- United Kingdom

- /

- Chemicals

- /

- LSE:ELM

Shareholders in Elementis (LON:ELM) have lost 23%, as stock drops 5.6% this past week

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But even the best stock picker will only win with some selections. So we wouldn't blame long term Elementis plc (LON:ELM) shareholders for doubting their decision to hold, with the stock down 25% over a half decade. The falls have accelerated recently, with the share price down 13% in the last three months.

After losing 5.6% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Elementis

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

We know that Elementis has been profitable in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics might give us a better handle on how its value is changing over time.

We don't think that the 1.3% is big factor in the share price, since it's quite small, as dividends go. Arguably, the revenue drop of 4.2% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

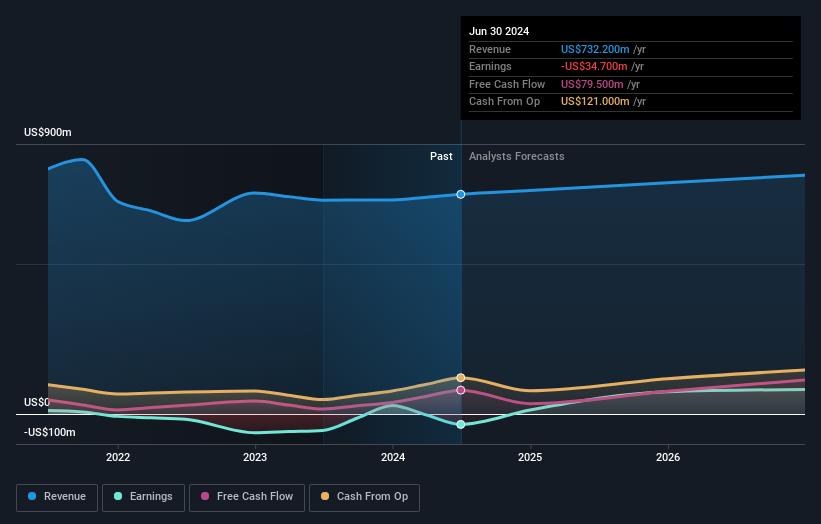

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Elementis' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Elementis shareholders are up 9.5% for the year (even including dividends). Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 4% per year, over five years. So this might be a sign the business has turned its fortunes around. Before spending more time on Elementis it might be wise to click here to see if insiders have been buying or selling shares.

We will like Elementis better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Elementis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ELM

Elementis

Operates as a specialty chemical company in the United Kingdom, rest of Europe, North America, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026