- United Kingdom

- /

- Personal Products

- /

- LSE:ULVR

Unilever's (LON:ULVR) Upcoming Dividend Will Be Larger Than Last Year's

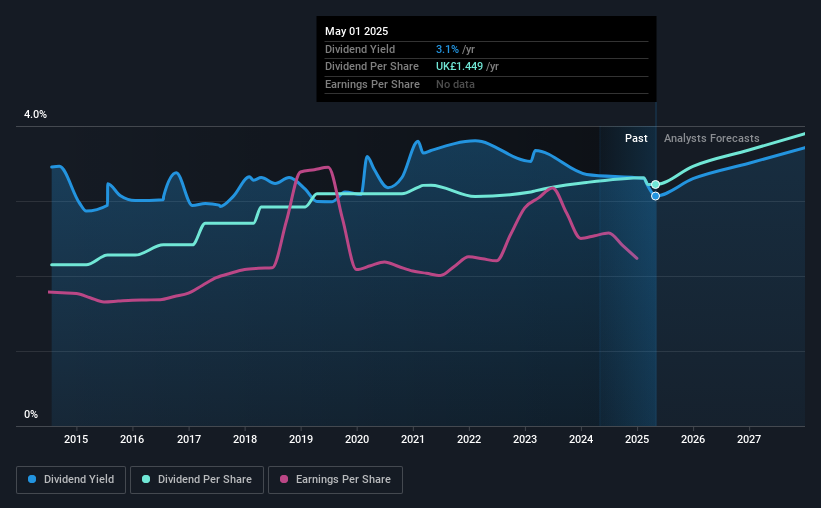

Unilever PLC's (LON:ULVR) dividend will be increasing from last year's payment of the same period to €0.3887 on 13th of June. This will take the annual payment to 3.1% of the stock price, which is above what most companies in the industry pay.

Unilever's Payment Could Potentially Have Solid Earnings Coverage

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Before this announcement, Unilever was paying out 78% of earnings, but a comparatively small 57% of free cash flows. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

Looking forward, earnings per share is forecast to rise by 38.1% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 49%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

View our latest analysis for Unilever

Unilever Has A Solid Track Record

The company has an extended history of paying stable dividends. The annual payment during the last 10 years was €1.14 in 2015, and the most recent fiscal year payment was €1.71. This works out to be a compound annual growth rate (CAGR) of approximately 4.1% a year over that time. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

Unilever May Find It Hard To Grow The Dividend

The company's investors will be pleased to have been receiving dividend income for some time. Unfortunately, Unilever's earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year. There are exceptions, but limited earnings growth and a high payout ratio can signal that a company has reached maturity. This isn't the end of the world, but for investors looking for strong dividend growth they may want to look elsewhere.

Our Thoughts On Unilever's Dividend

Overall, we always like to see the dividend being raised, but we don't think Unilever will make a great income stock. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 1 warning sign for Unilever that investors should know about before committing capital to this stock. Is Unilever not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ULVR

Unilever

Operates as a fast-moving consumer goods company in the Asia Pacific, Africa, the Americas, and Europe.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.