For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Beazley (LON:BEZ). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Fast Is Beazley Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Beazley's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 53%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

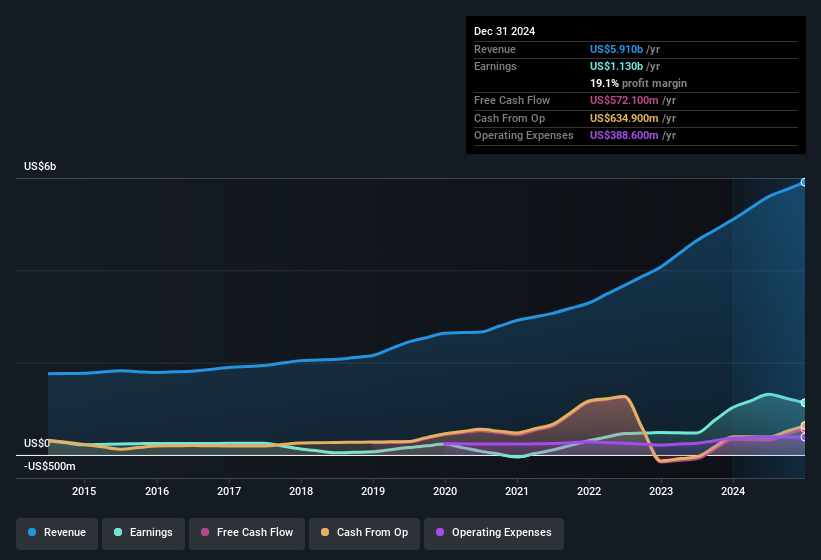

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Beazley's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. EBIT margins for Beazley remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 16% to US$5.9b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

View our latest analysis for Beazley

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Beazley's future profits.

Are Beazley Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Beazley shares, in the last year. So it's definitely nice that Independent Non-Executive Director Anthony Reizenstein bought US$37k worth of shares at an average price of around US$7.36. It seems that at least one insider is prepared to show the market there is potential within Beazley.

The good news, alongside the insider buying, for Beazley bulls is that insiders (collectively) have a meaningful investment in the stock. As a matter of fact, their holding is valued at US$15m. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 0.3% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Beazley Deserve A Spot On Your Watchlist?

Beazley's earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bunch of shares, and one has been buying more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Beazley belongs near the top of your watchlist. It is worth noting though that we have found 2 warning signs for Beazley (1 is significant!) that you need to take into consideration.

The good news is that Beazley is not the only stock with insider buying. Here's a list of small cap, undervalued companies in GB with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Beazley might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BEZ

Beazley

Provides risk insurance and reinsurance solutions in the United States, the United Kingdom, rest of Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives