- United Kingdom

- /

- Insurance

- /

- AIM:PGH

3 UK Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market pressures, penny stocks remain an intriguing area for investors seeking opportunities at lower price points. Often associated with smaller or newer companies, penny stocks can offer a blend of affordability and potential growth when supported by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.23 | £840.18M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.405 | £438.1M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.18 | £100.7M | ★★★★★★ |

| Solid State (AIM:SOLI) | £1.25 | £71.31M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4135 | $240.38M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.00 | £190.77M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.04 | £78.76M | ★★★★★★ |

Click here to see the full list of 469 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Eurasia Mining (AIM:EUA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Eurasia Mining Plc is a mining and mineral exploration company focused on the exploration, development, and production of palladium, platinum, rhodium, iridium, copper, nickel, gold, and other minerals in Russia with a market cap of £58.72 million.

Operations: No revenue segments are reported for this mining and mineral exploration company focused on palladium, platinum, rhodium, iridium, copper, nickel, gold, and other minerals in Russia.

Market Cap: £58.72M

Eurasia Mining, a pre-revenue company with a market cap of £58.72 million, faces significant challenges as it operates in the volatile mining sector. Despite having more cash than debt and short-term assets exceeding liabilities, its financial health is precarious with less than one year of cash runway. The company reported sales of £2.07 million for 2023 but remains unprofitable with ongoing losses and an auditor's report expressing doubt about its ability to continue as a going concern. Share price volatility persists, though it has decreased over the past year, indicating potential investor uncertainty.

- Click here to discover the nuances of Eurasia Mining with our detailed analytical financial health report.

- Explore historical data to track Eurasia Mining's performance over time in our past results report.

Personal Group Holdings (AIM:PGH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Personal Group Holdings Plc operates in the United Kingdom, offering benefits and platform products, pay and reward consultancy services, and salary sacrifice technology products, with a market cap of £61.05 million.

Operations: The company's revenue is primarily derived from its Affordable Insurance segment (£30.27 million), followed by the Benefits Platform (£10.09 million) and Pay & Reward services (£2.37 million).

Market Cap: £61.05M

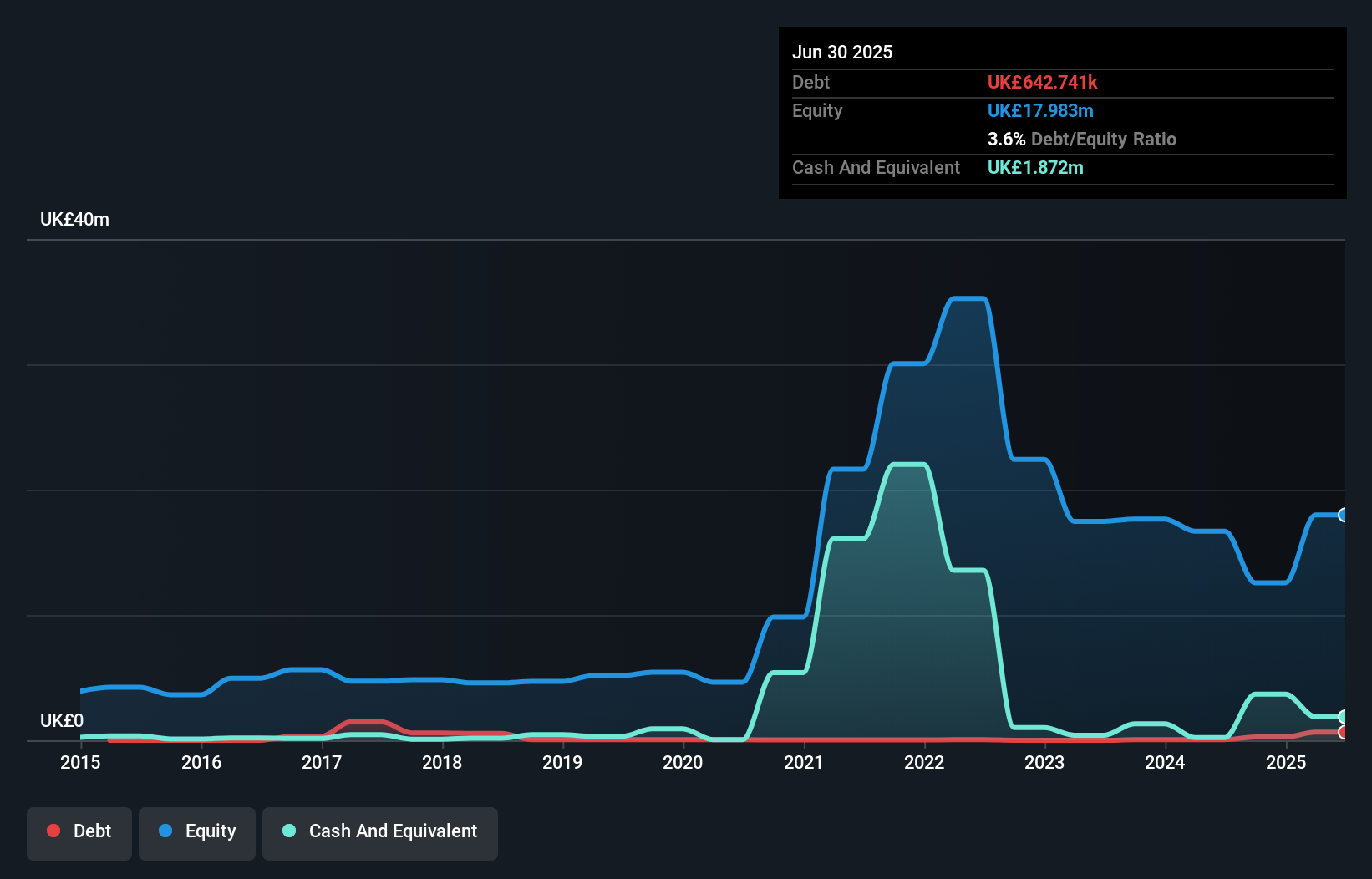

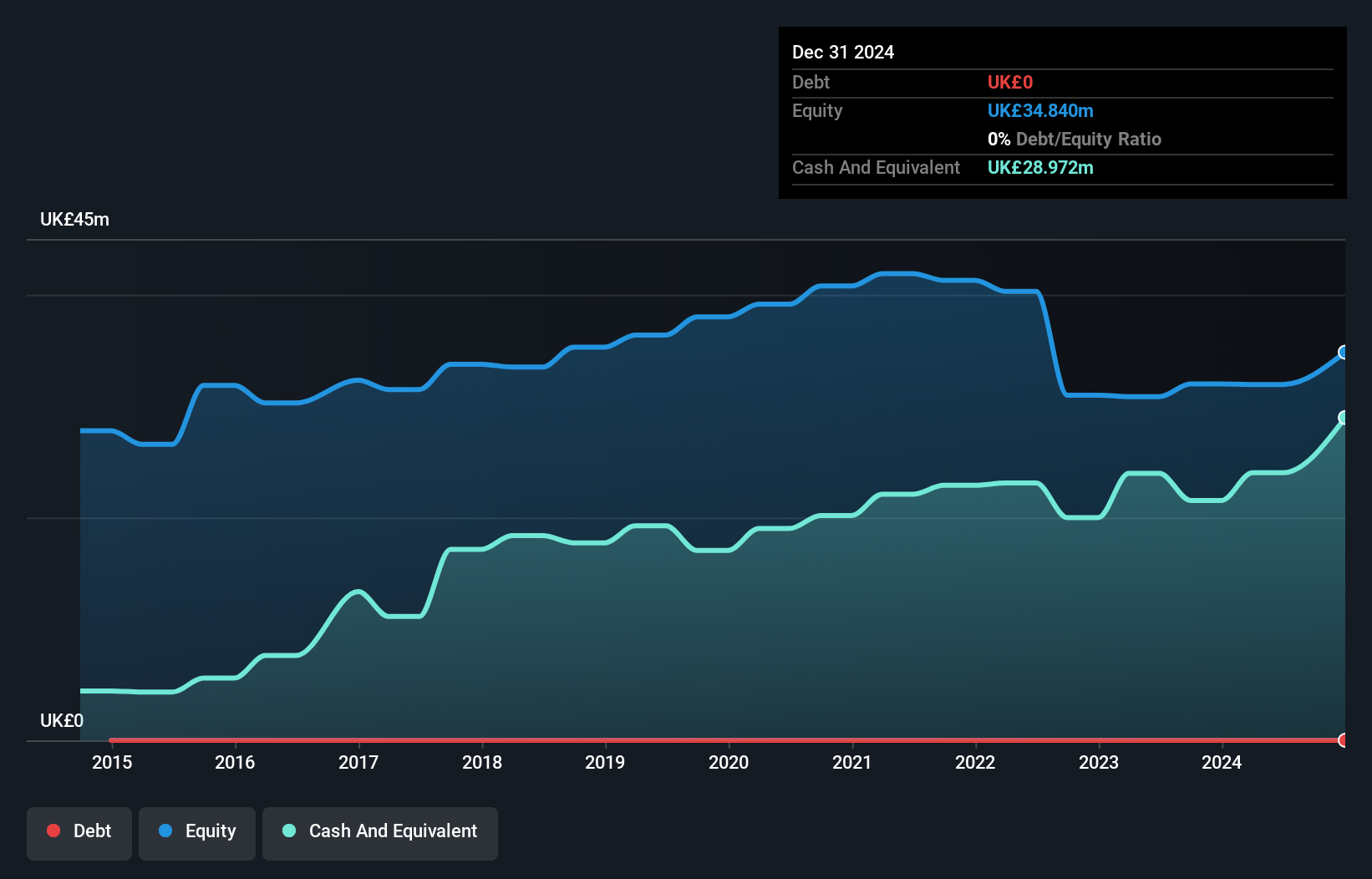

Personal Group Holdings, with a market cap of £61.05 million, has shown resilience in the penny stock landscape through its diversified revenue streams primarily from Affordable Insurance (£30.27 million). The company recently reported increased earnings and a net income rise to £1.69 million for H1 2024, alongside an 11% dividend increase, reflecting shareholder value focus. Debt-free for over five years and backed by experienced management, it maintains financial stability with short-term assets exceeding liabilities significantly. However, while profitable this year with stable volatility and undervalued P/E ratio (13.5x), its dividend coverage by free cash flow remains weak.

- Get an in-depth perspective on Personal Group Holdings' performance by reading our balance sheet health report here.

- Gain insights into Personal Group Holdings' future direction by reviewing our growth report.

Water Intelligence (AIM:WATR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Water Intelligence plc, with a market cap of £69.06 million, offers leak detection and remediation services for both potable and non-potable water across the United States, the United Kingdom, Australia, Canada, and other international markets.

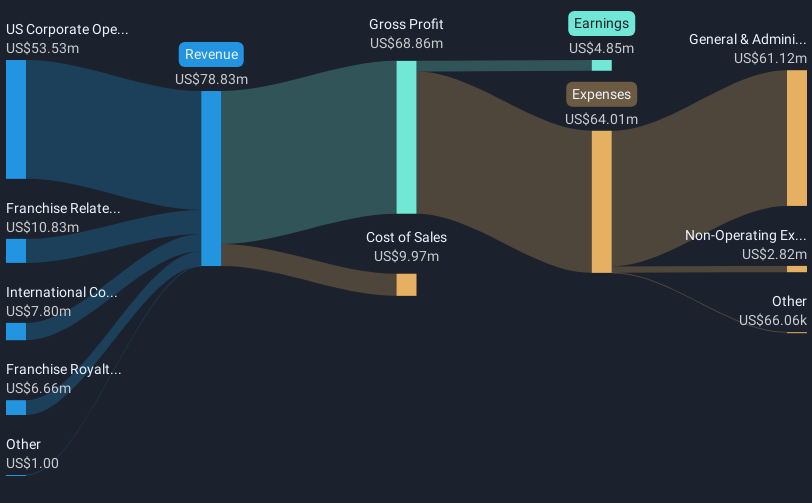

Operations: The company's revenue is derived from Franchise Royalty Income ($6.66 million), Franchise Related Activities ($10.83 million), US Corporate Operated Locations ($53.53 million), and International Corporate Operated Locations ($7.80 million).

Market Cap: £69.06M

Water Intelligence plc, with a market cap of £69.06 million, demonstrates solid growth in the penny stock segment through its diverse revenue streams across multiple international markets. The company has shown consistent earnings growth, averaging 15.9% annually over the past five years and achieving a 20.7% increase last year, although this matches industry performance. Its financial health is supported by well-covered interest payments and manageable debt levels, with short-term assets exceeding liabilities. Recent share repurchase initiatives signal confidence in its valuation strategy while maintaining high-quality earnings and stable profit margins at 6.1%, up from 5.4% last year.

- Click here and access our complete financial health analysis report to understand the dynamics of Water Intelligence.

- Review our growth performance report to gain insights into Water Intelligence's future.

Next Steps

- Gain an insight into the universe of 469 UK Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Personal Group Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:PGH

Personal Group Holdings

Engages in the provision of employee services and salary sacrifice technology products in the United Kingdom.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives