If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. So when we looked at Carclo (LON:CAR) and its trend of ROCE, we really liked what we saw.

Return On Capital Employed (ROCE): What is it?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Carclo:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.11 = UK£6.2m ÷ (UK£119m - UK£64m) (Based on the trailing twelve months to March 2020).

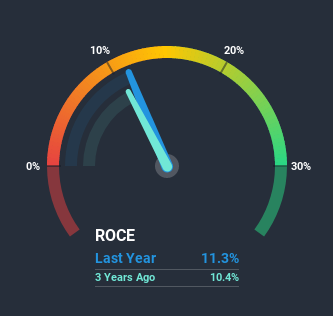

Therefore, Carclo has an ROCE of 11%. On its own, that's a standard return, however it's much better than the 6.4% generated by the Chemicals industry.

See our latest analysis for Carclo

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Carclo's past further, check out this free graph of past earnings, revenue and cash flow.

What Can We Tell From Carclo's ROCE Trend?

Carclo has not disappointed in regards to ROCE growth. We found that the returns on capital employed over the last five years have risen by 30%. That's not bad because this tells for every dollar invested (capital employed), the company is increasing the amount earned from that dollar. Speaking of capital employed, the company is actually utilizing 38% less than it was five years ago, which can be indicative of a business that's improving its efficiency. A business that's shrinking its asset base like this isn't usually typical of a soon to be multi-bagger company.

On a side note, we noticed that the improvement in ROCE appears to be partly fueled by an increase in current liabilities. The current liabilities has increased to 54% of total assets, so the business is now more funded by the likes of its suppliers or short-term creditors. And with current liabilities at those levels, that's pretty high.In Conclusion...

In the end, Carclo has proven it's capital allocation skills are good with those higher returns from less amount of capital. However the stock is down a substantial 87% in the last five years so there could be other areas of the business hurting its prospects. In any case, we believe the economic trends of this company are positive and looking into the stock further could prove rewarding.

One final note, you should learn about the 3 warning signs we've spotted with Carclo (including 1 which is is potentially serious) .

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

If you decide to trade Carclo, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:CAR

Carclo

Provides plastic components for the life sciences, aerospace, and advanced industries in the United Kingdom, France, the Czech Republic, China, India, rest of Europe, North America, and internationally.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives