Stock Analysis

- United Kingdom

- /

- Consumer Durables

- /

- LSE:CRN

Warpaint London Leads Three Undiscovered UK Stocks With Strong Potential

Reviewed by Simply Wall St

Recent data indicating a slowdown in China's economy has led to a dip in the FTSE 100 and FTSE 250 indices, reflecting broader concerns that could affect market sentiment. In such an environment, uncovering stocks with strong fundamentals and potential for growth becomes particularly crucial.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| Georgia Capital | NA | -27.80% | 18.94% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Fix Price Group | 43.59% | 12.53% | 23.49% | ★★★★★☆ |

| Ros Agro | 57.18% | 17.80% | 18.35% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

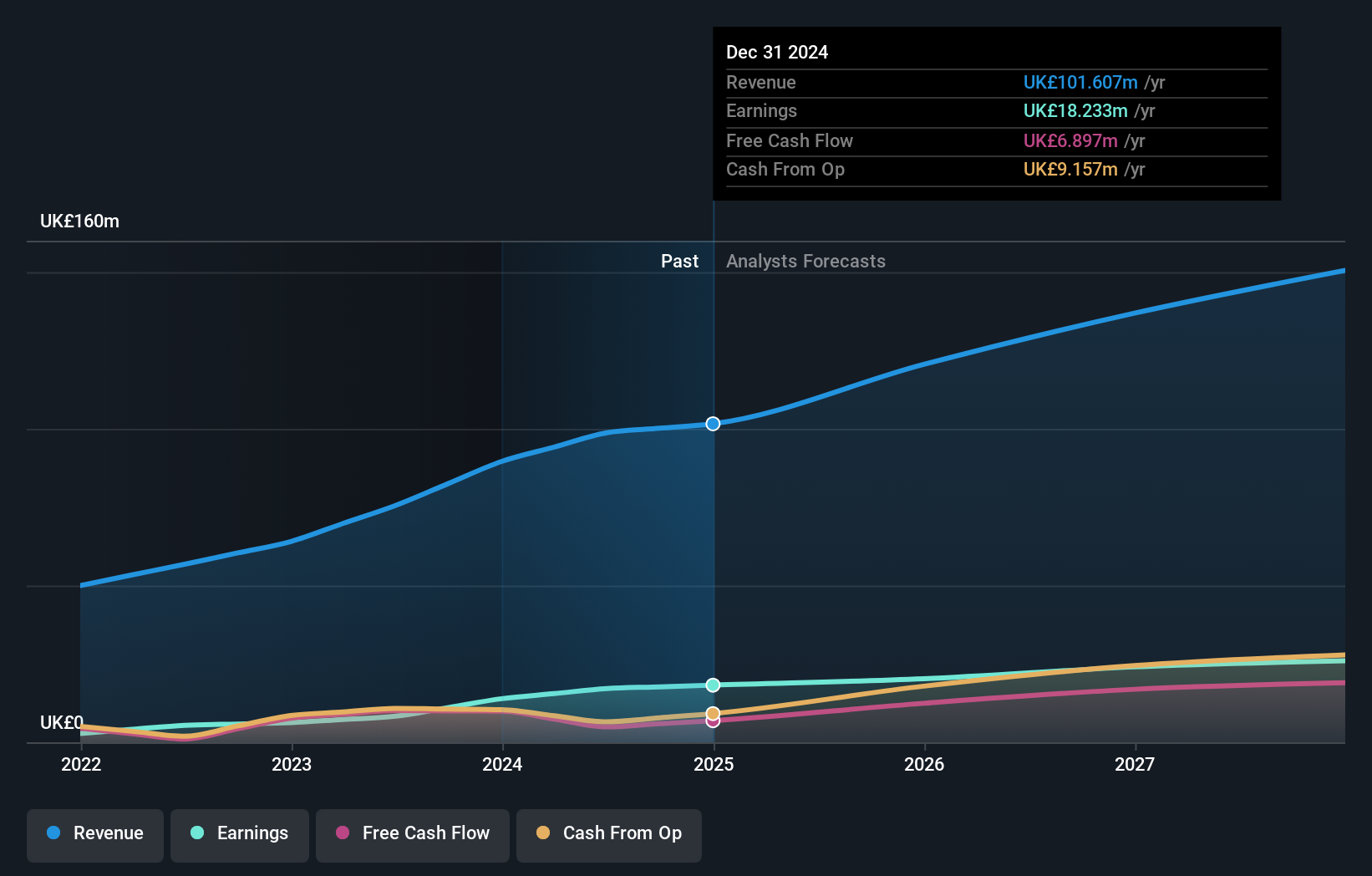

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★★★

Overview: Warpaint London PLC, together with its subsidiaries, is engaged in the production and sale of cosmetics, boasting a market capitalization of £485.20 million.

Operations: Warpaint London primarily generates its revenue from its own brand products, which contributed £87.07 million, significantly overshadowing the close-out segment's contribution of £2.52 million. The company has observed a notable increase in gross profit margins over the years, reaching 39.87% by the end of 2023, reflecting an improving efficiency in managing production costs relative to sales revenue.

Warpaint London PLC, a standout in the Personal Products sector, has demonstrated robust growth with earnings surging by 122.4% last year—outpacing the industry's 16.5%. Looking ahead, earnings are projected to grow annually by 14.71%. Notably debt-free, the company has transitioned from a debt-to-equity ratio of 5.2 five years ago to zero today, underscoring its solid financial management and operational efficiency. Recent strategic moves include a £31.5 million equity offering and a proposed dividend increase of 27%, reflecting confidence in sustained profitability and cash flow generation.

- Dive into the specifics of Warpaint London here with our thorough health report.

Explore historical data to track Warpaint London's performance over time in our Past section.

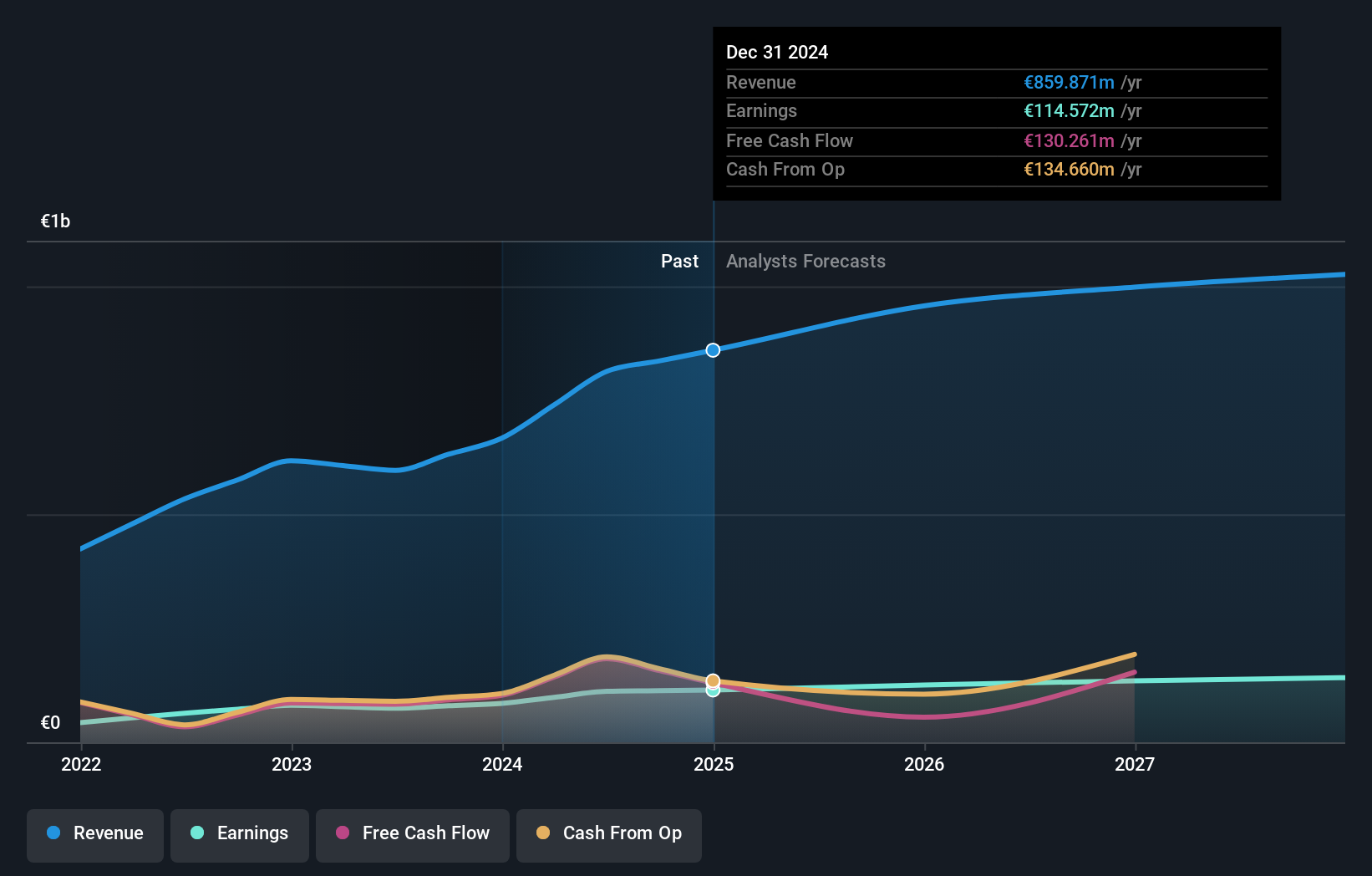

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★★

Overview: Cairn Homes plc is a holding company engaged in home and community building across Ireland, with a market capitalization of £1.02 billion.

Operations: Cairn Homes primarily engages in building and property development, generating €666.81 million in revenue. The company's business model shows a significant portion of its costs attributed to the cost of goods sold (COGS), which was €519.19 million for the latest reported period, with a gross profit margin of 22.14%.

Cairn Homes, trading at a compelling 4.8% below its estimated fair value, showcases robust financial health with a debt to equity improvement from 26% to 23% over five years. Its earnings growth of 5.4% last year outpaced the Consumer Durables industry's decline by 21.1%. With an EBIT coverage ratio of 8.4x for interest payments and a net debt to equity ratio deemed satisfactory at 19.6%, Cairn is positioned well for sustained profitability and growth, projected at nearly 10.91% annually.

- Navigate through the intricacies of Cairn Homes with our comprehensive health report here.

Examine Cairn Homes' past performance report to understand how it has performed in the past.

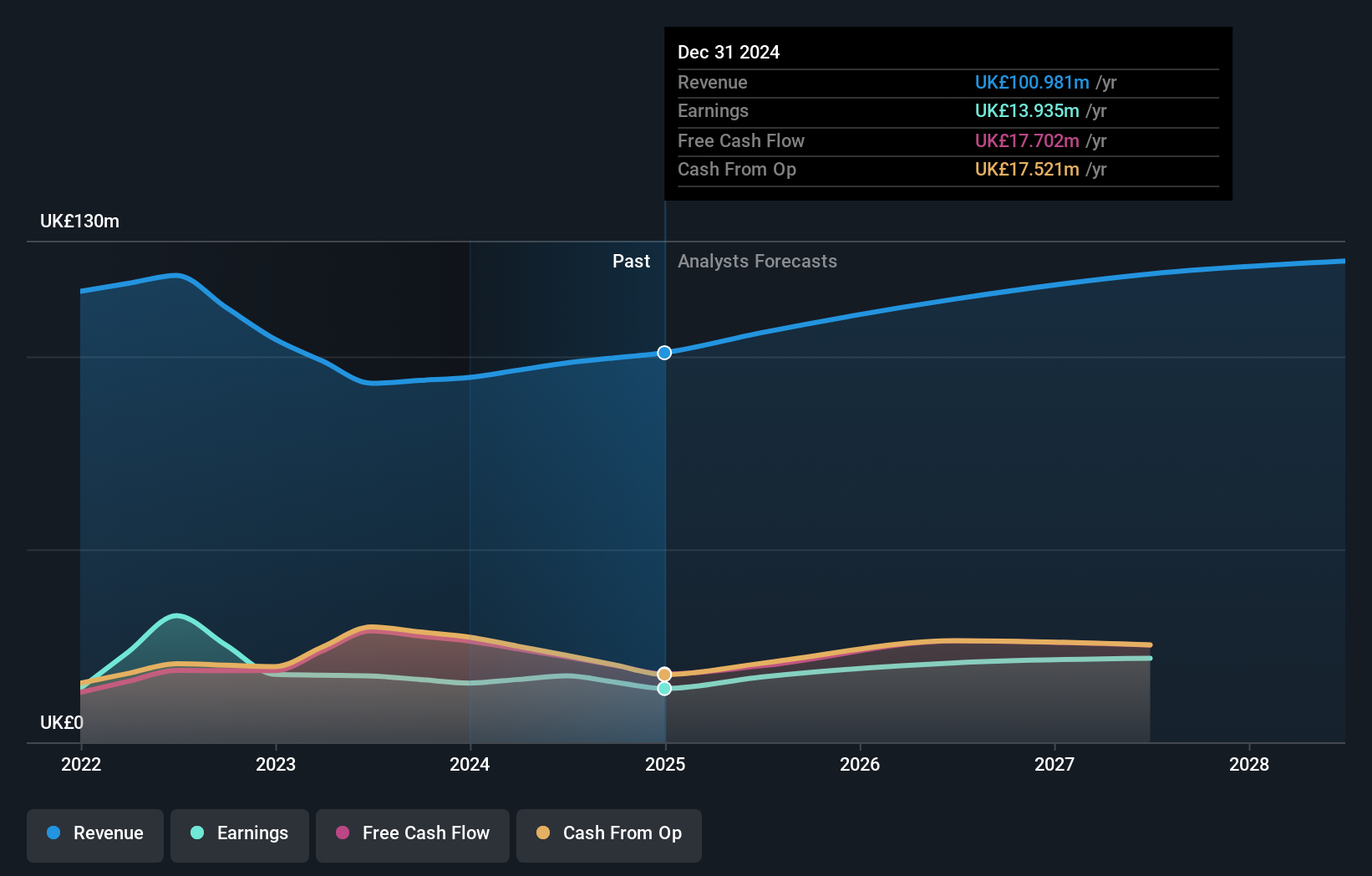

Wilmington (LSE:WIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Wilmington plc operates globally, offering information, data, training, and education solutions to professional markets across the UK, Europe, North America, and other international regions with a market capitalization of £335.46 million.

Operations: The company generates its revenue through two primary segments: Intelligence and Training & Education, contributing £57.86 million and £67.13 million respectively. Its business model involves significant operational expenses that impact net income, evident from varying net income margins over the years such as 0.16% in June 2023 and a higher 19.63% in March 2022, reflecting fluctuations in non-operating expenses and cost of goods sold (COGS).

Wilmington, a lesser-known UK entity, trades at 56.1% below our fair value estimate, signaling potential undervaluation. With no debt and a history of high-quality earnings, the company's financial health appears robust. Despite outpacing the Professional Services industry with a 4.4% earnings growth last year, forecasts suggest an average annual earnings decline of 7.1% over the next three years. This juxtaposition highlights both resilience and challenges ahead for Wilmington as it navigates its market space.

- Click here and access our complete health analysis report to understand the dynamics of Wilmington.

Gain insights into Wilmington's past trends and performance with our Past report.

Next Steps

- Navigate through the entire inventory of 79 UK Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Cairn Homes is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CRN

Cairn Homes

A holding company, operates as a home and community builder in Ireland.

Flawless balance sheet and good value.