- United Kingdom

- /

- Retail Distributors

- /

- AIM:SUP

Three Undiscovered Gems In The United Kingdom Market

Reviewed by Simply Wall St

The United Kingdom market has recently faced challenges, with the FTSE 100 index slipping due to weak trade data from China, highlighting vulnerabilities in global economic recovery efforts. As broader market sentiment remains cautious amidst these international pressures, investors may find opportunities in lesser-known stocks that exhibit resilience and potential for growth despite current economic headwinds. Identifying such undiscovered gems involves looking for companies with strong fundamentals and unique value propositions that can withstand or even capitalize on prevailing market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 8.54% | 5.28% | 22.11% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| FW Thorpe | 5.89% | 11.97% | 12.07% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Griffin Mining (AIM:GFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Griffin Mining Limited is a mining and investment company focused on the exploration and development of mineral properties, with a market cap of £265.80 million.

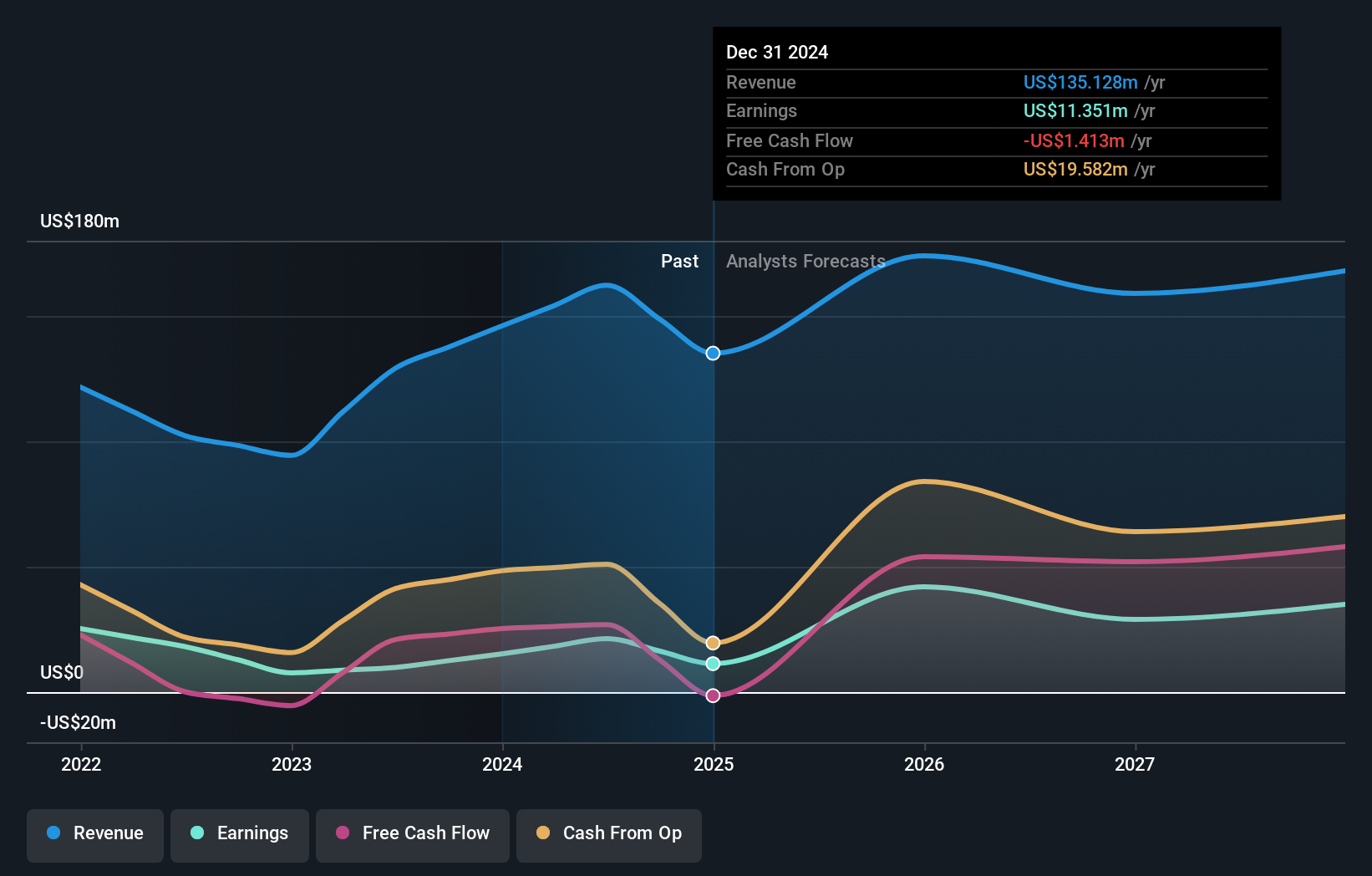

Operations: Griffin Mining generates revenue primarily from the Caijiaying Zinc Gold Mine, amounting to $162.25 million.

Griffin Mining, a nimble player in the metals and mining sector, boasts impressive earnings growth of 116.5% over the past year, outpacing industry peers at 13%. With no debt on its books for five years, it trades at 68% below estimated fair value. Recent performance highlights include a net income jump to US$11.3 million for H1 2024 from US$5.19 million last year and increased sales reaching US$85.75 million from US$69.52 million previously. The company recently reported robust production figures with notable increases in gold and silver outputs compared to last year’s third quarter results.

- Navigate through the intricacies of Griffin Mining with our comprehensive health report here.

Examine Griffin Mining's past performance report to understand how it has performed in the past.

James Halstead (AIM:JHD)

Simply Wall St Value Rating: ★★★★★★

Overview: James Halstead plc is a company that manufactures and supplies flooring products for commercial and domestic uses across various international markets, with a market cap of £837.74 million.

Operations: The primary revenue stream for James Halstead comes from the manufacture and distribution of flooring products, generating £274.88 million.

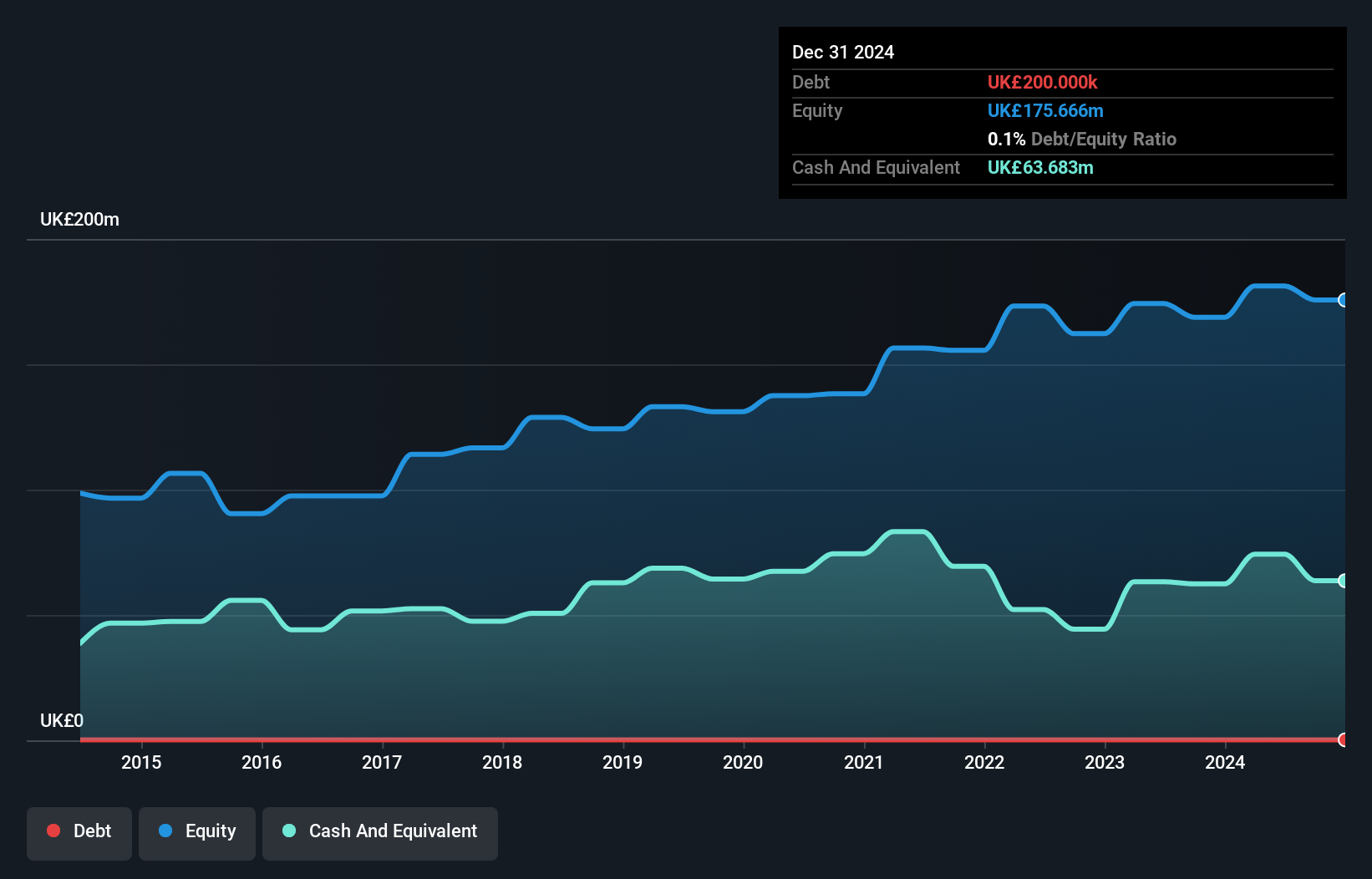

James Halstead, a small yet resilient player in the UK market, showcases robust financial health with more cash than total debt and a reduced debt-to-equity ratio from 0.2 to 0.1 over five years. Despite a slight dip in earnings by 2.1% against the building industry's growth of 4.4%, it maintains high-quality past earnings and positive free cash flow at £46 million as of June 2024. Recent results show sales at £274.88 million, down from £303.56 million last year, while net income stands steady at £41.52 million; dividends increased to a record level for the 49th consecutive year, reflecting solid profitability and strategic foresight amidst leadership changes with Anthony Wild stepping down as Chairman soon.

- Click here to discover the nuances of James Halstead with our detailed analytical health report.

Gain insights into James Halstead's historical performance by reviewing our past performance report.

Supreme (AIM:SUP)

Simply Wall St Value Rating: ★★★★★★

Overview: Supreme Plc is a company that owns, manufactures, and distributes products such as batteries, lighting, vaping, sports nutrition and wellness items, and branded household consumer goods across the UK, Ireland, the Netherlands, France, the rest of Europe, and internationally with a market cap of £202.90 million.

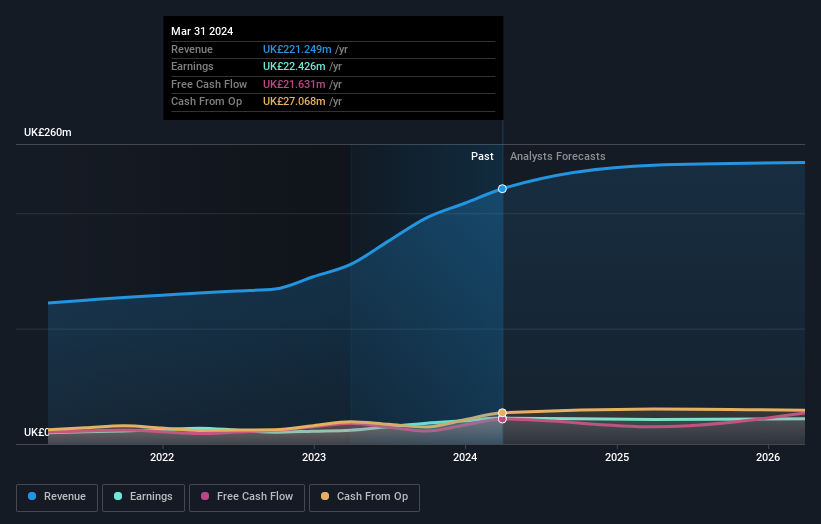

Operations: Supreme generates revenue primarily from its vaping segment (£82.79 million) and branded household consumer goods (£63.48 million), with additional contributions from batteries, lighting, and sports nutrition & wellness.

Supreme's financial health appears robust, with its debt to equity ratio impressively dropping from 501.1% to 0% over the past five years, indicating a solid balance sheet. The company boasts high-quality earnings and is trading at a significant discount of 70.6% below estimated fair value, suggesting potential undervaluation. Earnings surged by 87.4% last year, outperforming the industry average of -11.4%, although future earnings are expected to decline by an average of 1.2% annually over the next three years. Despite recent insider selling and share price volatility, Supreme’s interest payments are well-covered by EBIT at a rate of 23 times coverage, underscoring its strong financial footing amidst market fluctuations.

- Get an in-depth perspective on Supreme's performance by reading our health report here.

Understand Supreme's track record by examining our Past report.

Make It Happen

- Gain an insight into the universe of 78 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Supreme, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SUP

Supreme

Owns, manufactures, and distributes batteries, lighting, vaping, sports nutrition and wellness, and branded household consumer goods in the United Kingdom, Ireland, the Netherlands, France, rest of Europe, and internationally.

Outstanding track record with flawless balance sheet.