The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Beazley (LON:BEZ), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Beazley with the means to add long-term value to shareholders.

See our latest analysis for Beazley

Beazley's Improving Profits

In the last three years Beazley's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Outstandingly, Beazley's EPS shot from US$0.79 to US$1.56, over the last year. It's a rarity to see 98% year-on-year growth like that. That could be a sign that the business has reached a true inflection point.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that Beazley's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. The good news is that Beazley is growing revenues, and EBIT margins improved by 13.2 percentage points to 33%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

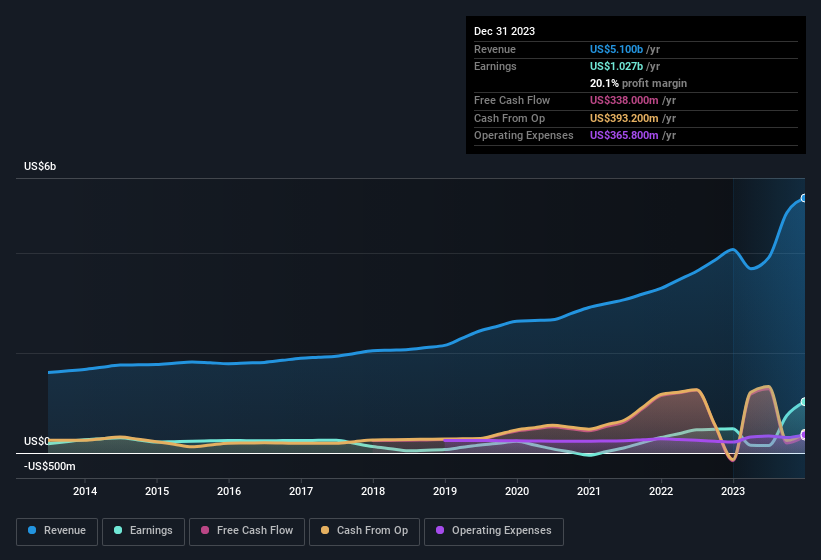

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Beazley's forecast profits?

Are Beazley Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

With strong conviction, Beazley insiders have stood united by refusing to sell shares over the last year. But the bigger deal is that the Independent Non Executive Director, Robert Stuchbery, paid US$50k to buy shares at an average price of US$5.30. Strong buying like that could be a sign of opportunity.

On top of the insider buying, it's good to see that Beazley insiders have a valuable investment in the business. As a matter of fact, their holding is valued at US$10m. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.3% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Beazley Deserve A Spot On Your Watchlist?

Beazley's earnings per share have been soaring, with growth rates sky high. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Beazley deserves timely attention. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Beazley (1 is a bit concerning) you should be aware of.

The good news is that Beazley is not the only growth stock with insider buying. Here's a list of growth-focused companies in GB with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Beazley might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BEZ

Beazley

Provides risk insurance and reinsurance solutions in the United States, the United Kingdom, rest of Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives