- United Kingdom

- /

- Metals and Mining

- /

- LSE:ATYM

Atalaya Mining Copper Insiders Sell €976k Of Stock, Possibly Signalling Caution

In the last year, many Atalaya Mining Copper, S.A. (LON:ATYM) insiders sold a substantial stake in the company which may have sparked shareholders' attention. When evaluating insider transactions, knowing whether insiders are buying is usually more beneficial than knowing whether they are selling, as the latter can be open to many interpretations. However, if numerous insiders are selling, shareholders should investigate more.

While insider transactions are not the most important thing when it comes to long-term investing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

Atalaya Mining Copper Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the Chief Financial Officer, Cesar Sanchez, for UK£542k worth of shares, at about UK£5.42 per share. That means that an insider was selling shares at slightly below the current price (UK£8.20). As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. We note that the biggest single sale was 100% of Cesar Sanchez's holding.

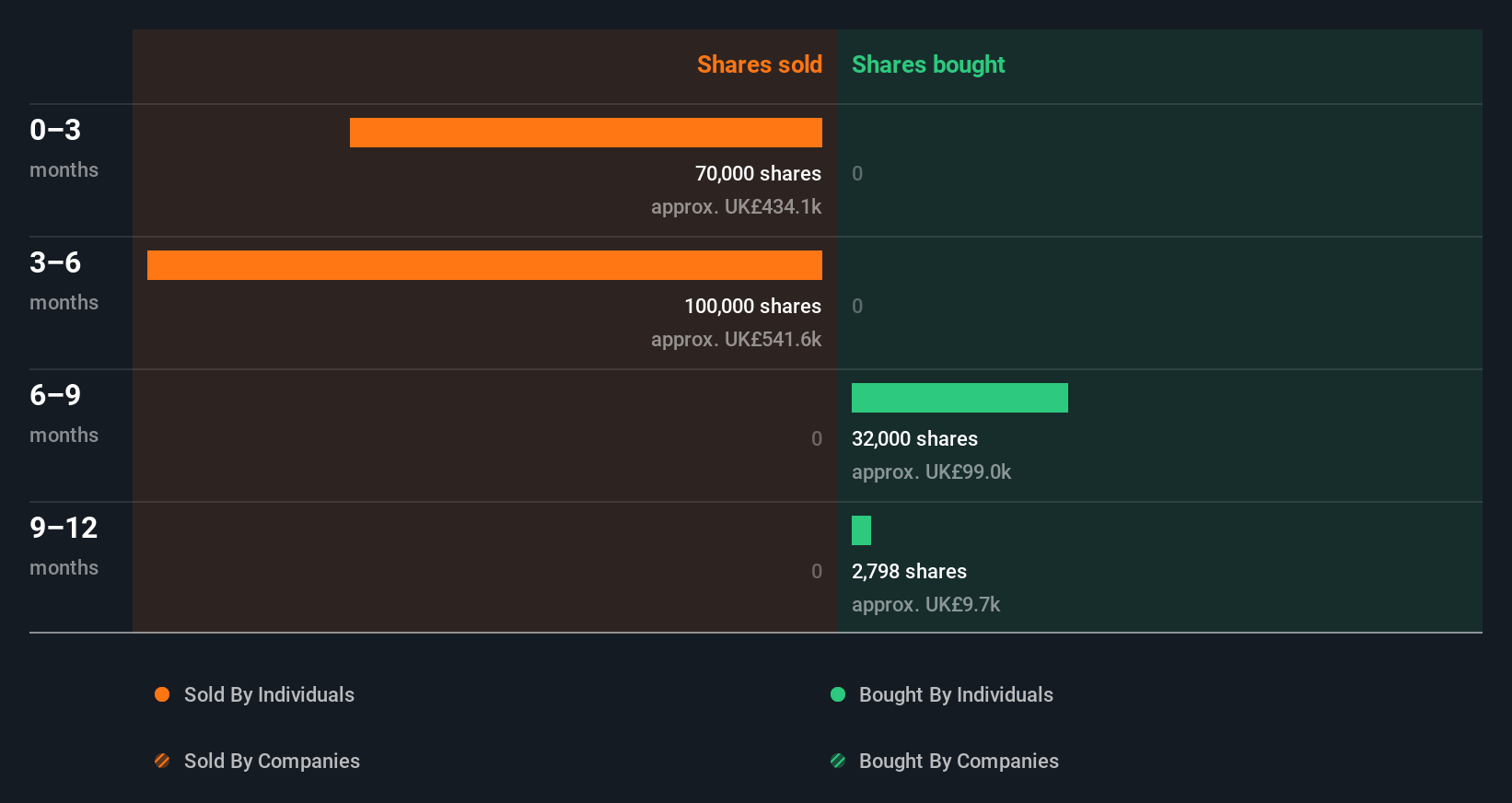

Happily, we note that in the last year insiders paid UK£108k for 34.80k shares. But they sold 170.00k shares for UK£976k. In total, Atalaya Mining Copper insiders sold more than they bought over the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

View our latest analysis for Atalaya Mining Copper

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: Most of them are flying under the radar).

Atalaya Mining Copper Insiders Are Selling The Stock

Over the last three months, we've seen significant insider selling at Atalaya Mining Copper. Specifically, Non-Independent Non-Executive Director Jesus Lopez ditched UK£434k worth of shares in that time, and we didn't record any purchases whatsoever. This may suggest that some insiders think that the shares are not cheap.

Insider Ownership

Many investors like to check how much of a company is owned by insiders. We usually like to see fairly high levels of insider ownership. Atalaya Mining Copper insiders own about UK£7.9m worth of shares. That equates to 0.7% of the company. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Do The Atalaya Mining Copper Insider Transactions Indicate?

An insider hasn't bought Atalaya Mining Copper stock in the last three months, but there was some selling. And our longer term analysis of insider transactions didn't bring confidence, either. But since Atalaya Mining Copper is profitable and growing, we're not too worried by this. When you consider that most companies have higher levels of insider ownership, we're a little wary. We'd certainly practice some caution before buying! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Atalaya Mining Copper. To assist with this, we've discovered 1 warning sign that you should run your eye over to get a better picture of Atalaya Mining Copper.

Of course Atalaya Mining Copper may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ATYM

Atalaya Mining Copper

Engages in the mineral exploration and development in Spain.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion