- United Kingdom

- /

- Metals and Mining

- /

- LSE:CAPD

UK Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index declining due to weak trade data from China, highlighting concerns about global economic recovery. In such a climate, investors often look towards smaller or less-established companies that might offer potential value and growth opportunities. Penny stocks, while an older term, still represent a segment of the market where strong financials can indicate promising prospects for those willing to explore beyond the blue-chip names.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.50 | £173.92M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.865 | £459.28M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.28 | £323.7M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.135 | £800.61M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.235 | £409.76M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.41 | £163.26M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.42 | £121.65M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.414 | £216.54M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.49 | £190.39M | ★★★★★☆ |

| Serabi Gold (AIM:SRB) | £0.915 | £67.71M | ★★★★★★ |

Click here to see the full list of 476 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

IG Design Group (AIM:IGR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IG Design Group plc is involved in the design, production, and distribution of celebrations, craft and creative play, stationery, gifting, and not-for-resale consumable products across the Americas, the United Kingdom, Netherlands, and internationally with a market cap of £132.40 million.

Operations: The company's revenue is primarily derived from its DG Americas segment, which accounts for $500.31 million, and its DG International segment, contributing $299.77 million.

Market Cap: £132.4M

IG Design Group plc, with a market cap of £132.40 million, has recently become profitable, marking a significant turnaround despite a 38.9% annual decline in earnings over the past five years. The company's debt-to-equity ratio has improved from 38.9% to 16.8%, and its debt is well covered by operating cash flow at 125.1%. While its Return on Equity is considered low at 10%, IG Design's Price-To-Earnings ratio of 4.8x suggests it may be undervalued compared to the UK market average of 16.2x, offering potential value for investors mindful of volatility and industry challenges.

- Unlock comprehensive insights into our analysis of IG Design Group stock in this financial health report.

- Gain insights into IG Design Group's future direction by reviewing our growth report.

Capital (LSE:CAPD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Capital Limited, along with its subsidiaries, offers a range of drilling solutions to the minerals industry and has a market capitalization of £168.78 million.

Operations: The company generates revenue of $333.59 million from its Business Services segment, providing drilling solutions to the minerals industry.

Market Cap: £168.78M

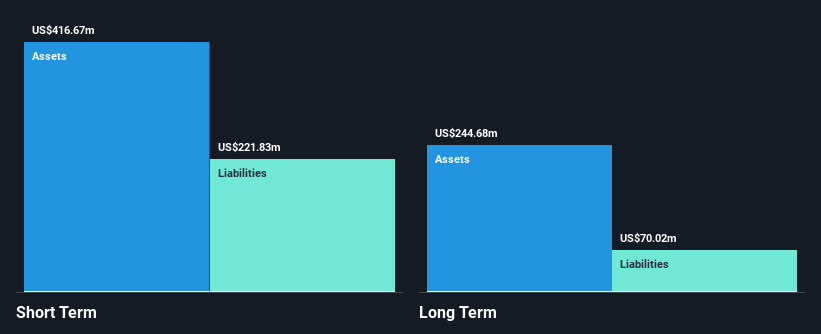

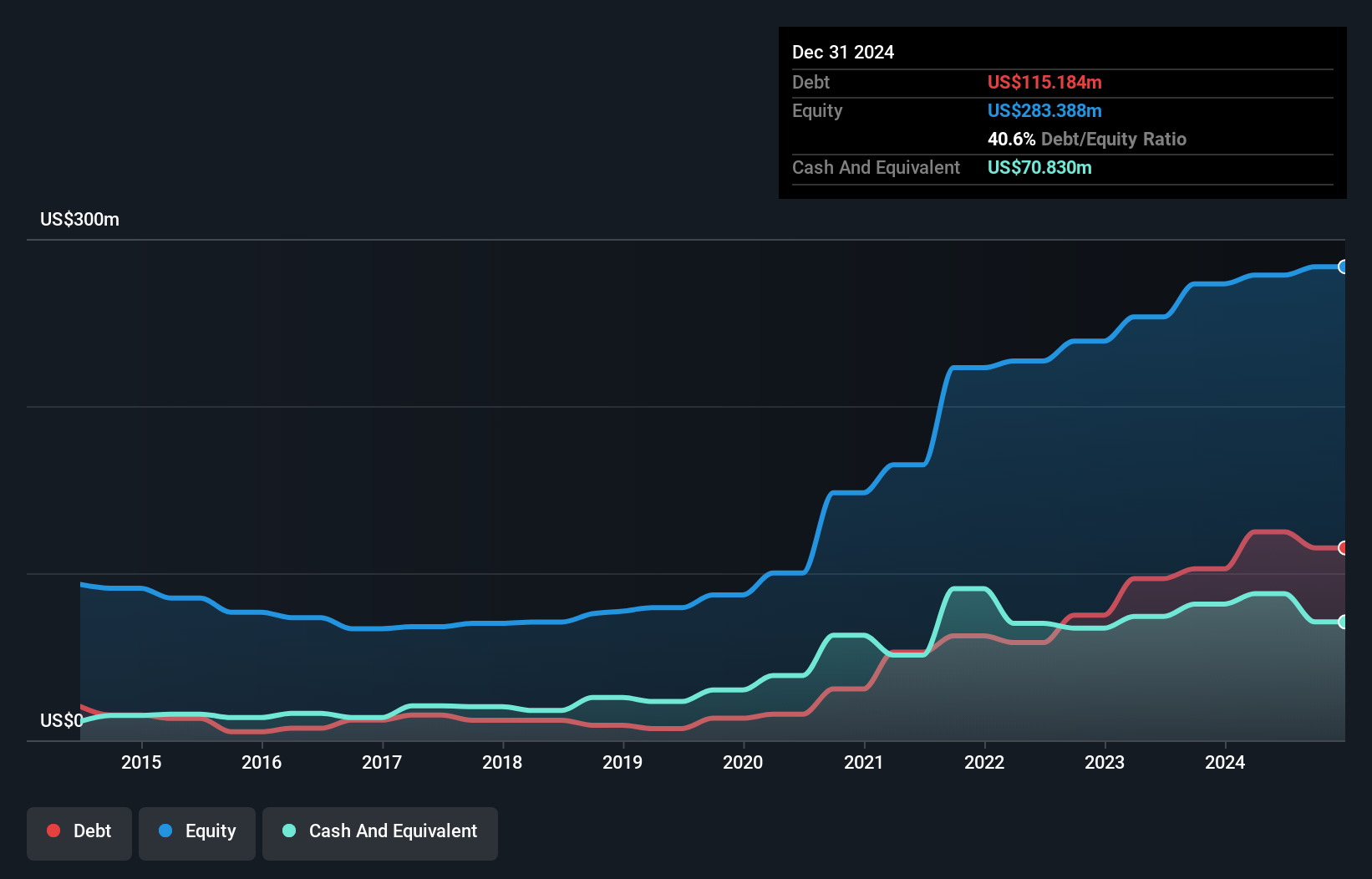

Capital Limited, with a market cap of £168.78 million, offers drilling solutions in the minerals sector and has shown stable financial health. Its short-term assets ($231.3M) comfortably cover both short- and long-term liabilities, indicating strong liquidity. Despite a satisfactory net debt to equity ratio of 13.3% and well-covered interest payments (3.7x EBIT), earnings have declined recently, impacting profit margins which fell from 9.5% to 8.7%. The company forecasts revenue between $355 million and $375 million for 2024 but faces challenges with negative earnings growth over the past year amid board changes following a director's passing.

- Navigate through the intricacies of Capital with our comprehensive balance sheet health report here.

- Gain insights into Capital's outlook and expected performance with our report on the company's earnings estimates.

LSL Property Services (LSE:LSL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LSL Property Services plc operates in the United Kingdom, offering business-to-business services to mortgage intermediaries and estate agency franchisees, along with valuation services for lenders, and has a market cap of £317.55 million.

Operations: The company's revenue is generated from three main segments: Financial Services (£47.22 million), Surveying and Valuation (£79.49 million), and Estate Agency excluding Financial Services (£30.61 million).

