Stock Analysis

- United Kingdom

- /

- Construction

- /

- LSE:KLR

3 UK Dividend Stocks Offering Up To 6.5% Yield

Reviewed by Simply Wall St

As the FTSE 100 shows signs of extending its gains amid a dynamic backdrop of regulatory discussions and broader market movements, investors are closely monitoring the landscape for stable investment opportunities. In this context, dividend stocks emerge as particularly appealing options for those seeking regular income streams in a fluctuating market environment.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.92% | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | 6.90% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.05% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.69% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.93% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.57% | ★★★★★☆ |

| Rio Tinto Group (LSE:RIO) | 6.39% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.56% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.55% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 6.49% | ★★★★★☆ |

Click here to see the full list of 54 stocks from our Top UK Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

NWF Group (AIM:NWF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NWF Group plc operates primarily in the sale and distribution of fuel oils across the United Kingdom, with a market capitalization of approximately £84.54 million.

Operations: NWF Group plc generates its revenue through three key segments: Food (£74.30 million), Feeds (£210.40 million), and Fuels (£707.20 million).

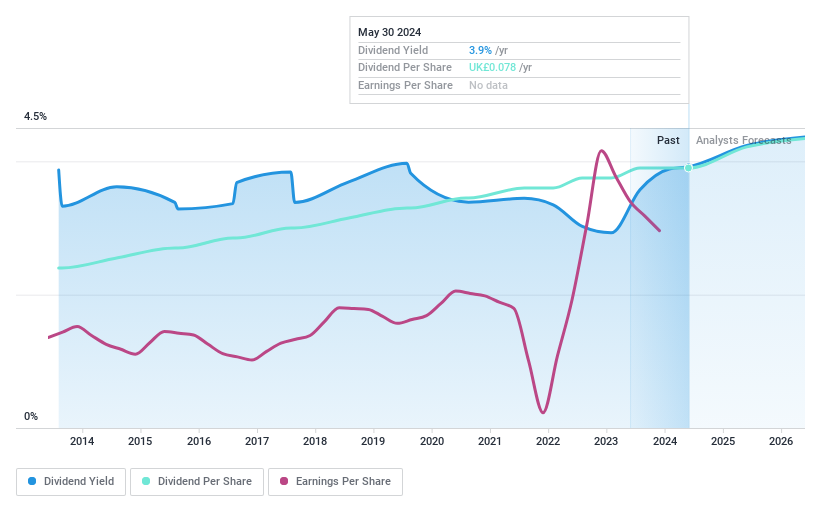

Dividend Yield: 4.6%

NWF Group maintains a solid dividend profile with a cash payout ratio of 10.3% and an earnings payout ratio of 29.6%, ensuring dividends are well-covered by both cash flows and earnings. Despite its low dividend yield of 4.56% compared to the UK market's top quartile, the company has shown consistency in its dividend payments over the past decade, with increases noted annually. However, it faces challenges with forecasted earnings decline averaging 10.1% annually over the next three years while expecting modest revenue growth at 3.89% per year.

- Click here to discover the nuances of NWF Group with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that NWF Group is trading beyond its estimated value.

Castings (LSE:CGS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Castings P.L.C. is a company based in the United Kingdom that specializes in iron casting and machining, operating across Europe, North and South America, with a market cap of approximately £167.31 million.

Operations: Castings P.L.C. generates revenue primarily through its Foundry Operations and Machining Operations, which collectively brought in £288.62 million.

