- United Kingdom

- /

- Insurance

- /

- LSE:SAGA

Saga plc's (LON:SAGA) Price Is Right But Growth Is Lacking After Shares Rocket 27%

Saga plc (LON:SAGA) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Looking further back, the 18% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

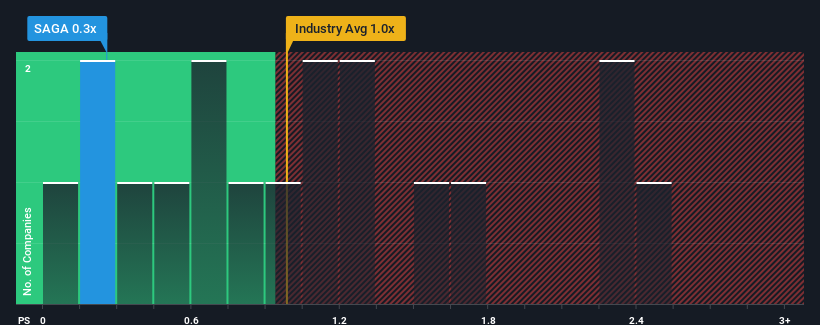

Although its price has surged higher, considering around half the companies operating in the United Kingdom's Insurance industry have price-to-sales ratios (or "P/S") above 1x, you may still consider Saga as an solid investment opportunity with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Saga

How Saga Has Been Performing

Recent times haven't been great for Saga as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Saga will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Saga's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 29%. The latest three year period has also seen an excellent 122% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 3.9% during the coming year according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 68%, which is noticeably more attractive.

With this in consideration, its clear as to why Saga's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

The latest share price surge wasn't enough to lift Saga's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Saga maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you settle on your opinion, we've discovered 1 warning sign for Saga that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:SAGA

Saga

Provides package and cruise holidays, general insurance, and personal finance products and services in the United Kingdom.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives