- United Kingdom

- /

- Personal Products

- /

- LSE:ULVR

Unilever (LSE:ULVR) Faces Portfolio Slimming and Ice Cream Segment Challenges Amid Financial Gains

Reviewed by Simply Wall St

Unilever (LSE:ULVR) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include a notable 31.2% increase in dividend payouts and innovative product launches, juxtaposed against a 16.7% drop in Q2 net sales and inflationary pressures. In the discussion that follows, we will explore Unilever's financial health, operational inefficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Delve into the full analysis report here for a deeper understanding of Unilever.

Strengths: Core Advantages Driving Sustained Success For Unilever

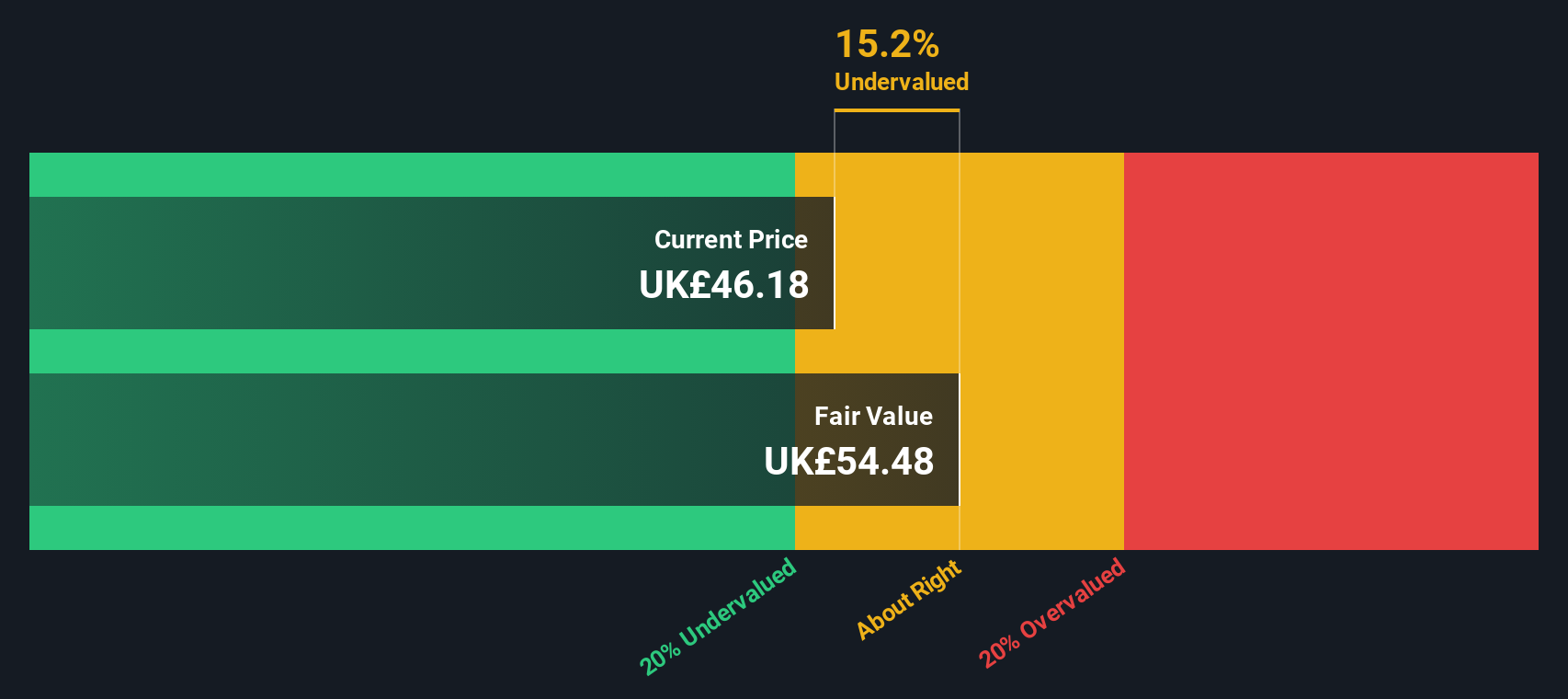

Unilever's financial health is underscored by its significant profit growth and gross margin expansion. CEO Hein M. Schumacher highlighted that the underlying operating profit surged by 17.1% to EUR 6.1 billion, with the operating margin climbing 250 basis points to 19.6%. This profitability is further supported by a gross margin increase of 420 basis points to 45.7%. The company's strategic focus on its Power Brands, which saw a 5.7% sales growth and a 4% volume increase, showcases its ability to drive growth through its core products. Additionally, Unilever's commitment to sustainability and innovation, with nearly EUR 700 million invested in brand and marketing initiatives, positions it favorably in the market. Unilever's current share price of £48.67 is above the estimated fair value of £47.09, indicating it may be overvalued compared to its peers and industry averages.

To dive deeper into how Unilever's valuation metrics are shaping its market position, check out our detailed analysis of Unilever's Valuation.Weaknesses: Critical Issues Affecting Unilever's Performance and Areas For Growth

Unilever faces several critical challenges that impact its performance. CFO Fernando Fernandez noted the disappointing performance of the Ice Cream segment, which has not met the company's ambitions. Additionally, the company has encountered significant market challenges in China, with tougher market conditions and competitive pressures leading to a negative earnings growth of -19.9% over the past year. This is a stark contrast to the Personal Products industry average growth of 9.4%. Furthermore, Unilever's Price-To-Earnings Ratio of 21.9x is higher than the European Personal Products industry average of 21.3x, suggesting it is expensive relative to its industry peers. The company's valuation, with a current share price of £48.67 above the fair value estimate of £47.09, reflects these financial challenges.

To gain deeper insights into Unilever's historical performance, explore our detailed analysis of past performance.Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Unilever has several strategic opportunities to leverage for growth and competitive advantage. The company is focusing on expanding its Power Brands, with Hein M. Schumacher emphasizing the importance of achieving net cost productivity through tight cost control. Geographic growth, particularly in Latin America, presents a significant opportunity, with the company confident in its prospects despite expected consumption slowdowns in regions like Argentina. Additionally, Unilever's stronger innovation pipeline and increased brand investments are set to accelerate performance in key markets. The ongoing productivity drive, including consultations with employee representatives, aims to enhance operational efficiency and support long-term growth.

Threats: Key Risks and Challenges That Could Impact Unilever's Success

Unilever faces several external threats that could impact its success. Competitive pressures, particularly in markets like the U.S. and India, are increasing, as noted by Fernando Fernandez. Economic factors also pose a risk, with underlying sales growth for 2024 expected to be within a modest range of 3% to 5%. Regulatory risks, especially in markets like Indonesia, require significant portfolio initiatives and strategic adjustments, which may take time to yield benefits. Additionally, market risks in China remain a concern, with the recovery expected to be gradual. These challenges highlight the need for Unilever to navigate a complex and competitive global environment to maintain its market position.

Conclusion

Unilever's strong financial health, driven by significant profit growth and gross margin expansion, underscores its ability to leverage its core Power Brands for sustained success. However, challenges such as underperformance in the Ice Cream segment and market difficulties in China highlight areas needing strategic focus. The company's emphasis on cost control and geographic expansion, particularly in Latin America, presents viable growth opportunities. The current share price of £48.67, which is above the estimated fair value of £47.09, suggests that investors may be pricing in an optimistic outlook that doesn't fully account for existing challenges and competitive pressures. This discrepancy indicates that while Unilever is well-positioned for future growth, it must navigate its weaknesses and threats effectively to justify its current market valuation.

Turning Ideas Into Actions

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:ULVR

Unilever

Operates as a fast-moving consumer goods company in the Asia Pacific, Africa, the Americas, and Europe.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives