- United Kingdom

- /

- Insurance

- /

- LSE:PRU

Shareholders Should Be Pleased With Prudential plc's (LON:PRU) Price

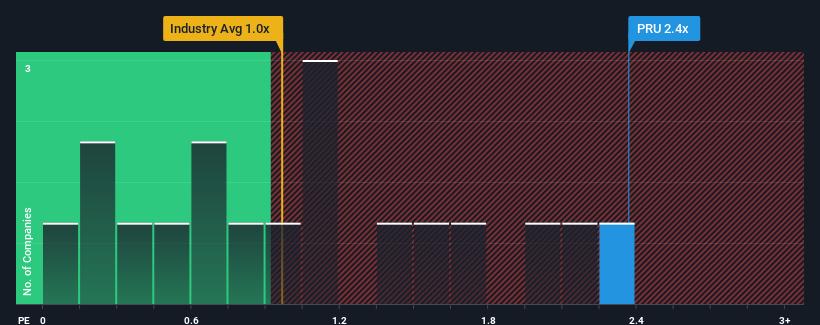

When you see that almost half of the companies in the Insurance industry in the United Kingdom have price-to-sales ratios (or "P/S") below 1x, Prudential plc (LON:PRU) looks to be giving off some sell signals with its 2.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Prudential

What Does Prudential's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Prudential has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Prudential will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Prudential's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 39% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 70% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 22% per annum as estimated by the analysts watching the company. With the industry only predicted to deliver 14% per year, the company is positioned for a stronger revenue result.

With this information, we can see why Prudential is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Prudential's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Prudential shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Prudential that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PRU

Prudential

Through its subsidiaries, provides life and health insurance, and asset management solutions to individuals in Asia and Africa.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives