- United Kingdom

- /

- Entertainment

- /

- AIM:LBG

3 UK Penny Stocks With Market Caps Up To £400M

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index declining amid weak trade data from China, reflecting broader global economic uncertainties. Despite these headwinds, there are still opportunities for investors interested in smaller or newer companies. Penny stocks, though an older term, continue to offer potential value when backed by strong financial health and growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.69 | £535.61M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.16 | £174.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.93 | £14.04M | ✅ 2 ⚠️ 3 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.075 | £14.79M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.30 | £29.18M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.56 | $325.54M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.723 | £267.35M | ✅ 5 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £2.625 | £94.39M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.125 | £179.55M | ✅ 4 ⚠️ 2 View Analysis > |

| ME Group International (LSE:MEGP) | £1.75 | £661.02M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 296 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

AOTI (AIM:AOTI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AOTI, Inc., along with its subsidiaries, focuses on producing, renting, and selling medical devices for treating severe acute and chronic wounds globally, with a market cap of £39.88 million.

Operations: The company's revenue is primarily generated from the United States, amounting to $63.86 million.

Market Cap: £39.88M

AOTI has recently achieved profitability, reporting a net income of US$0.248 million for the first half of 2025, marking a significant turnaround from a loss the previous year. The company's revenue increased to US$31.84 million, driven by its medical devices segment. AOTI's topical oxygen therapy has been recognized by NICE in the UK and included in NHS Supply Chain's Advanced Wound Care Framework, enhancing its market presence and potential revenue streams. Despite high volatility and negative operating cash flow, AOTI trades below estimated fair value with satisfactory debt levels covered by short-term assets.

- Take a closer look at AOTI's potential here in our financial health report.

- Assess AOTI's future earnings estimates with our detailed growth reports.

Griffin Mining (AIM:GFM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Griffin Mining Limited is a mining and investment company focused on the exploration, development, and mining of mineral properties with a market cap of £332.14 million.

Operations: The company generates revenue primarily from its Caijiaying Zinc Gold Mine, which contributed $113.09 million.

Market Cap: £332.14M

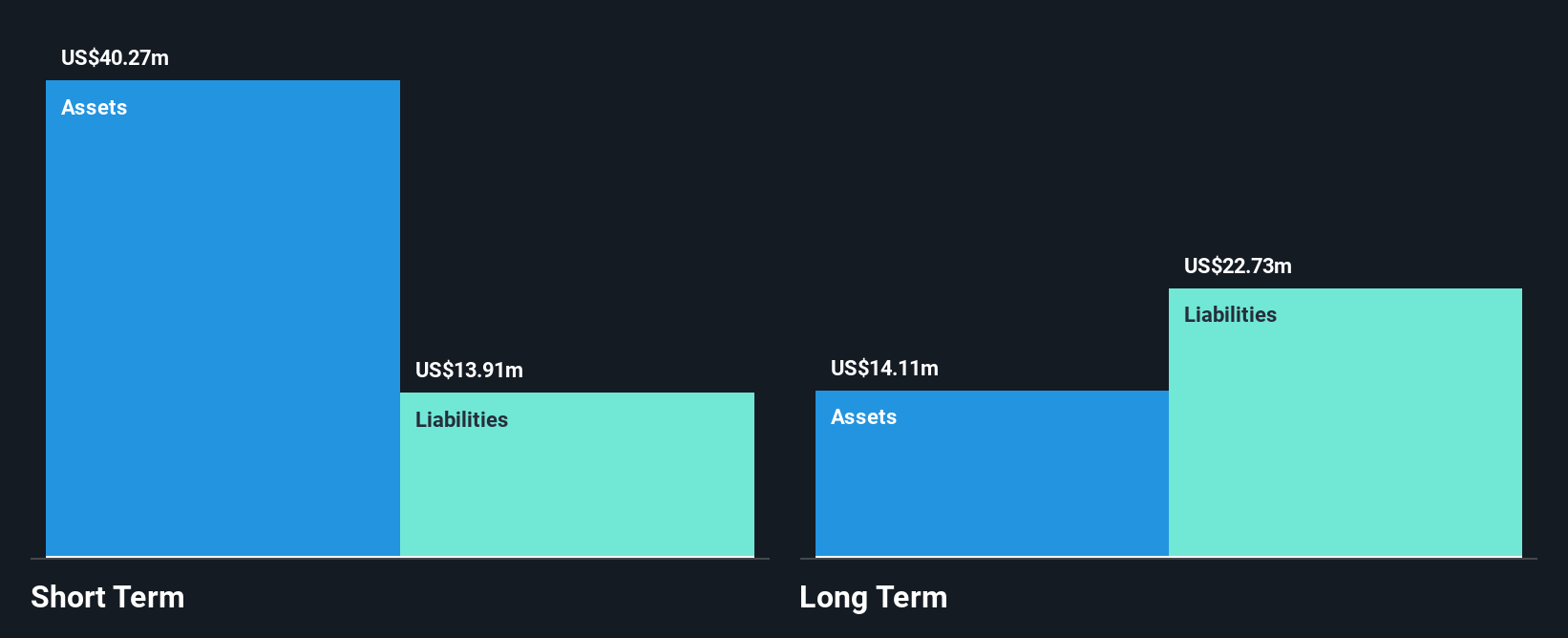

Griffin Mining Limited has experienced a decline in net profit margins, now at 7.8% compared to 13.2% last year, and negative earnings growth of -58.6%, underperforming the industry average. Despite trading significantly below estimated fair value, its Return on Equity remains low at 3.1%. The company is debt-free with short-term assets exceeding both short and long-term liabilities, providing financial stability amidst volatility. Recent share buybacks totaling $19.24 million aim to reduce capital but follow substantial insider selling over the past quarter, raising governance concerns despite an experienced board with an average tenure of 4.2 years.

- Click here and access our complete financial health analysis report to understand the dynamics of Griffin Mining.

- Examine Griffin Mining's earnings growth report to understand how analysts expect it to perform.

LBG Media (AIM:LBG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LBG Media plc is an online media publisher operating in the United Kingdom, Ireland, Australia, the United States, and internationally with a market cap of £181.90 million.

Operations: The company generates £91.70 million in revenue from its online media publishing industry segment.

Market Cap: £181.9M

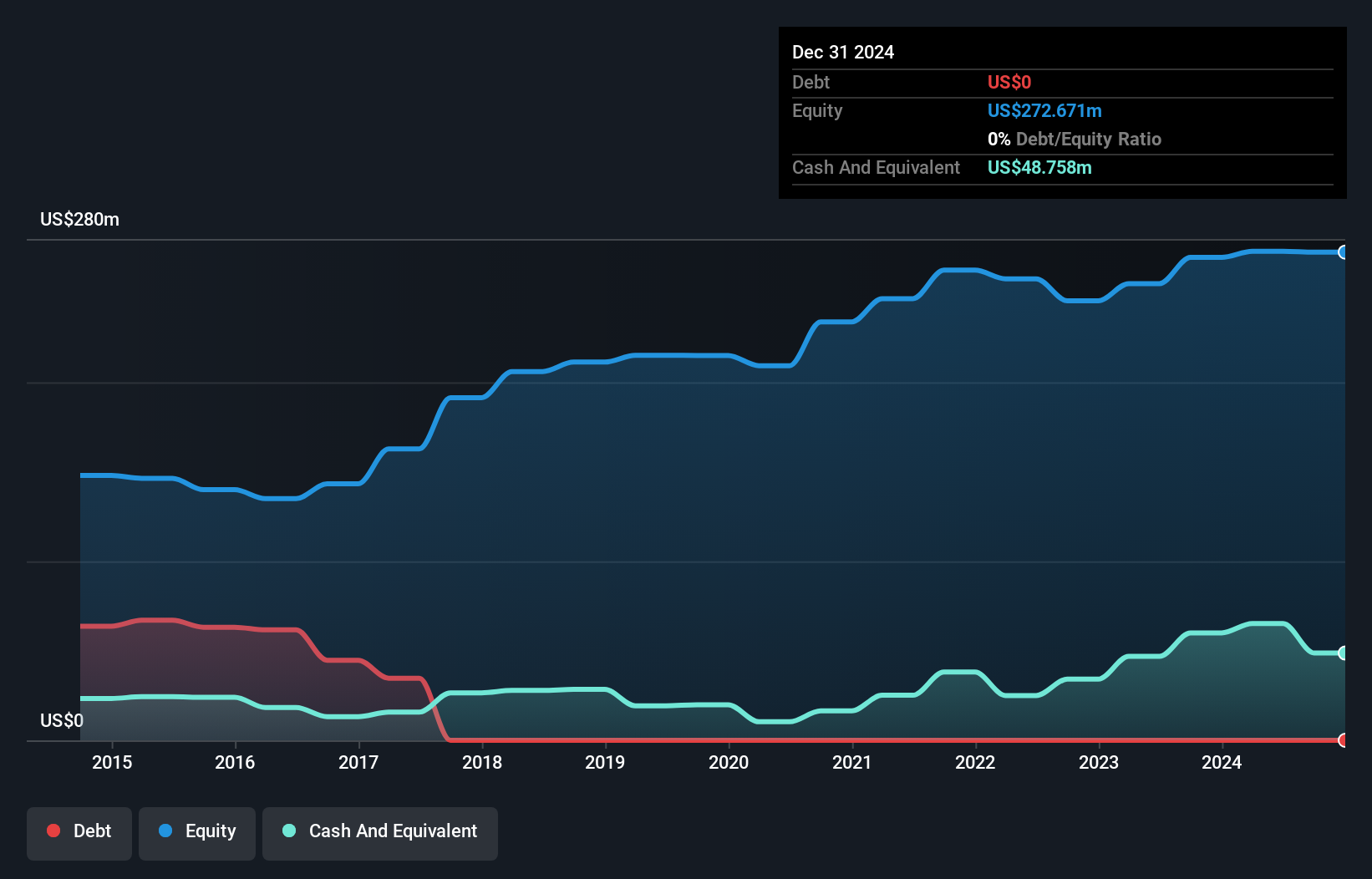

LBG Media's recent performance highlights significant earnings growth of 281.2% over the past year, outpacing both its historical average and the broader entertainment industry. The company operates debt-free, with robust financial health as short-term assets exceed liabilities. Despite a low Return on Equity at 18.9%, it maintains high-quality earnings and improved profit margins from last year's 5.1% to 16%. Trading below analyst price targets, LBG offers good value relative to peers with a Price-To-Earnings ratio of 12.4x against the UK market's 16.1x, suggesting potential for future appreciation amidst stable weekly volatility at 5%.

- Click here to discover the nuances of LBG Media with our detailed analytical financial health report.

- Learn about LBG Media's future growth trajectory here.

Next Steps

- Explore the 296 names from our UK Penny Stocks screener here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:LBG

LBG Media

Operates an online media publisher in the United Kingdom, Ireland, Australia, the United States, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives