- United Kingdom

- /

- Metals and Mining

- /

- LSE:GLEN

Glencore (LSE:GLEN): Assessing Valuation After a 30% Three-Month Share Price Rebound

Reviewed by Simply Wall St

Glencore (LSE:GLEN) has quietly moved higher in recent weeks, with the share price gaining around 9% over the past week and more than 30% over the past 3 months, catching the attention of income and value investors.

See our latest analysis for Glencore.

That recent strength comes after a choppy spell, with Glencore’s 1 day share price return of 6.3% and 90 day share price return of 34.2% contrasting with a modest 1 year total shareholder return of just over 4%. This suggests momentum is rebuilding as investors reassess both growth prospects and risk.

If Glencore’s move has you watching the commodity space more closely, it could be worth scanning other aerospace and defense stocks for fresh ideas before the next leg of this cycle plays out.

With earnings rebounding and the shares now trading only slightly below analyst targets, investors face a key question: is Glencore still undervalued after this rally, or is the market already pricing in its next phase of growth?

Most Popular Narrative Narrative: 6% Undervalued

With Glencore last closing at £3.83 against a narrative fair value of about £4.06, the story hinges on execution rather than a simple rerating.

A significant uplift in copper production volumes is expected in the second half of 2025 and beyond, as operational bottlenecks and mine sequencing normalize across key sites, with a clear pathway to 1 million tonnes of annual copper by 2028 and new low capex, high return brown or greenfield projects in Argentina progressing, supporting sustained, long term revenue and EBITDA growth in alignment with continued global electrification and EV adoption.

Want to understand why modest top line growth could still support a higher valuation multiple and sharply improved margins? The narrative leans on surprisingly strong earnings power and a richer future profit multiple than the sector typically commands. Curious which assumptions need to hold for that upside to stick? Read on to see the projections in full.

Result: Fair Value of $4.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several narrative risks remain, particularly around weaker coal and copper pricing, as well as heightened regulatory uncertainty in key jurisdictions like the DRC and Argentina.

Find out about the key risks to this Glencore narrative.

Another View: Signals From The Sales Multiple

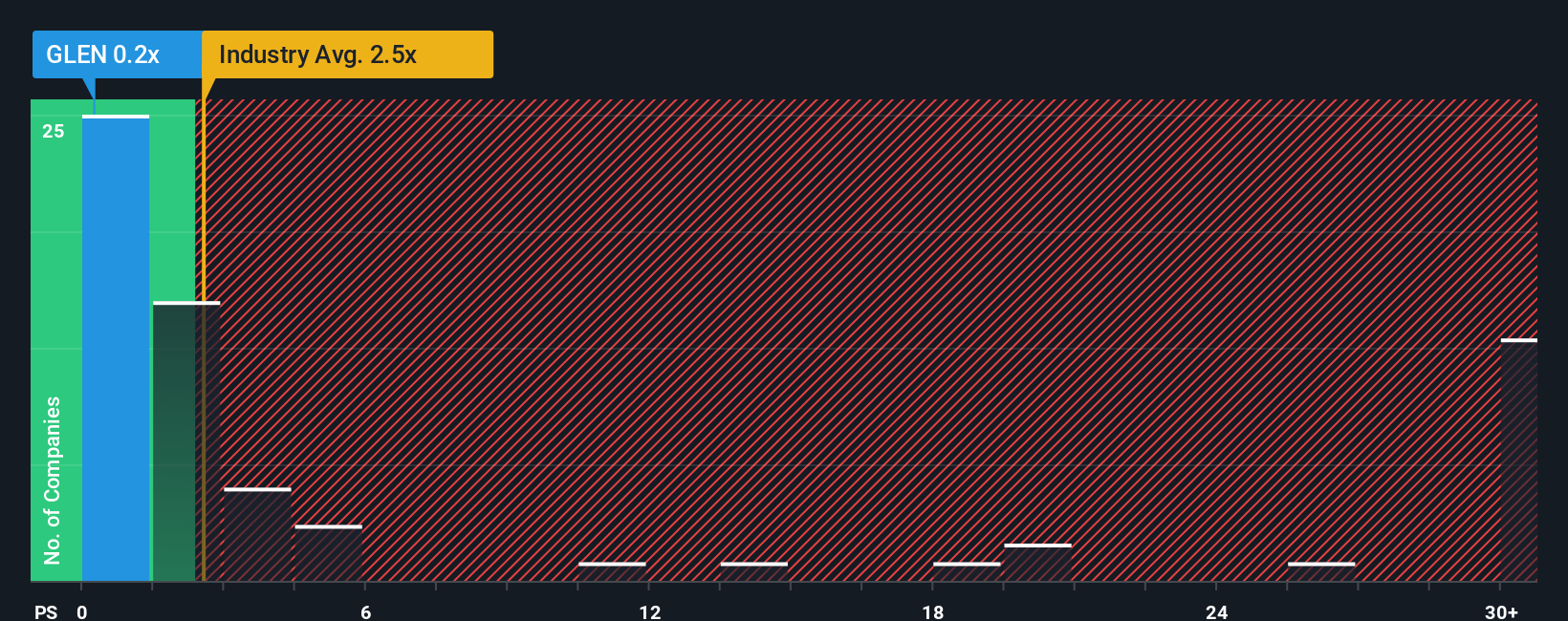

While the narrative fair value suggests Glencore is modestly undervalued, its 0.3x price to sales stands far below the 1x fair ratio, the 2.6x industry average, and the 3.9x peer average. That deep discount hints at upside, but is the gap a bargain or a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Glencore for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Glencore Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in minutes: Do it your way.

A great starting point for your Glencore research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one opportunity when the market is full of potential, use the Simply Wall Street Screener to pinpoint stocks that match your strategy.

- Capture powerful turnaround potential by targeting companies that look mispriced based on cash generation with these 917 undervalued stocks based on cash flows.

- Tap into cutting edge innovation by focusing on businesses reshaping industries through machine learning and automation with these 25 AI penny stocks.

- Strengthen your income stream by homing in on reliable payers offering attractive yields and resilient cash flows through these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GLEN

Glencore

Engages in the production, refinement, processing, storage, transport, and marketing of metals and minerals, and energy products in the Americas, Europe, Asia, Africa, and Oceania.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026