Market Cap: £317.55M

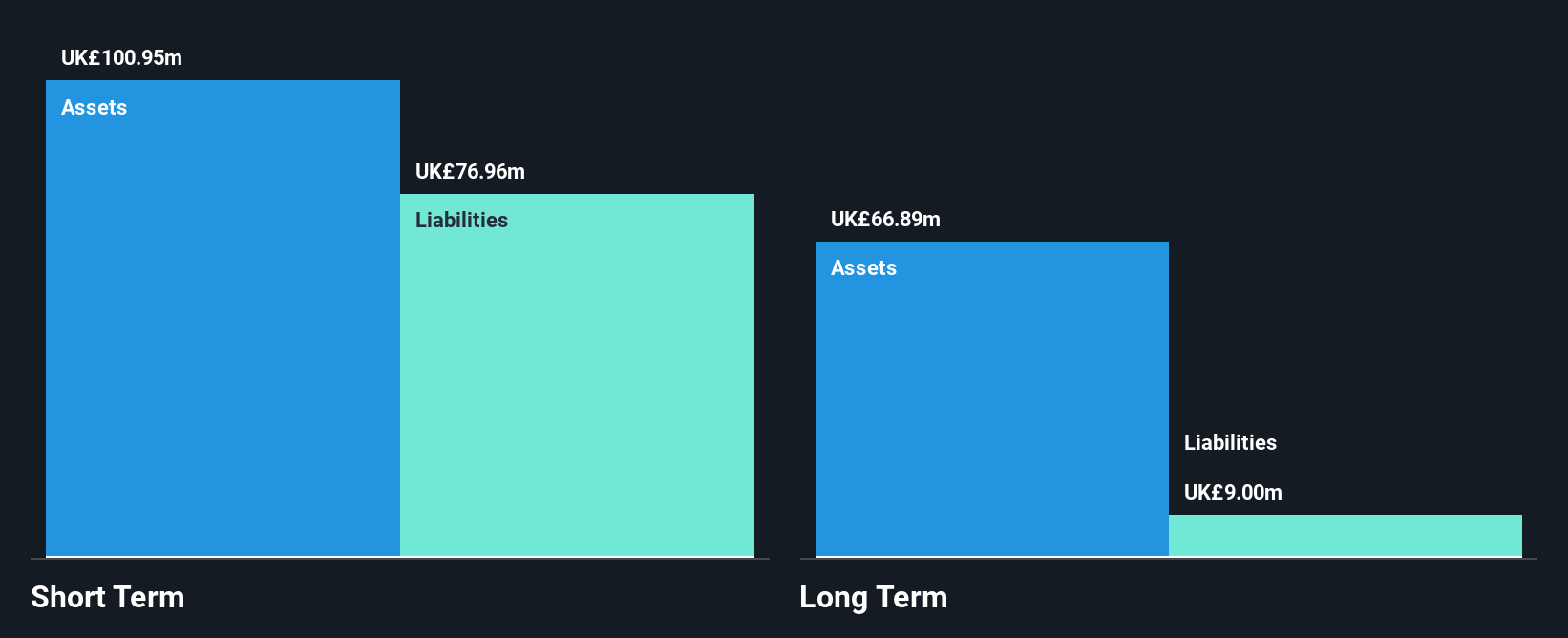

LSL Property Services, with a market cap of £317.55 million, has shown a turnaround by becoming profitable recently, reporting sales of £85.39 million for the half-year ending June 30, 2024. The company declared an interim dividend of 4 pence per share and completed a modest share buyback program worth £0.34 million. Although its return on equity is considered low at 16.5%, LSL's short-term assets significantly exceed both short- and long-term liabilities, indicating solid financial health despite some volatility in past earnings due to large one-off losses. Earnings are forecast to grow annually by 28.23%, suggesting potential future growth prospects.

- Click to explore a detailed breakdown of our findings in LSL Property Services' financial health report.

- Assess LSL Property Services' future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Click here to access our complete index of 476 UK Penny Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CAPD

Capital

Provides various drilling solutions to customers in the minerals industry.

Undervalued with excellent balance sheet and pays a dividend.