- United Kingdom

- /

- Retail Distributors

- /

- AIM:LIKE

Discover 3 UK Penny Stocks With Market Caps Under £50M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index declining amid concerns over weak trade data from China, highlighting global economic uncertainties. For investors looking to explore beyond established giants, penny stocks present intriguing opportunities despite their somewhat outdated moniker. These smaller or newer companies can offer growth potential and stability when backed by solid financials, making them an interesting area for those seeking to diversify their portfolios.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.20 | £828.88M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.575 | £183.66M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.44 | £355.43M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.81 | £61.34M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.21 | £103.3M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.33 | £205.12M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.405 | £435.71M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.372 | $216.25M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.475 | £187.85M | ★★★★★☆ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Condor Gold (AIM:CNR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Condor Gold Plc, with a market cap of £41.40 million, is engaged in gold exploration and development through its operations in the United Kingdom and Nicaragua.

Operations: Condor Gold Plc has not reported any revenue segments.

Market Cap: £41.4M

Condor Gold Plc, with a market cap of £41.40 million, is pre-revenue and focuses on gold exploration. The company has no long-term liabilities and remains debt-free, but it faces challenges with less than a year of cash runway based on current free cash flow trends. While its board and management team are experienced, shareholders have faced dilution in the past year with shares outstanding increasing by 9%. Recent earnings results show a reduced net loss for the half-year ending June 2024 compared to the previous year. Condor Gold's short-term assets significantly exceed its short-term liabilities.

- Take a closer look at Condor Gold's potential here in our financial health report.

- Gain insights into Condor Gold's past trends and performance with our report on the company's historical track record.

Likewise Group (AIM:LIKE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Likewise Group Plc, with a market cap of £41.40 million, distributes floorcoverings, rugs, and matting products for both domestic and commercial flooring markets in the United Kingdom and internationally.

Operations: The company generates revenue of £143.72 million from its textile manufacturing segment.

Market Cap: £41.4M

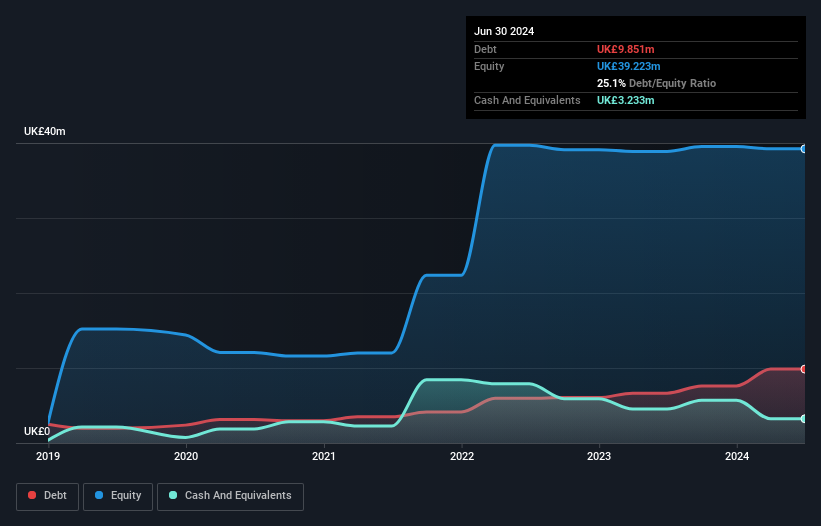

Likewise Group Plc, with a market cap of £41.40 million, has shown improvement in profitability over the past year despite reporting a net loss of £0.33 million for the half-year ending June 2024. The company's short-term assets (£44.3M) comfortably cover both short and long-term liabilities, though its debt-to-equity ratio has risen to 25.1% over five years. Earnings are projected to grow significantly at 48.49% annually, yet return on equity remains low at 2.6%. While dividends are not well covered by earnings, insider selling has been significant recently, which could be a point of concern for potential investors.

- Click here to discover the nuances of Likewise Group with our detailed analytical financial health report.

- Explore Likewise Group's analyst forecasts in our growth report.

Steppe Cement (AIM:STCM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Steppe Cement Ltd. is an investment holding company involved in the production and sale of cement and clinkers in Kazakhstan, with a market cap of £32.85 million.

Operations: The company's revenue primarily comes from the production and sale of cement, amounting to $79.26 million.

Market Cap: £32.85M

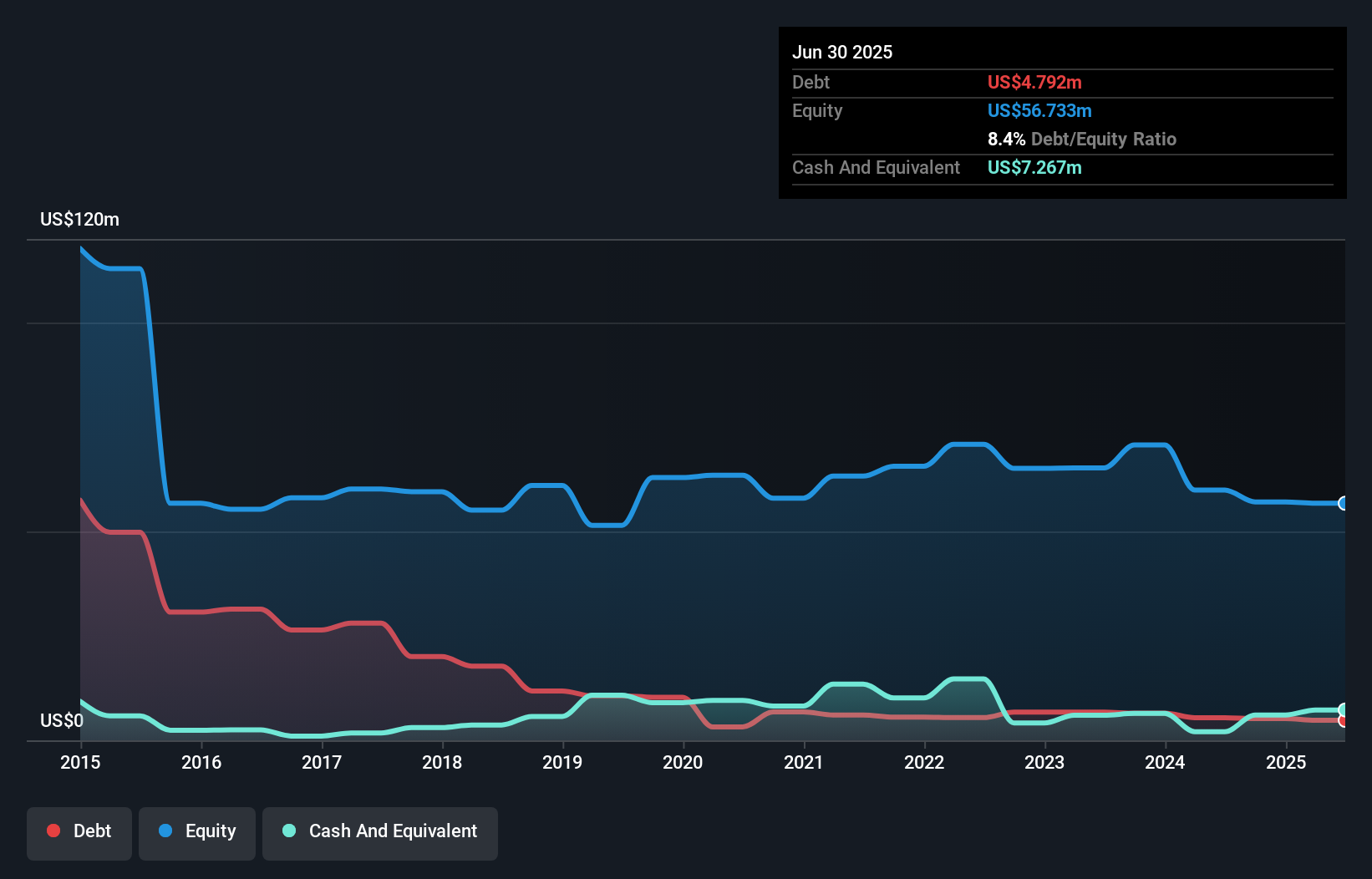

Steppe Cement Ltd., with a market cap of £32.85 million, has seen its debt-to-equity ratio decline from 20.7% to 9% over five years, indicating improved financial stability. However, the company's earnings have contracted by 8.5% annually over the same period, and it reported a net loss of US$3.5 million for the half-year ending June 2024 compared to a small profit previously. Recent revenue figures show modest growth in Q3 2024 but an overall slight decline year-to-date compared to last year. The board is experienced with an average tenure of 7.1 years, yet return on equity remains low at 1.6%.

- Unlock comprehensive insights into our analysis of Steppe Cement stock in this financial health report.

- Assess Steppe Cement's previous results with our detailed historical performance reports.

Make It Happen

- Unlock more gems! Our UK Penny Stocks screener has unearthed 462 more companies for you to explore.Click here to unveil our expertly curated list of 465 UK Penny Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:LIKE

Likewise Group

Distributes floorcoverings, rugs, and matting products for domestic and commercial flooring markets in the United Kingdom and internationally.

Reasonable growth potential with adequate balance sheet.