Stock Analysis

- United Kingdom

- /

- Medical Equipment

- /

- LSE:SN.

Admiral Group And 2 More UK Exchange Stocks Estimated As Below Intrinsic Value

Reviewed by Simply Wall St

Recent performance of the United Kingdom's stock market has been notably affected by external economic factors, including weak trade data from China which has led to declines in the FTSE 100 and FTSE 250 indices. Amid these challenging conditions, identifying stocks that are potentially undervalued becomes particularly crucial as they may offer resilience or recovery potential when broader markets are faltering.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Begbies Traynor Group (AIM:BEG) | £1.005 | £1.97 | 49.1% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.69 | 47.7% |

| WPP (LSE:WPP) | £7.502 | £14.13 | 46.9% |

| LSL Property Services (LSE:LSL) | £3.35 | £6.37 | 47.4% |

| Ibstock (LSE:IBST) | £1.84 | £3.40 | 45.9% |

| Auction Technology Group (LSE:ATG) | £4.83 | £9.65 | 49.9% |

| Accsys Technologies (AIM:AXS) | £0.55 | £1.05 | 47.8% |

| Franchise Brands (AIM:FRAN) | £1.715 | £3.16 | 45.8% |

| Nexxen International (AIM:NEXN) | £2.435 | £4.74 | 48.6% |

| M&C Saatchi (AIM:SAA) | £2.01 | £3.96 | 49.3% |

We'll examine a selection from our screener results.

Admiral Group (LSE:ADM)

Overview: Admiral Group plc is a financial services company offering insurance and personal lending products across the United Kingdom, France, Italy, Spain, and the United States, with a market capitalization of approximately £7.89 billion.

Operations: Admiral Group's revenue is primarily generated from its UK Insurance segment, which earned £2.73 billion, and its International Insurance operations, contributing £818.10 million.

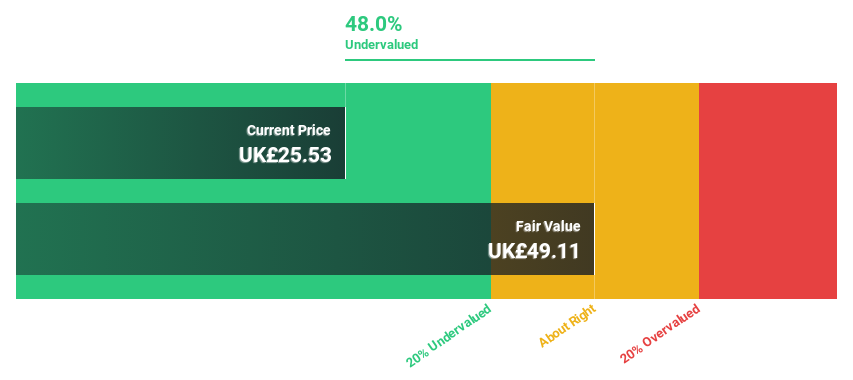

Estimated Discount To Fair Value: 36.6%

Admiral Group, priced at £26.27, is significantly undervalued based on a discounted cash flow (DCF) valuation of £41.44, indicating a trading value 36.6% below its estimated fair value. Despite a dividend yield of 3.92%, the payout is not well supported by free cash flows. The company's Return on Equity is expected to be very high at 46.7% in three years, with earnings growth projected at 12.77% annually and revenue growth anticipated to outpace the UK market average at 8.1% per year compared to the market's 3.5%. Recent executive changes include Fiona Muldoon’s approval as Chair of the Audit Committee effective from April 25, 2024.

- Our growth report here indicates Admiral Group may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Admiral Group's balance sheet health report.

Smith & Nephew (LSE:SN.)

Overview: Smith & Nephew plc is a global medical device company based in the UK, specializing in the development, manufacture, and marketing of medical devices and services, with a market capitalization of approximately £9.61 billion.

Operations: The company's revenue is divided into three main segments: Orthopaedics generating $2.21 billion, Sports Medicine & ENT at $1.73 billion, and Advanced Wound Management contributing $1.61 billion.

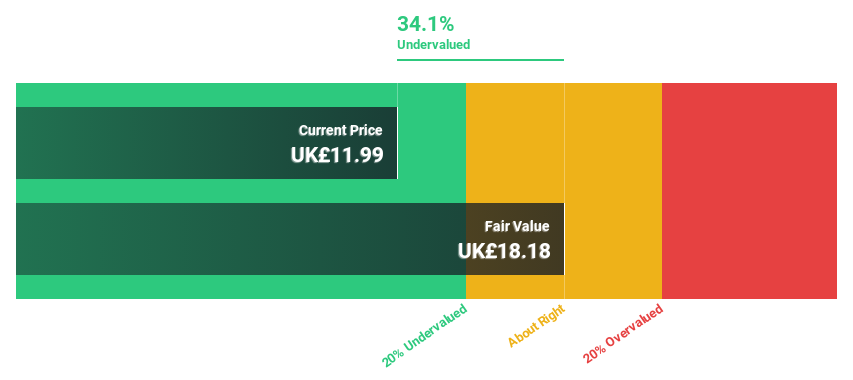

Estimated Discount To Fair Value: 30.2%

Smith & Nephew, valued at £11.03, is trading 30.2% below its estimated fair value of £15.79, suggesting significant undervaluation based on discounted cash flow analysis. Despite challenges like high debt levels and dividends not well-covered by earnings or free cash flows, the company shows promise with expected earnings growth of 22% per year outpacing the UK market's 12.6%. Recent FDA approval for its CATALYSTEM Primary Hip System could enhance its market position in evolving surgical practices.

- Our comprehensive growth report raises the possibility that Smith & Nephew is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Smith & Nephew stock in this financial health report.

TP ICAP Group (LSE:TCAP)

Overview: TP ICAP Group PLC operates as an intermediary in various financial markets, offering services such as trade execution, pre-trade and settlement services, and data solutions across regions including Europe, the Middle East, Africa, the Americas, and Asia Pacific, with a market capitalization of approximately £1.66 billion.

Operations: TP ICAP Group's revenue is generated from four primary segments: Global Broking (£1.26 billion), Energy & Commodities (£458 million), Liquidnet (£315 million), and Parameta Solutions (£189 million).

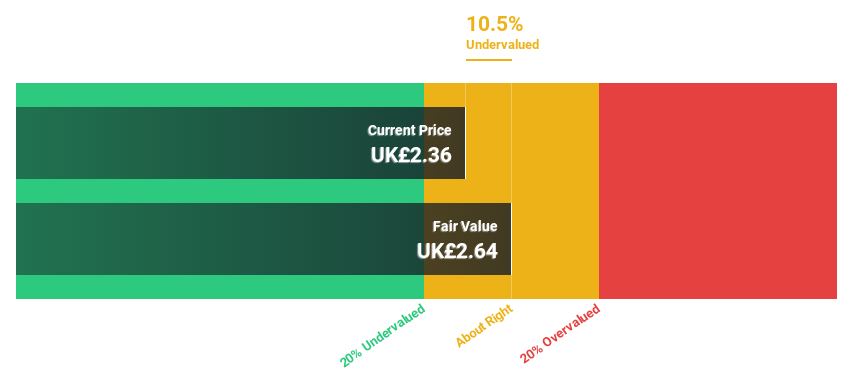

Estimated Discount To Fair Value: 16.4%

TP ICAP Group, priced at £2.18, is undervalued by 16.4%, with a fair value calculated at £2.6 based on discounted cash flow. While the dividend yield of 6.8% is poorly supported by earnings, the company’s earnings are expected to increase by a substantial 24.2% annually, outperforming the UK market projection of 12.6%. However, its return on equity is anticipated to remain modest at 10.8% in three years, and recent revenue trends show a slight decline with first-quarter revenues down by 3%.

- Upon reviewing our latest growth report, TP ICAP Group's projected financial performance appears quite optimistic.

- Navigate through the intricacies of TP ICAP Group with our comprehensive financial health report here.

Summing It All Up

- Access the full spectrum of 60 Undervalued UK Stocks Based On Cash Flows by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Smith & Nephew is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SN.

Smith & Nephew

Develops, manufactures, markets, and sells medical devices and services in the United Kingdom and internationally.

Reasonable growth potential with adequate balance sheet.