenges the Upside

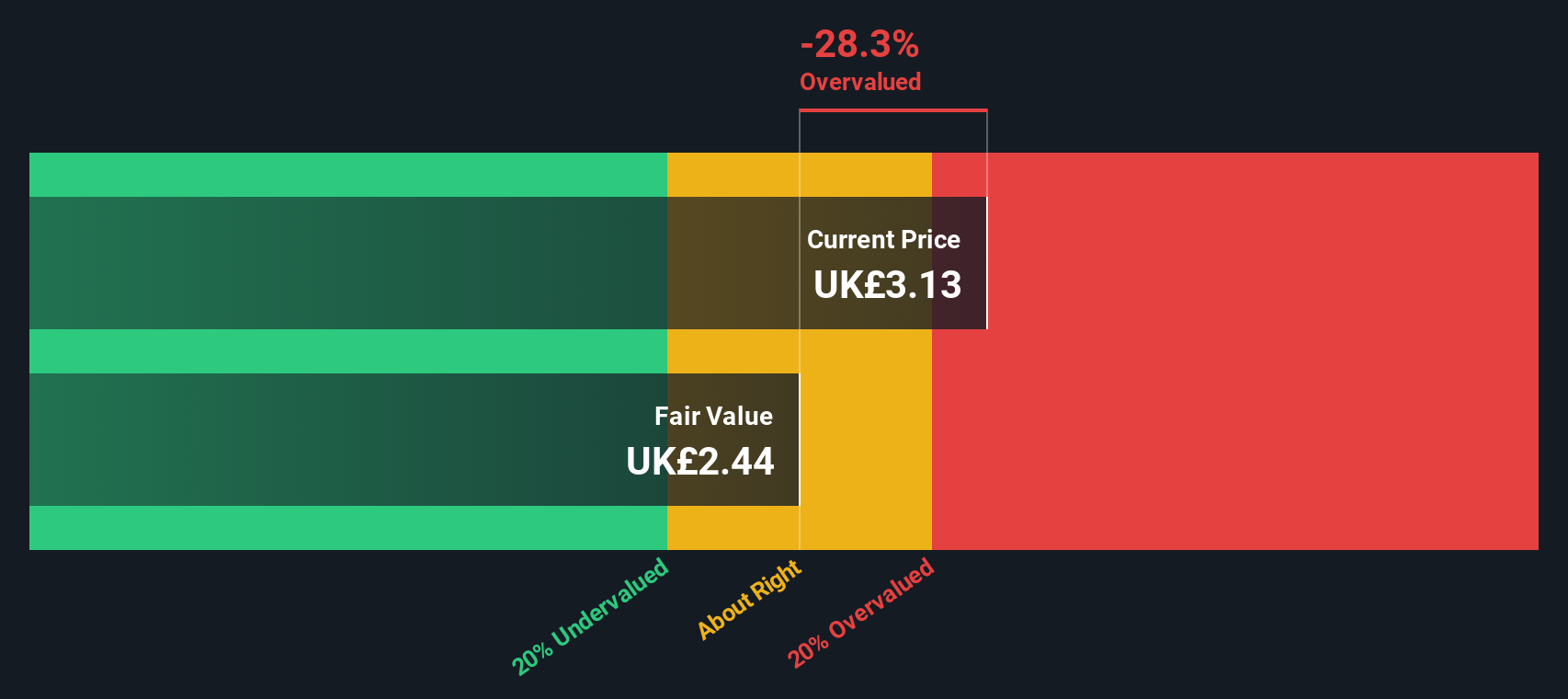

While many analysts see Glencore trading below their fair value estimates, the SWS DCF model takes a more conservative stance. By forecasting future cash flows and discounting them back to today, our DCF model values Glencore at £2.46 per share, which is well below the current market price. This paints a more cautious picture and raises a key question: could the market be too optimistic about Glencore’s long-term growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Glencore for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Glencore Narrative

If you see the outlook differently, or would rather dig through the data on your own, crafting a personalized Glencore narrative only takes a few minutes. Do it your way.

A great starting point for your Glencore research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Strengthen your portfolio and stay ahead of the curve by searching for standout stocks with these exclusive lists:

- Unlock top payout potential and steady income by checking out these 19 dividend stocks with yields > 3% with attractive yields above 3%.

- Find under-the-radar technology breakthroughs fueling the future by browsing these 25 AI penny stocks, where artificial intelligence is reshaping entire industries.

- Capitalize on long-term winners with solid fundamentals hidden among these 886 undervalued stocks based on cash flows to spot the next great value opportunity before the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GLEN

Glencore

Engages in the production, refinement, processing, storage, transport, and marketing of metals and minerals, and energy products in the Americas, Europe, Asia, Africa, and Oceania.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives