- United Kingdom

- /

- Metals and Mining

- /

- AIM:CGH

Not Many Are Piling Into Chaarat Gold Holdings Limited (LON:CGH) Stock Yet As It Plummets 28%

To the annoyance of some shareholders, Chaarat Gold Holdings Limited (LON:CGH) shares are down a considerable 28% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 45% share price drop.

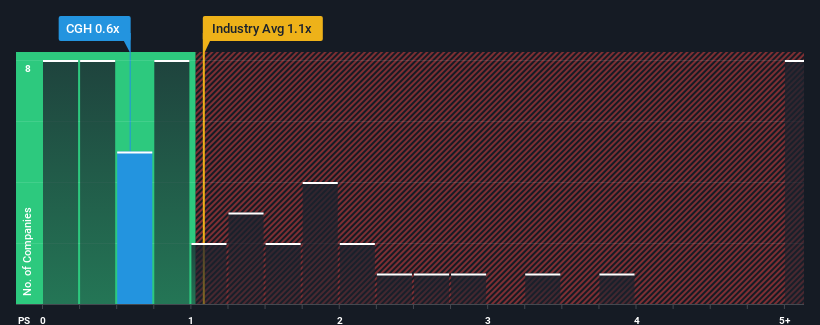

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Chaarat Gold Holdings' P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Metals and Mining industry in the United Kingdom is also close to 1.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Chaarat Gold Holdings

How Chaarat Gold Holdings Has Been Performing

With revenue that's retreating more than the industry's average of late, Chaarat Gold Holdings has been very sluggish. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. You'd much rather the company improve its revenue if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Chaarat Gold Holdings.Is There Some Revenue Growth Forecasted For Chaarat Gold Holdings?

Chaarat Gold Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 18%. Regardless, revenue has managed to lift by a handy 15% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue growth will be highly resilient over the next year growing by 113%. That would be an excellent outcome when the industry is expected to decline by 2.1%.

With this information, we find it odd that Chaarat Gold Holdings is trading at a fairly similar P/S to the industry. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Key Takeaway

Chaarat Gold Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Chaarat Gold Holdings' analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't resulting in the company trading at a higher P/S, as per our expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. It appears some are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Chaarat Gold Holdings (at least 1 which is significant), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CGH

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives