- United Kingdom

- /

- Basic Materials

- /

- LSE:BREE

October 2025 European Undervalued Small Caps With Insider Activity

Reviewed by Simply Wall St

In October 2025, the European markets have experienced a robust rally, with the pan-European STOXX Europe 600 Index reaching record levels due to a surge in technology stocks and expectations for lower U.S. borrowing costs. As investors navigate this optimistic landscape, identifying promising small-cap stocks involves looking for those with strong fundamentals and potential insider activity, which can indicate confidence in future growth prospects amidst the broader economic sentiment.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 11.9x | 1.5x | 31.70% | ★★★★★★ |

| Speedy Hire | NA | 0.3x | 20.07% | ★★★★★☆ |

| BEWI | NA | 0.5x | 38.13% | ★★★★★☆ |

| Bytes Technology Group | 17.4x | 4.4x | 12.03% | ★★★★☆☆ |

| Renold | 10.7x | 0.7x | 0.12% | ★★★★☆☆ |

| Social Housing REIT | NA | 6.7x | 36.30% | ★★★★☆☆ |

| Fastighets AB Trianon | 13.3x | 4.4x | -202.65% | ★★★★☆☆ |

| Pexip Holding | 35.3x | 5.2x | 41.93% | ★★★☆☆☆ |

| Nyab | 22.0x | 1.0x | 35.77% | ★★★☆☆☆ |

| FastPartner | 16.3x | 4.2x | -26.84% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Breedon Group (LSE:BREE)

Simply Wall St Value Rating: ★★★★★★

Overview: Breedon Group is a construction materials company involved in the production and supply of cement, aggregates, asphalt, and ready-mixed concrete, with a market capitalization of approximately £1.88 billion.

Operations: Breedon Group generates revenue primarily from its operations in Great Britain, Ireland, and the United States, with significant contributions from its cement segment. The company has seen fluctuations in gross profit margin, which reached a high of 82.31% as of December 2024. Operating expenses have varied over time but remain a substantial part of the cost structure.

PE: 13.4x

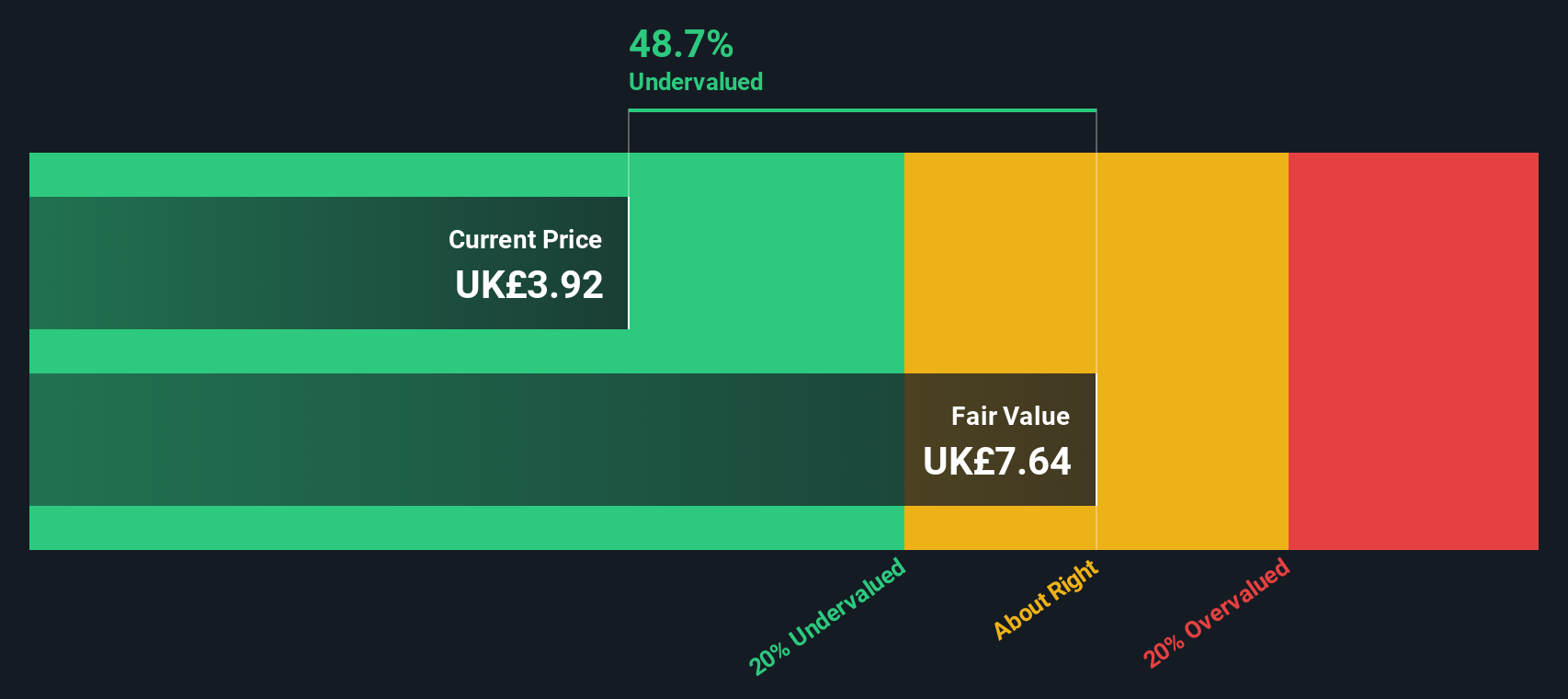

Breedon Group, a construction materials company, shows potential among European small caps despite challenges. Recent earnings reveal sales of £815.9 million for the first half of 2025, up from £764.6 million the previous year, though net income dipped to £27.5 million from £34.1 million. Insider confidence is evident with recent share purchases by executives in July 2025, suggesting belief in future growth prospects as earnings are forecasted to grow annually by 16%.

- Unlock comprehensive insights into our analysis of Breedon Group stock in this valuation report.

Gain insights into Breedon Group's past trends and performance with our Past report.

MilDef Group (OM:MILDEF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: MilDef Group is a company that specializes in providing ruggedized computer hardware solutions, with a market capitalization of approximately SEK 1.67 billion.

Operations: MilDef Group's revenue primarily stems from its computer hardware segment, amounting to SEK 1.39 billion. The company's gross profit margin has shown variability, reaching up to 49.50% in recent periods. Operating expenses are significant, with a considerable portion allocated to sales and marketing efforts.

PE: -41.5x

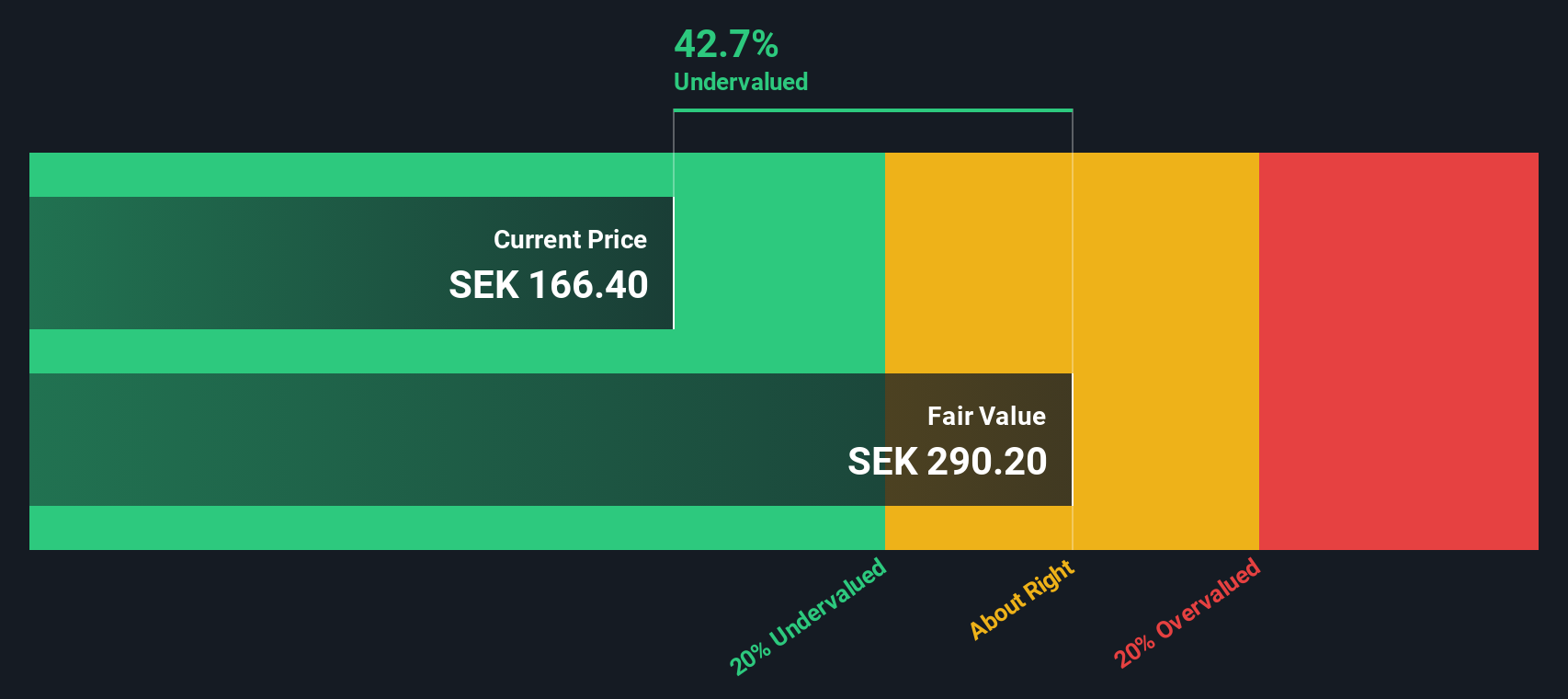

MilDef Group, a European defense technology company, is navigating its small cap status with strategic maneuvers. Recent share repurchases totaling SEK 3.77 million reflect insider confidence and align with their long-term incentive plans. Their focus on M&A activities signals ambition for growth, while showcasing cutting-edge products at DSEI 2025 highlights their commitment to innovation in military technology. Despite a dip in Q2 net income to SEK 9.2 million from last year's SEK 23.3 million, revenue increased to SEK 383.3 million, indicating potential for future expansion amidst evolving defense needs and market dynamics.

- Click here and access our complete valuation analysis report to understand the dynamics of MilDef Group.

Assess MilDef Group's past performance with our detailed historical performance reports.

Vimian Group (OM:VIMIAN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Vimian Group operates in the animal health sector, offering products and services across medtech, diagnostics, specialty pharma, and veterinary services with a market cap of €1.85 billion.

Operations: Vimian Group's revenue primarily stems from its Specialty Pharma and Medtech segments, contributing €178.20 million and €142.10 million respectively. The company has experienced fluctuations in its net income margin, with a recent figure of 5.64% as of June 2025, indicating variability in profitability over time. Operating expenses have consistently been a significant component of the cost structure, with general and administrative expenses reaching €190.30 million by the latest reporting period.

PE: 60.4x

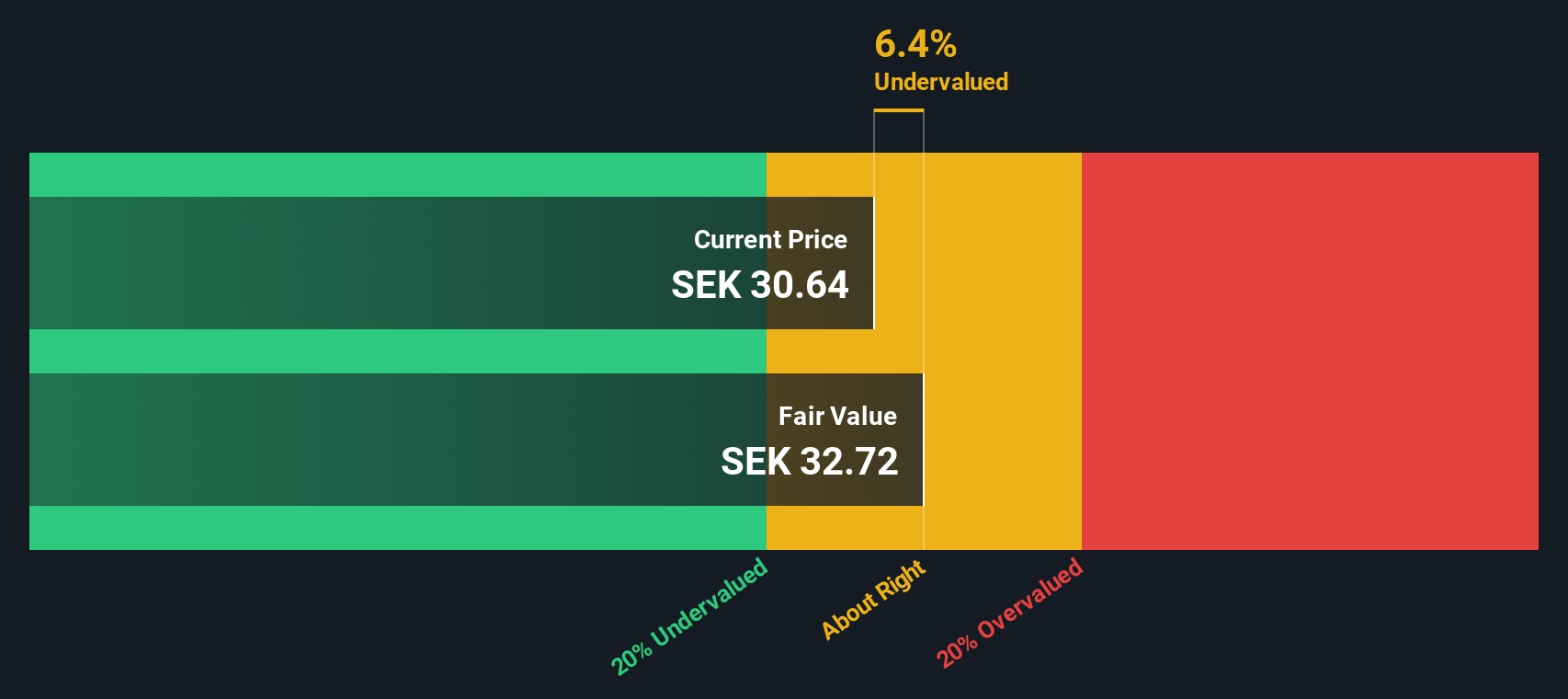

Vimian Group's recent financial results highlight a strong performance, with second-quarter sales rising to €104.3 million from €91 million the previous year, and net income increasing to €8.3 million from €4.9 million. Insider confidence is evident as Director Gabriel Fitzgerald acquired 6.2 million shares, reflecting a 12% increase in their holdings valued at approximately €189 million. Despite leadership changes and reliance on external funding sources, the company shows promising growth potential with earnings forecasted to grow annually by over 42%.

- Delve into the full analysis valuation report here for a deeper understanding of Vimian Group.

Evaluate Vimian Group's historical performance by accessing our past performance report.

Key Takeaways

- Unlock more gems! Our Undervalued European Small Caps With Insider Buying screener has unearthed 48 more companies for you to explore.Click here to unveil our expertly curated list of 51 Undervalued European Small Caps With Insider Buying.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Breedon Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BREE

Breedon Group

Engages in the quarrying, manufacture, and sale of construction materials and building products primarily in the United Kingdom and internationally.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives