- United Kingdom

- /

- Chemicals

- /

- LSE:ESNT

Essentra (LON:ESNT) Will Pay A Larger Dividend Than Last Year At £0.023

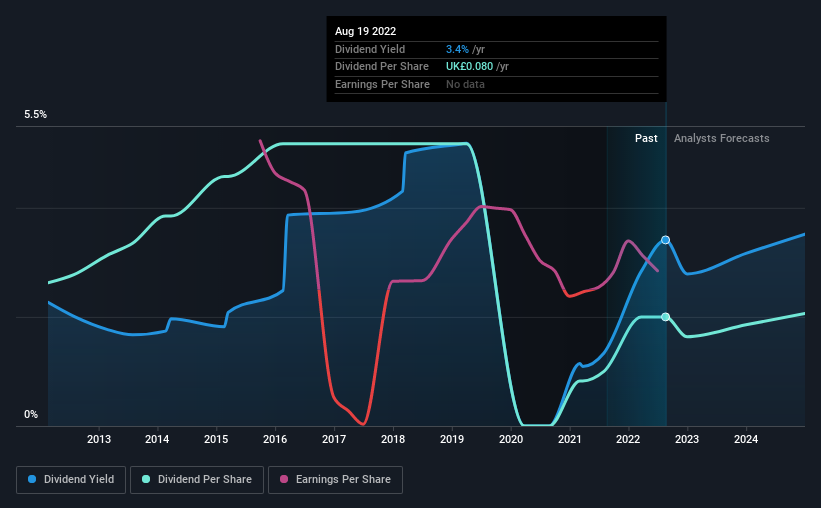

Essentra plc's (LON:ESNT) dividend will be increasing from last year's payment of the same period to £0.023 on 28th of October. This will take the dividend yield to an attractive 3.4%, providing a nice boost to shareholder returns.

View our latest analysis for Essentra

Essentra's Dividend Is Well Covered By Earnings

If the payments aren't sustainable, a high yield for a few years won't matter that much. Prior to this announcement, the dividend made up 182% of earnings, and the company was generating negative free cash flows. This high of a dividend payment could start to put pressure on the balance sheet in the future.

Analysts expect a massive rise in earnings per share in the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 25%, which would make us comfortable with the dividend's sustainability, despite the levels currently being elevated.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2012, the annual payment back then was £0.105, compared to the most recent full-year payment of £0.08. This works out to be a decline of approximately 2.7% per year over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Essentra Might Find It Hard To Grow Its Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. It's encouraging to see that Essentra has been growing its earnings per share at 20% a year over the past five years. EPS has been growing well, but Essentra has been paying out a massive proportion of its earnings, which can make the dividend tough to maintain.

Essentra's Dividend Doesn't Look Sustainable

Overall, we always like to see the dividend being raised, but we don't think Essentra will make a great income stock. In general, the distributions are a little bit higher than we would like, but we can't ignore the fact the quickly growing earnings gives this stock great potential in the future. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 2 warning signs for Essentra that investors need to be conscious of moving forward. Is Essentra not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Essentra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ESNT

Essentra

Engages in the manufacturing and distribution of plastic injection moulded, vinyl dip moulded, and metal items in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026