- United Kingdom

- /

- Basic Materials

- /

- LSE:FORT

UK Stocks That Could Be Trading Below Estimated Value In October 2025

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index slipping due to weak trade data from China and concerns over global economic recovery. As these market conditions persist, investors may find opportunities in stocks that appear to be trading below their estimated value, offering potential for long-term growth despite current uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SigmaRoc (AIM:SRC) | £1.194 | £2.32 | 48.6% |

| On the Beach Group (LSE:OTB) | £2.185 | £4.37 | 50% |

| Norcros (LSE:NXR) | £2.94 | £5.51 | 46.7% |

| Gooch & Housego (AIM:GHH) | £5.68 | £11.14 | 49% |

| Forterra (LSE:FORT) | £1.836 | £3.63 | 49.4% |

| Fevertree Drinks (AIM:FEVR) | £8.59 | £15.76 | 45.5% |

| Barratt Redrow (LSE:BTRW) | £4.059 | £7.56 | 46.3% |

| AstraZeneca (LSE:AZN) | £124.96 | £241.98 | 48.4% |

| AOTI (AIM:AOTI) | £0.39 | £0.77 | 49.3% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.24 | £4.32 | 48.2% |

Here we highlight a subset of our preferred stocks from the screener.

Victorian Plumbing Group (AIM:VIC)

Overview: Victorian Plumbing Group plc is an online retailer specializing in bathroom products and accessories for both B2C and trade customers in the United Kingdom, with a market cap of £265.26 million.

Operations: Victorian Plumbing Group generates revenue by selling bathroom products and accessories to both consumer and trade markets in the UK.

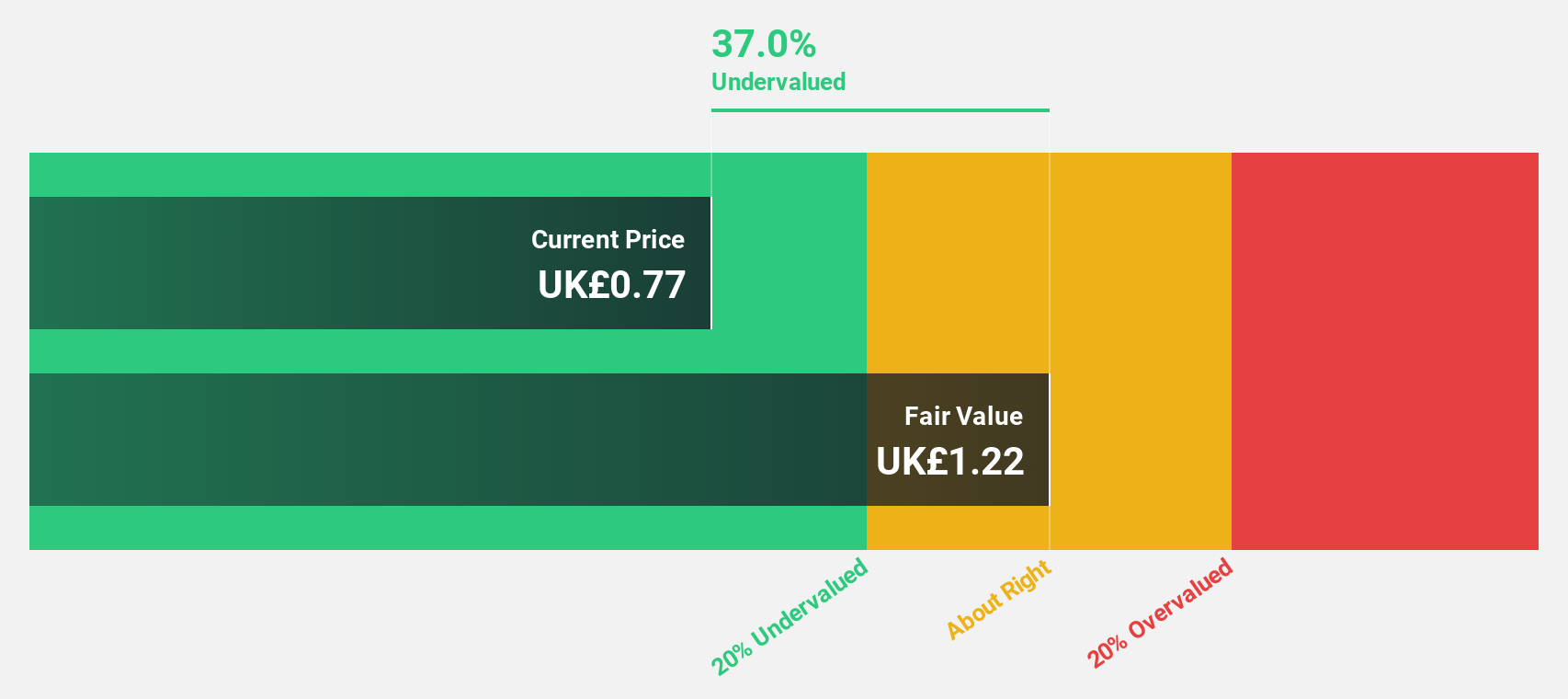

Estimated Discount To Fair Value: 37.7%

Victorian Plumbing Group is trading at £0.81, significantly below its estimated fair value of £1.3, indicating it is highly undervalued based on discounted cash flow analysis. Forecasts suggest revenue growth of 6.1% annually and earnings growth of 29% per year, outpacing the UK market's average rates. However, profit margins have declined from 4.3% to 2.2%, partly due to large one-off items impacting financial results, which may affect perceived quality of earnings.

- Insights from our recent growth report point to a promising forecast for Victorian Plumbing Group's business outlook.

- Click to explore a detailed breakdown of our findings in Victorian Plumbing Group's balance sheet health report.

Forterra (LSE:FORT)

Overview: Forterra plc manufactures and sells building products made from clay and concrete in the United Kingdom, with a market cap of £387.25 million.

Operations: The company generates revenue through its segments, with Bricks and Blocks contributing £300.70 million and Bespoke Products adding £80 million.

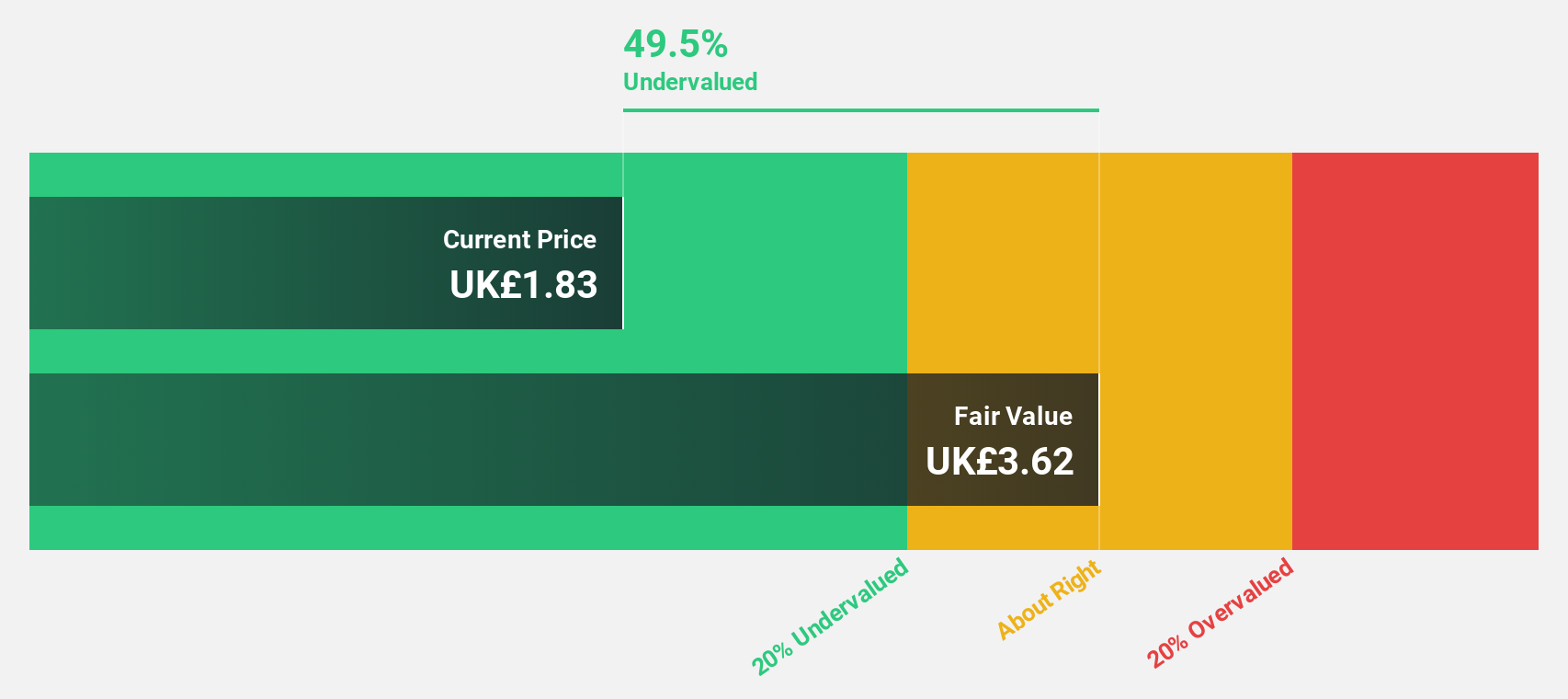

Estimated Discount To Fair Value: 49.4%

Forterra is trading at £1.84, significantly below its estimated fair value of £3.63, highlighting its undervaluation based on discounted cash flow analysis. With expected earnings growth of 28.2% annually, it surpasses the UK market average of 14.3%. Recent sales increased to £195.1 million from £162.1 million a year ago, though net income decreased to £7.2 million from £9 million, reflecting challenges in maintaining profitability amidst expansion efforts and dividend increases.

- The analysis detailed in our Forterra growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Forterra.

Wickes Group (LSE:WIX)

Overview: Wickes Group plc is a UK-based retailer specializing in home improvement products and services, with a market cap of £533.92 million.

Operations: The company's revenue is primarily derived from its retail segment, which focuses on home improvement products and services, generating £1.58 billion.

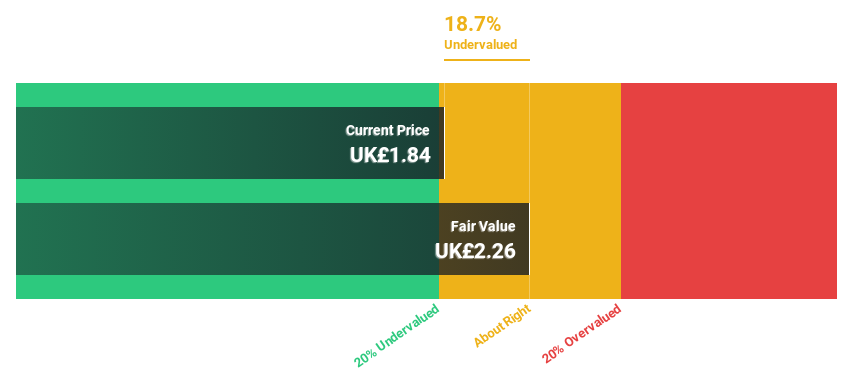

Estimated Discount To Fair Value: 26.6%

Wickes Group, currently trading at £2.27, is undervalued with an estimated fair value of £3.09 according to discounted cash flow analysis. Despite a dividend yield of 4.8% not fully covered by earnings, the company’s earnings are projected to grow significantly at 25.5% annually over the next three years, outpacing the UK market's average growth rate of 14.3%. Recent half-year results showed increased sales and net income, reinforcing its potential for future profitability improvements.

- Our earnings growth report unveils the potential for significant increases in Wickes Group's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Wickes Group.

Seize The Opportunity

- Unlock more gems! Our Undervalued UK Stocks Based On Cash Flows screener has unearthed 51 more companies for you to explore.Click here to unveil our expertly curated list of 54 Undervalued UK Stocks Based On Cash Flows.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FORT

Forterra

Engages in the manufacturing and sale of building products made from clay and concrete in the United Kingdom.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives