- United Kingdom

- /

- Media

- /

- AIM:NFG

3 UK Dividend Stocks Yielding Up To 4.2%

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced challenges, closing lower amid weak trade data from China and global economic concerns. In such uncertain market conditions, dividend stocks can offer investors a measure of stability and income potential, making them an attractive option for those seeking reliable returns.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.19% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 8.30% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.28% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.58% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.15% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.17% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.21% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.80% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.56% | ★★★★★☆ |

Click here to see the full list of 63 stocks from our Top UK Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

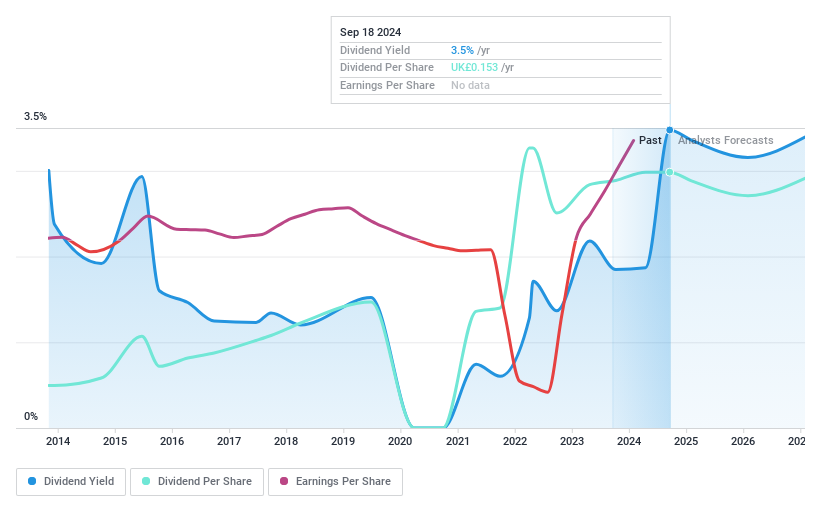

Next 15 Group (AIM:NFG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Next 15 Group plc, along with its subsidiaries, offers communications services across the United Kingdom, Europe, Africa, the United States, and the Asia Pacific with a market cap of £402.80 million.

Operations: Next 15 Group plc generates revenue through its provision of communications services across multiple regions, including the United Kingdom, Europe, Africa, the United States, and the Asia Pacific.

Dividend Yield: 3.8%

Next 15 Group's dividend yield of 3.79% is lower than the UK market's top quartile, yet its dividends are well covered by earnings and cash flows, with payout ratios of 25.2% and 23.3%, respectively. Despite past volatility in dividend payments, recent earnings growth—132% over the past year—indicates potential stability. However, high debt levels and volatile share prices pose risks to dividend reliability, though the stock trades at a significant discount to estimated fair value.

- Click here and access our complete dividend analysis report to understand the dynamics of Next 15 Group.

- The valuation report we've compiled suggests that Next 15 Group's current price could be quite moderate.

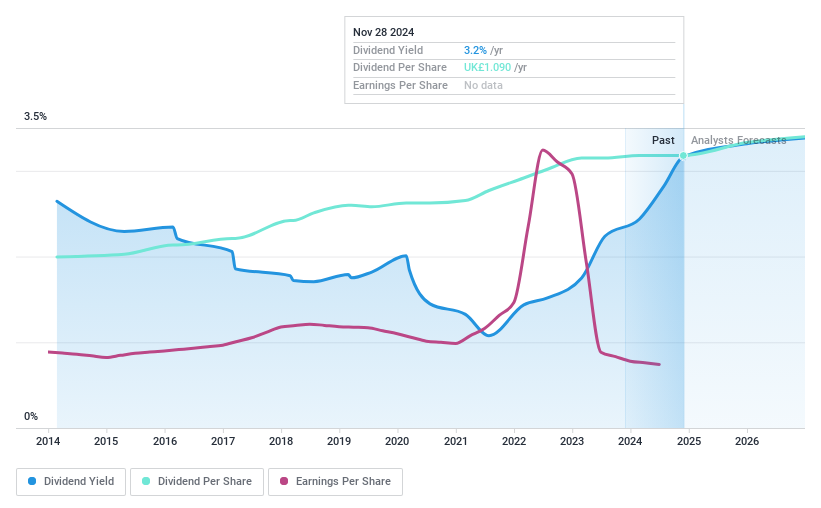

Croda International (LSE:CRDA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Croda International Plc operates in the consumer care, life sciences, and industrial specialty sectors across Europe, the Middle East, Africa, North America, Asia, and Latin America with a market cap of £4.95 billion.

Operations: Croda International Plc's revenue is segmented into Consumer Care (£898.90 million), Life Sciences (£545.30 million), and Industrial Specialties (£185.30 million).

Dividend Yield: 3.1%

Croda International's dividend yield of 3.07% is below the UK market's top quartile, with dividends not well covered by earnings due to a high payout ratio of 93.5%. However, cash flows sufficiently cover current payouts at an 80.4% cash payout ratio, and dividends have been stable and reliable over the past decade. Recent Q3 sales increased to £407 million from £387 million last year, indicating some revenue growth amidst executive board changes.

- Navigate through the intricacies of Croda International with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Croda International is trading beyond its estimated value.

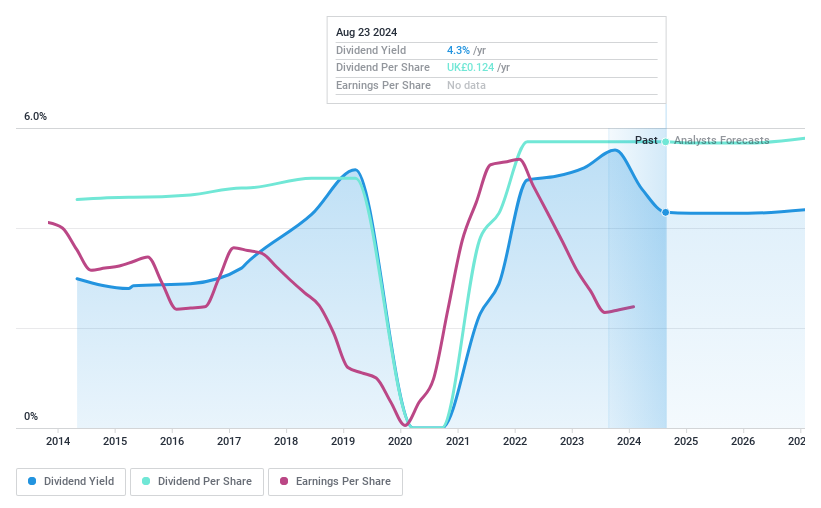

Kingfisher (LSE:KGF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kingfisher plc, with a market cap of £5.32 billion, supplies home improvement products and services primarily in the United Kingdom, Ireland, France, and internationally through its subsidiaries.

Operations: Kingfisher plc generates revenue of £12.86 billion from the supply of home improvement products and services.

Dividend Yield: 4.2%

Kingfisher's dividend yield of 4.2% is below the top quartile in the UK, but dividends are well covered by earnings with a payout ratio of 67% and cash flows at 21.3%. Despite past volatility, dividends have grown over the last decade. Recent buybacks totaling £142 million could enhance shareholder value. Interim dividends remain consistent at 3.80 pence per share, with a dividend reinvestment plan available for shareholders seeking to reinvest payouts into company shares.

- Get an in-depth perspective on Kingfisher's performance by reading our dividend report here.

- According our valuation report, there's an indication that Kingfisher's share price might be on the cheaper side.

Next Steps

- Dive into all 63 of the Top UK Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Next 15 Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NFG

Next 15 Group

Provides communications services in the United Kingdom, Europe, Africa, the United States, and the Asia Pacific.

Very undervalued with solid track record and pays a dividend.