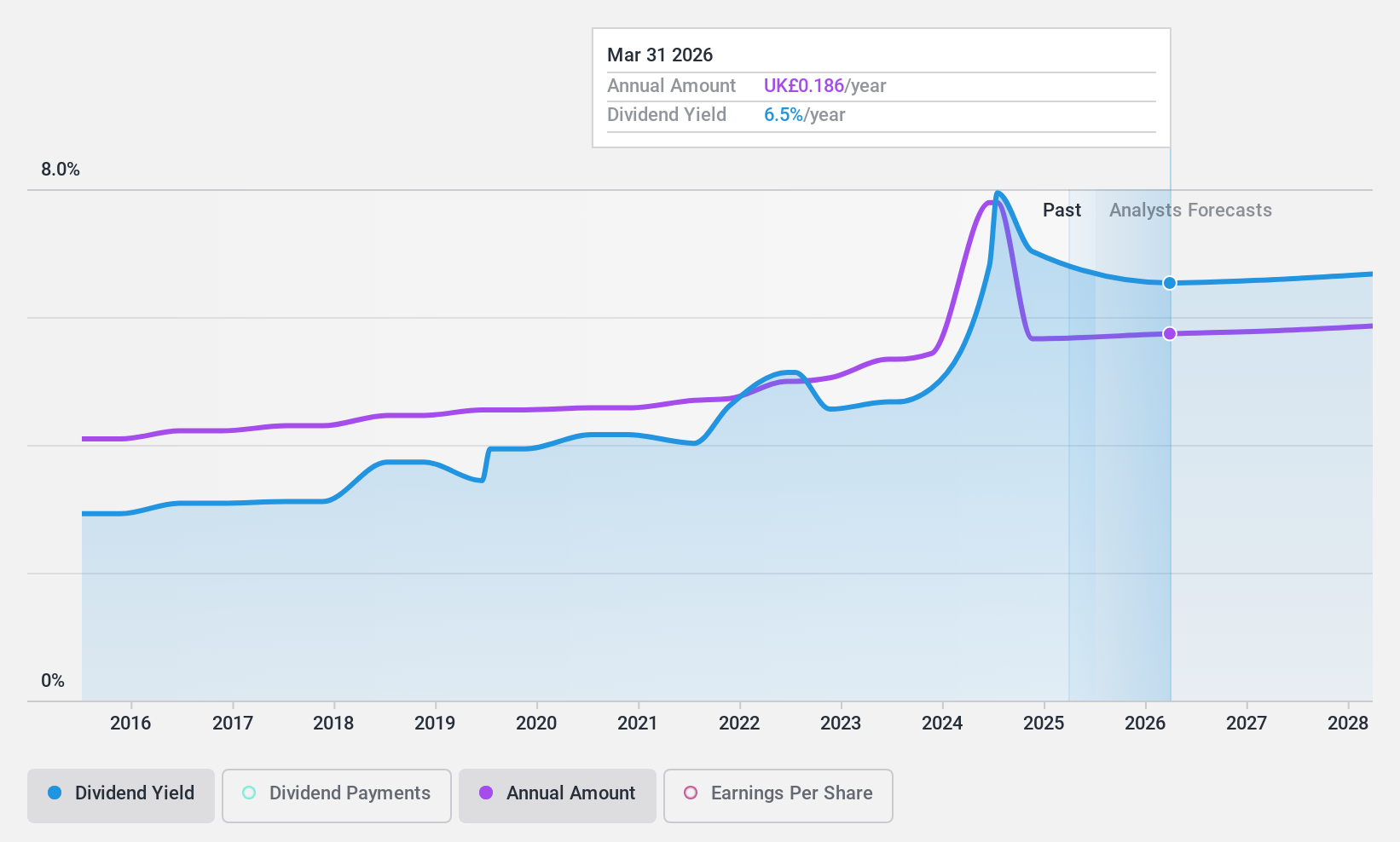

Dividend Yield: 6.6%

Castings P.L.C. has increased its total annual dividend to £0.1832 per share, up 5.6% from last year, and declared a special dividend of £0.07 per share due to a strong cash position. Despite this growth, dividends are not fully covered by free cash flows or earnings, with a high cash payout ratio of 100.4%. The company's dividends have been reliable over the past decade but face sustainability challenges amid forecasted earnings declines of 5.8% annually over the next three years.

- Get an in-depth perspective on Castings' performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Castings is trading behind its estimated value.

Keller Group (LSE:KLR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Keller Group plc is a provider of specialist geotechnical services across North America, Europe, Asia-Pacific, the Middle East, and Africa, with a market capitalization of approximately £1.05 billion.

Operations: Keller Group plc generates £2.97 billion in revenue from its specialist geotechnical services.

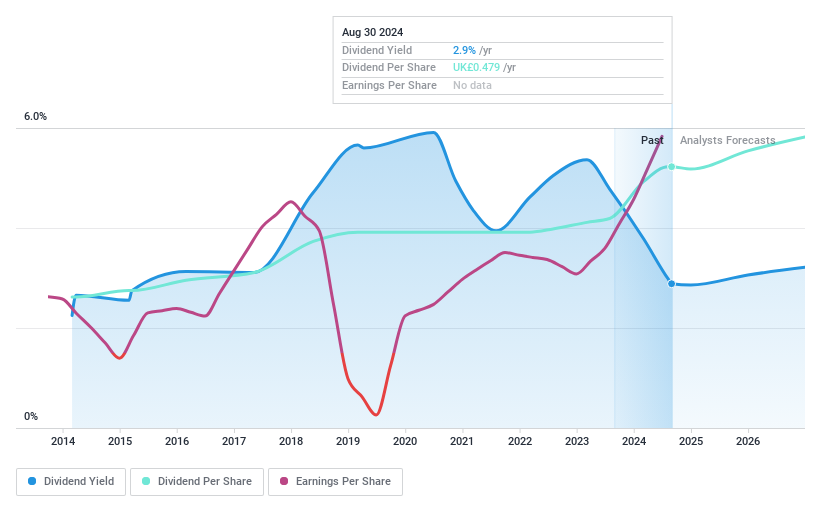

Dividend Yield: 3.1%

Keller Group's dividend, set at 3.15%, is underpinned by a solid foundation with a payout ratio of 36.8% and cash payout ratio of 32.2%, indicating good coverage by both earnings and cash flows. Despite its share price volatility over the past three months, the company maintains a stable dividend history over the last decade and trades at 20.8% below estimated fair value, offering attractive pricing relative to peers. However, its yield is modest compared to the UK market's top dividend payers. On May 15, 2024, Keller increased its final dividend to £0.313 per share.

- Navigate through the intricacies of Keller Group with our comprehensive dividend report here.

- Our valuation report unveils the possibility Keller Group's shares may be trading at a discount.

Make It Happen

- Reveal the 54 hidden gems among our Top UK Dividend Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Keller Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:KLR

Keller Group

Provides specialist geotechnical services in North America, Europe, the Asia-Pacific, the Middle East, and Africa.

Flawless balance sheet, undervalued and pays a dividend.