- United Kingdom

- /

- Metals and Mining

- /

- AIM:PAF

Does Pan African Resources (LON:PAF) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Pan African Resources (LON:PAF). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Pan African Resources

Pan African Resources's Improving Profits

In the last three years Pan African Resources's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like the last firework on New Year's Eve accelerating into the sky, Pan African Resources's EPS shot from US$0.023 to US$0.039, over the last year. You don't see 69% year-on-year growth like that, very often. The best case scenario? That the business has hit a true inflection point.

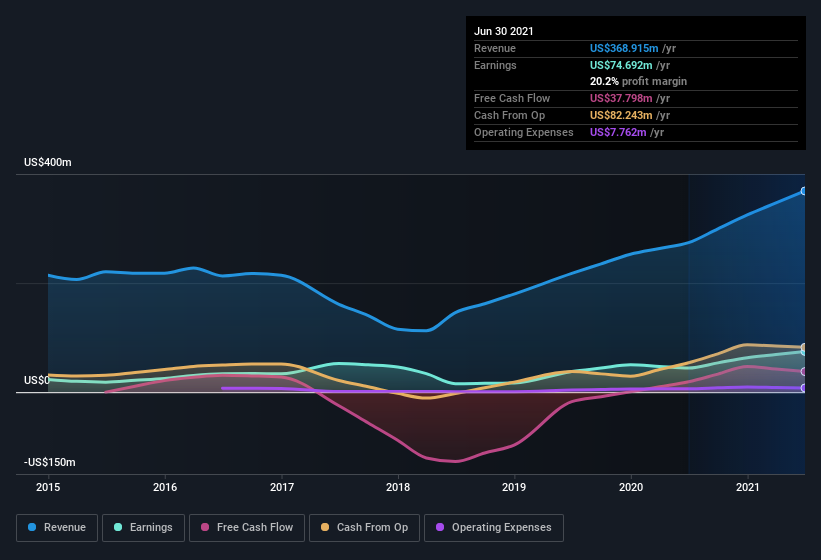

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Pan African Resources shareholders can take confidence from the fact that EBIT margins are up from 24% to 31%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Pan African Resources's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Pan African Resources Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We do note that, in the last year, insiders sold -US$521k worth of shares. But that's far less than the US$7.2m insiders spend purchasing stock. I find this encouraging because it suggests they are optimistic about the Pan African Resources's future. We also note that it was the CEO & Executive Director, Jacobus Albertus Loots, who made the biggest single acquisition, paying UK£6.8m for shares at about UK£20.46 each.

Is Pan African Resources Worth Keeping An Eye On?

Pan African Resources's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Growth investors should find it difficult to look past that strong EPS move. And in fact, it could well signal a fundamental shift in the business economics. If that's the case, you may regret neglecting to put Pan African Resources on your watchlist. Still, you should learn about the 1 warning sign we've spotted with Pan African Resources .

As a growth investor I do like to see insider buying. But Pan African Resources isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:PAF

Pan African Resources

Engages in the mining, extraction, production, and sale of gold in South Africa.

Undervalued with high growth potential.