- United Kingdom

- /

- Capital Markets

- /

- LSE:REC

Top UK Dividend Stocks To Consider In October 2024

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index faltering due to weak trade data from China and global economic uncertainties. As investors navigate these turbulent waters, dividend stocks can offer a measure of stability and income, making them an attractive option for those seeking to balance risk in their portfolios.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.71% | ★★★★★★ |

| 4imprint Group (LSE:FOUR) | 3.07% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.42% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.08% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.02% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.74% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.69% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.98% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.90% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.56% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top UK Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

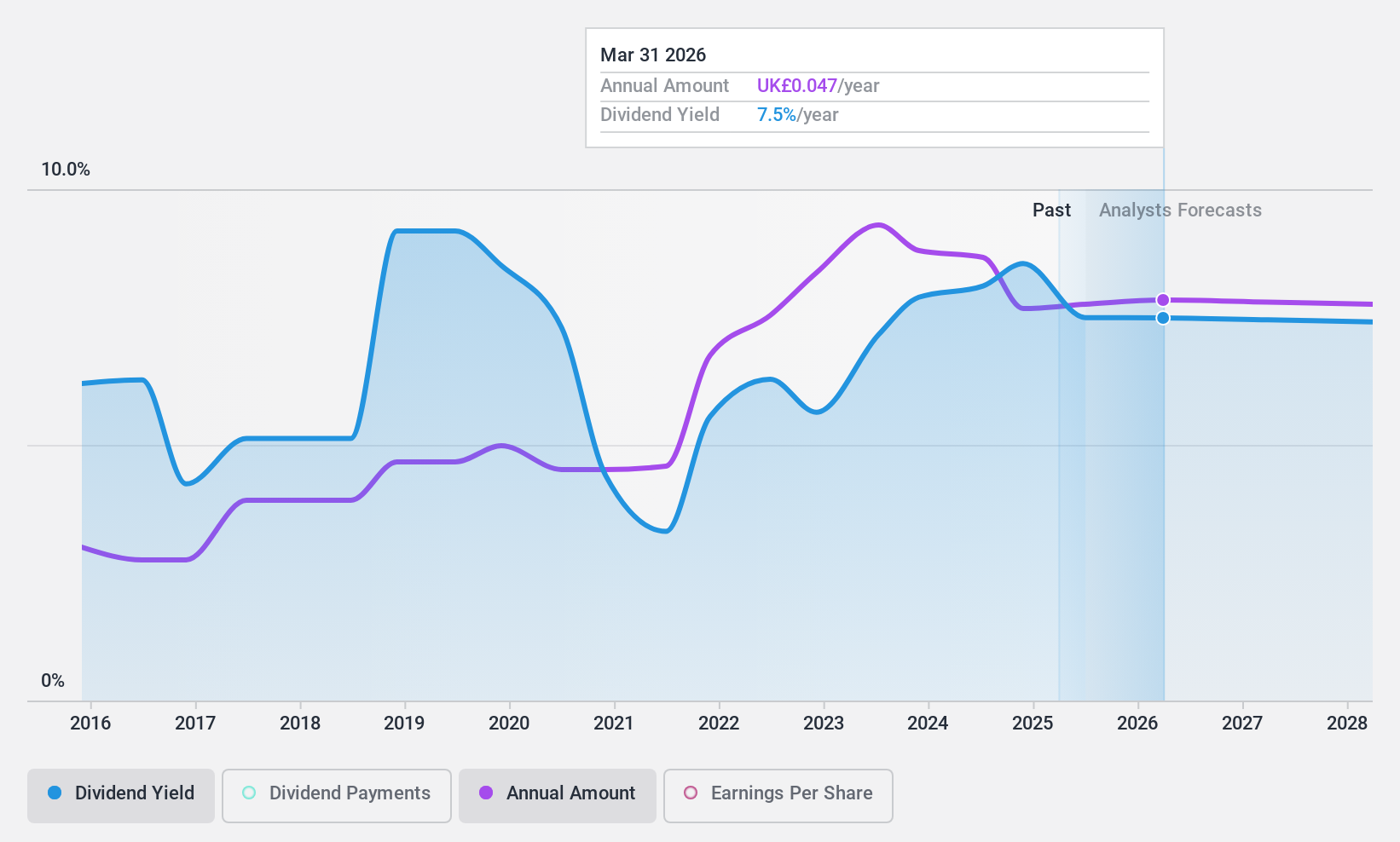

Capital (LSE:CAPD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Capital Limited, with a market cap of £171.14 million, offers a range of drilling solutions to clients in the minerals industry through its subsidiaries.

Operations: Capital Limited generates revenue primarily from its Business Services segment, amounting to $333.59 million.

Dividend Yield: 3.4%

Capital Limited's dividend payments have been unreliable over the past decade, with a history of volatility. Despite this, its dividends are well-covered by earnings and cash flows, boasting low payout ratios of 26.1% and 24%, respectively. Trading significantly below estimated fair value, analysts project a substantial price rise. Recent interim dividend declarations continue despite a drop in net income for H1 2024 to $9.21 million from $16.94 million year-on-year amidst board changes following David Abery's passing.

- Delve into the full analysis dividend report here for a deeper understanding of Capital.

- Our valuation report unveils the possibility Capital's shares may be trading at a discount.

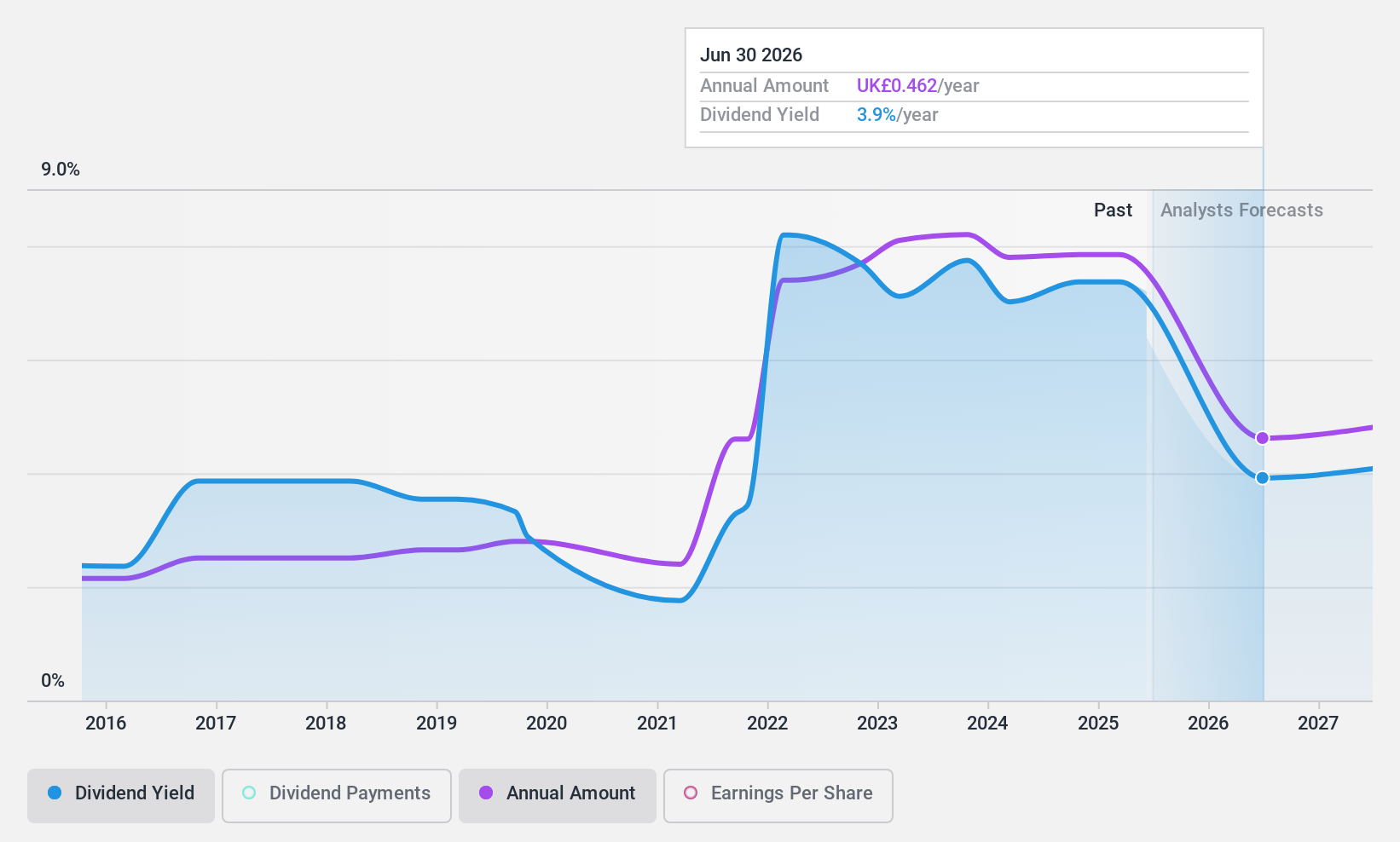

Dunelm Group (LSE:DNLM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dunelm Group plc is a UK-based retailer specializing in homewares with a market cap of £2.37 billion.

Operations: Dunelm Group plc generates its revenue primarily through the retail of homewares, amounting to £1.71 billion.

Dividend Yield: 6.7%

Dunelm Group's dividend yield ranks in the top 25% of UK payers, supported by a payout ratio of 58.2%, ensuring coverage by earnings and cash flows. Despite recent increases, dividends have been volatile over the past decade. The proposed final dividend for fiscal year 2024 reflects confidence in performance, with full-year sales reaching £1.71 billion and net income slightly declining to £151.2 million from last year. Recent board changes and share placements may impact future stability.

- Click here to discover the nuances of Dunelm Group with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Dunelm Group is priced lower than what may be justified by its financials.

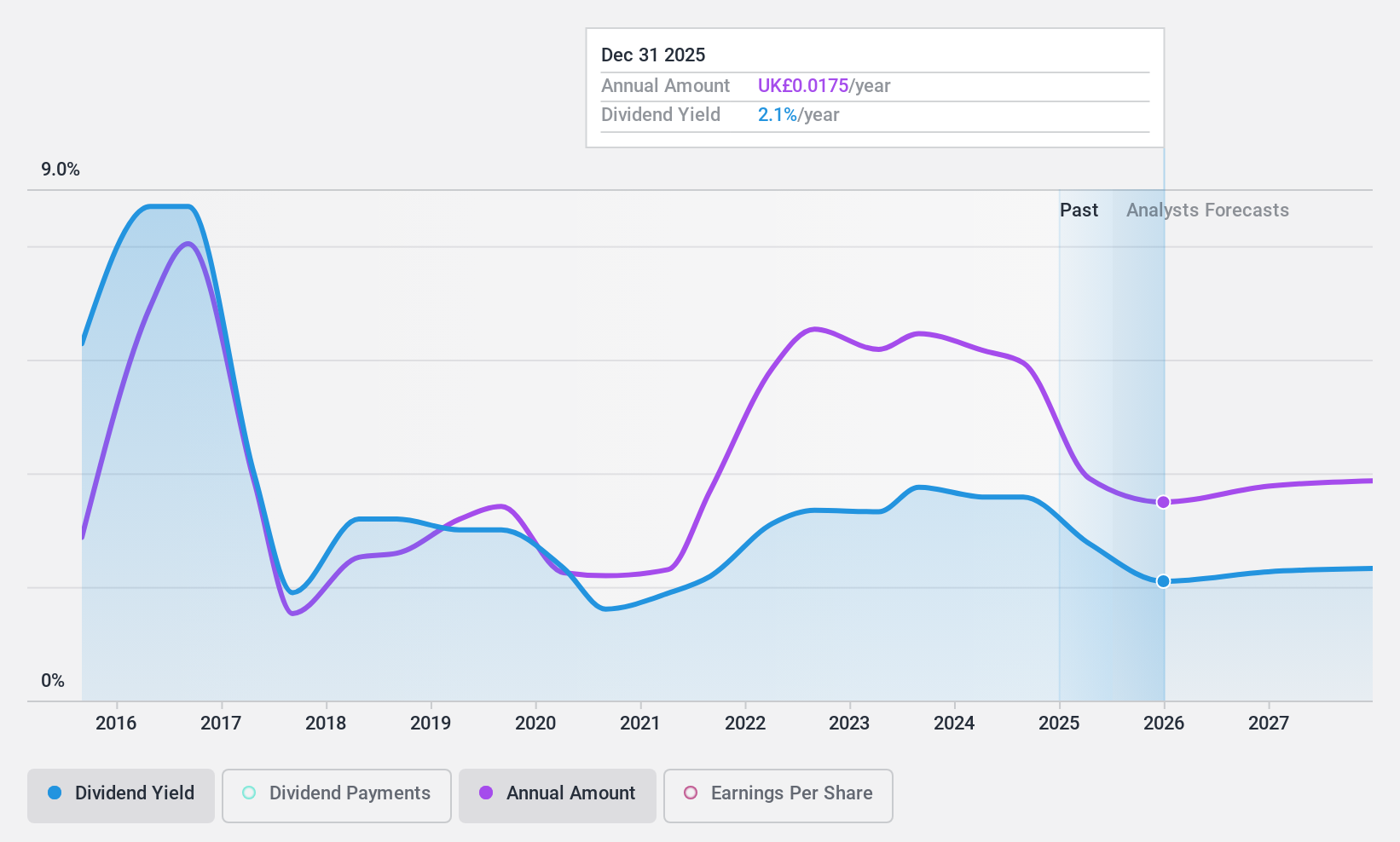

Record (LSE:REC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Record plc, with a market cap of £122.72 million, provides currency and derivative management services across the United Kingdom, North America, Continental Europe, Australia, and internationally.

Operations: Record plc generates revenue of £45.38 million from its currency and derivative management services across various regions.

Dividend Yield: 8.2%

Record's dividend yield of 8.15% ranks in the top 25% of UK payers, though it is not well covered by earnings due to a high payout ratio of 95%. Despite this, dividends are covered by cash flows with an 81.7% cash payout ratio and have been stable and growing over the past decade. Recent insider selling may raise concerns about future stability, but a final dividend of 2.45 pence per share was affirmed at the recent AGM.

- Navigate through the intricacies of Record with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Record shares in the market.

Taking Advantage

- Access the full spectrum of 60 Top UK Dividend Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:REC

Record

Through its subsidiaries, provides currency and derivative management services in the United Kingdom, North America, Continental Europe, Australia, and internationally.

Flawless balance sheet average dividend payer.