The UK market has remained flat over the past week, but it is up 6.3% over the last year, with earnings forecasted to grow by 15% annually. Investing in penny stocks—often smaller or newer companies—can still offer growth opportunities when these stocks are supported by strong financial health. We'll explore several penny stocks that combine balance sheet strength with potential for significant gains, providing investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.195 | £827M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.91 | £68.92M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.555 | £181.33M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.465 | £361.6M | ★★★★★★ |

| Solid State (AIM:SOLI) | £1.275 | £72.73M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.2325 | £105.22M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.31 | £202.04M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.393 | $228.46M | ★★★★★★ |

Click here to see the full list of 462 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Argentex Group (AIM:AGFX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Argentex Group PLC offers tailored currency risk management and payment solutions in the United Kingdom, with a market cap of £36.43 million.

Operations: The company generates revenue of £48.8 million from its foreign currency dealing business.

Market Cap: £36.43M

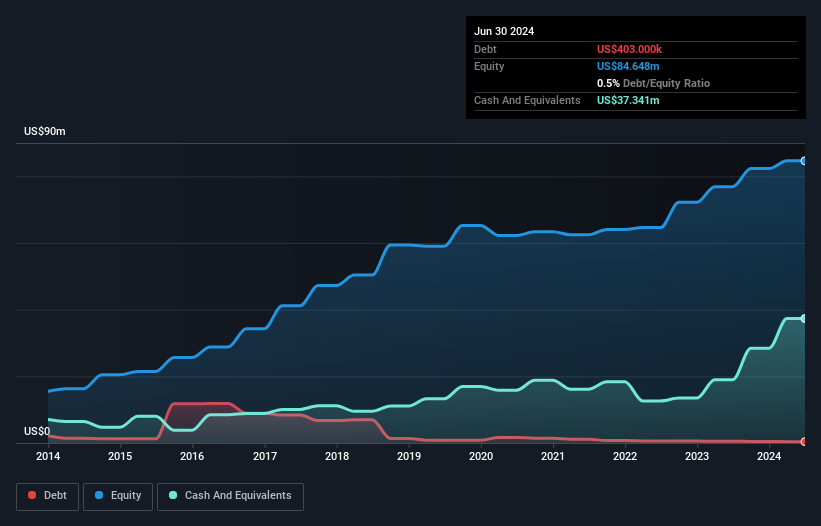

Argentex Group PLC, with a market cap of £36.43 million, faces challenges typical of penny stocks. Despite generating £23.9 million in sales for the first half of 2024, it reported a net loss of £1.7 million compared to a profit last year, indicating financial volatility. The company has no debt and strong short-term assets (£90.7M) exceeding liabilities (£58M), suggesting sound liquidity management. However, earnings have declined over the past five years by 12.2% annually and recent shareholder dilution may concern investors seeking stability amidst its strategic focus on growth without declaring dividends this fiscal year.

- Click here to discover the nuances of Argentex Group with our detailed analytical financial health report.

- Examine Argentex Group's earnings growth report to understand how analysts expect it to perform.

Nexteq (AIM:NXQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nexteq plc is a business-to-business technology design and supply chain partner for industrial equipment manufacturers across North America, Europe, Asia, Australia, the rest of the United Kingdom, and internationally, with a market cap of £44.09 million.

Operations: Nexteq's revenue is derived from its Quixant segment, which contributes $65.87 million, and its Densitron segment, with $40.42 million.

Market Cap: £44.09M

Nexteq plc, with a market cap of £44.09 million, is navigating typical penny stock challenges amidst executive changes and revised earnings guidance. The company reported half-year sales of US$48.23 million, down from US$56.29 million the previous year, reflecting revenue pressures. Despite a stable weekly volatility and high-quality past earnings, Nexteq faces declining profit margins and forecasts suggest significant future earnings decline. However, its financial position remains robust with short-term assets covering liabilities and debt well-managed by operating cash flow. Recent leadership transitions aim to bolster strategic execution as the company focuses on cost management amid lowered revenue expectations for 2024.

- Unlock comprehensive insights into our analysis of Nexteq stock in this financial health report.

- Gain insights into Nexteq's future direction by reviewing our growth report.

Westminster Group (AIM:WSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Westminster Group PLC is a specialist security and services company that provides technology security solutions and services to governments, non-governmental organizations, and blue-chip commercial organizations globally, with a market cap of £5.78 million.

Operations: The company's revenue is derived from two main segments: Technology, contributing £1.20 million, and Managed Services (including Managed Services Guarding), which accounts for £4.83 million.

Market Cap: £5.78M

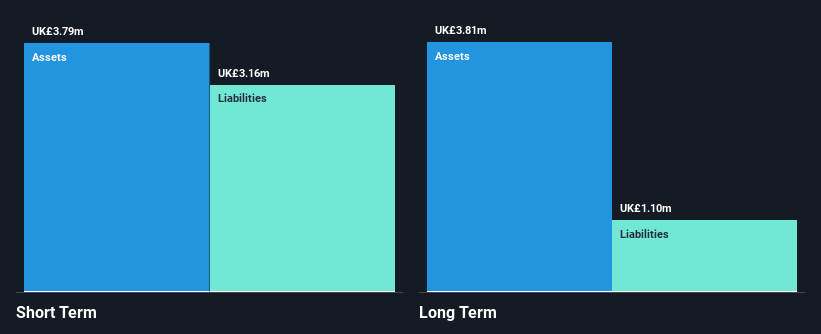

Westminster Group PLC, with a market cap of £5.78 million, is grappling with volatility and profitability challenges typical of penny stocks. Recent earnings reported sales of £9.05 million but a net loss of £4.25 million for the eighteen months ended June 2024, highlighting ongoing financial hurdles. The company has reduced its debt to equity ratio significantly over five years and maintains sufficient cash runway for over a year despite declining free cash flow. Strategic reviews are underway to address share-price concerns and improve liquidity, while securing new contracts worth over $1.2 million reflects potential growth avenues in security services globally.

- Dive into the specifics of Westminster Group here with our thorough balance sheet health report.

- Understand Westminster Group's track record by examining our performance history report.

Taking Advantage

- Explore the 462 names from our UK Penny Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westminster Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:WSG

Westminster Group

A specialist security and services company, designs and supplies technology security solutions and services worldwide.

Adequate balance sheet slight.

Market Insights

Community Narratives